Here’s a company for you involved in technology’s tectonic shift towards FinTech in 2019.

They aren’t new, but you’ve probably never heard of them.

It’s Fiserv Inc. (FISV) which sells financial technology and can include customers such as banks, credit unions, securities broker-dealers, leasing, and finance companies.

An inflection point is occurring within the global business and that is financial technology and the rapid integration of it.

Financial institutions are building products around this concept and Fiserv has a head start on the others with more than 30 years of experience in aiding banks, thrifts, and credit unions, managing cash and processing payments, loans, and account services.

The Wisconsin-based company constructed an unstoppable machine leveraging its time-honored relationships and expertise to bring banking to all the screens that pervade daily life.

“Innovation, Integration and Scale” has been the motto that has served this company well for so long.

The company cut its teeth in the trenches helping banks move money long before it became the next big thing.

Five years ago, under the leadership of CEO Jeff Yabuki, there was a corporate flashpoint with upper management realizing they needed to evolve or die.

Yabuki anticipated a near future fueled by mobile wallets and changing consumer expectations - an always-on, never-off connected world.

An environment where consumers want what they want when they want it.

There has been no letup in this trend.

Silicon Valley companies were always the 800-pound gorilla in the room and Fiserv didn’t want to become sideswiped by them.

And in 2014, at the Money 20/20 conference in Las Vegas, Yabuki set out his vision that continues to prevail today.

The financial services industry had become obsessed with point-of-sale transactions.

And at $200 billion in annual domestic sales, it was a business that resonated to all corners of the FinTech world.

It was sensical to persuade consumers to use branded credit or debit cards to pay for stuff in stores and online.

At the time, that was bread-and-butter banking.

To the banks' chagrin, Silicon Valley has gotten in on the act with the likes of Apple (AAPL), Alphabet (GOOGL), PayPal (PYPL), Square (SQ) firing warning shots.

They formulated products of their own, whipped up the necessary scale and maximized the reverberating network effects.

Yabuki urged financiers at the conference to double down on what they did best while looking to grab low-hanging fruits in the short-term.

The business beyond point-of-sale was theirs waiting on a decorative platter – the opportunity was a $55 billion behemoth consisting of consumer-to-consumer, business-to-business and consumer-to-business transactions.

Embracing FinTech translated into massive speed advantages, stauncher security-laced products while offering traditional bank customers higher quality service at their convenience.

Fiserv erected a platform to help financial institutions focus on payments beyond POS called Network for Our World.

The goal of this NOW Network was to help customers' flow of money by paying bills and getting paid.

These entrepreneurs are looking for more efficient ways to collect money owed - they are a lucrative addressable audience for bankers.

The Fiserv sales pitch is working wonders according to the data. The company has 12,000 clients worldwide, with 85 million online banking end-users.

It has rolled out innovative products for payments, processing, risk and compliance, customer service and optimization.

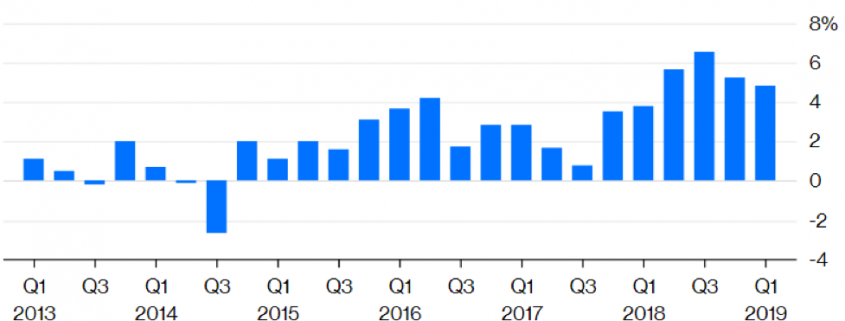

The company has become ever so profitable with a 3-year EPS growth rate of just 15%, but in the last quarter, this metric surged to 23% and projected to rise.

Fiserv also dabbled with some M&A hauling in debit-based assets of Elan Financial Services.

The stellar acquisition, with annual revenue of over $170 million, extends Fiserv’s leadership in payments, broadens client reach and scale, and provides new solutions to enhance the value proposition of the existing 3,000 debit solutions clients.

The deal also gave Fiserv ownership of Money Pass, the second largest surcharge-free ATM network in the U.S., with over 33,000 in-network ATMs.

They also added other major pieces with the purchase of First Data Corp (FDC).

The maneuver is strategically solid, and Fiserv will benefit from a parlay of idiosyncratic opportunities from the combined synergies.

Fiserv will be able to refer First Data's merchant-acquiring services to the banks it currently works with.

I predict cost savings of $1 billion from the deal and potential upside from platform rationalization, which has not yet been included in synergies.

There will be significant upside potential from interest expense savings given refinancing FDC's debt at investment-grade.

Dipping your toe into this name before its multiple inevitable expands is a good long-term strategy.

Profitability is increasing while management has made moves that will fatten its top line business from the 5% internal growth today.

All these growth levers will push up revenues in the upcoming quarters - Fiserv happens to be the right company in the right industry at the perfect time in the technology cycle.

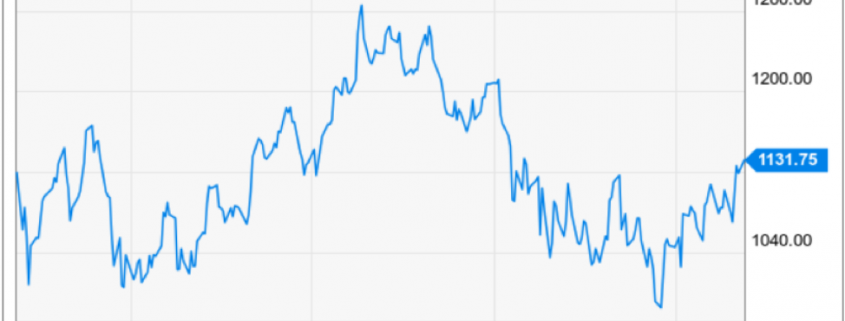

The stock is up over 1,000% in 10 years.

In February 2009, the stock was meddling around $8 and the $83 it trades at today demonstrates the potency of FinTech and the strength in their underlying business model.

I would wait for a sell-off to get into this one, but it’s a keeper.