One of the fastest parts of technology growing at a rapid clip is fintech.

Fintech has taken the world by storm threatening the traditional banks.

Companies such as Square (SQ) and PayPal (PYPL) are great bets to outlast these dinosaurs who have a laser-like focus on technology to move the digital dollars in an efficient and low-cost way.

Another section of the technology movement that has caught my eye morphing by the day is the online food delivery segment that has soaring operating margins aiding Uber on their quest to go public next year.

There have been whispers that Uber could garner a $120 billion valuation dwarfing Chinese tech giant Alibaba’s (BABA) IPO which was the biggest IPO to date at $25 billion.

Uber is following in Amazon’s footsteps executing the “blitzscaling” method to suppress competition.

This strategy involves scaling up as quick as possible and seizing market share before anyone can figure out what happened.

The growth explodes at such speed that investors pile in droves throwing inefficient capital at the business leading the company to make bold bets even though profit is nowhere to be seen.

Blitzscaling has fueled American and Chinese tech to the top of the global tech charts and the trade war is mainly about these two titans jousting for first and second place in a real-time blitzscale battle of epic proportion.

The audacious stabs at new businesses usually end up fizzling out, but the ones that do have the potential to blaze a trail to profitability.

One business that has Uber giving hope of one day returning capital to shareholders is Uber Eats – the online food delivery service.

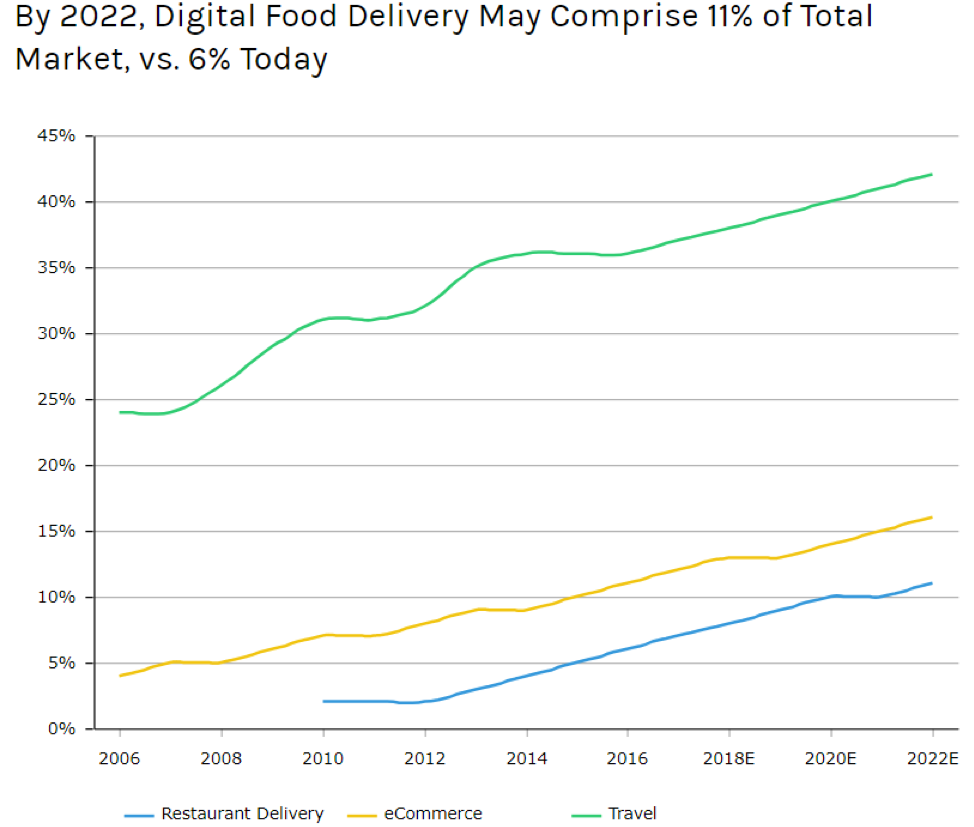

Total sales of restaurant deliveries will hit 11% of revenue if the current trend continues in 2022 marking a giant shift in consumer attitudes.

No longer are people eating out at restaurants, according to data, younger generations view ordering from an online food delivery platform as a direct substitute.

This mindset is eerily similar to Millennials attitude towards entertainment.

For many, Netflix (NFLX) is considered a better option than attending a movie theatre, and all forms of outdoor entertainment are under direct attack from these online substitutes.

One firm on the forefront of this movement has been Domino’s Pizza (DPZ).

You’d be surprised to find out that over half of the Domino’s Pizza staff are software developers.

They have focused on the customer experience doubling down on their online platform to offer the easiest way to order a pizza.

In 2012, the company was frightened to death that it still took a 25-step process to order a pizza.

By 2016, Domino’s rolled out “zero-click ordering” offering 15 different ways to order their product across many major platforms including Amazon’s Alexa.

This has all led to 60% of sales coming from online and rising.

The consistency, efficiency, and seamless online payment process has all helped Dominoes stock rise over 800% since May 2012 and that is even with this recent brutal sell-off.

Uber is perfectly positioned to take advantage of this new generation of dining in.

In the third quarter, Uber booked $2.1 billion of gross booking volume in their powerful online food delivery service.

The 150% YOY rise makes Uber Eats a force to be reckoned with.

Uber’s investment into e-scooters and bike transportation stems from the potential synergies of online food delivery efficiency.

It’s cheaper to deliver pizzas on a bicycle or anything without an internal combustion engine.

If you ever go to China, the electric powered three-wheel modified tuk-tuk with a storage compartment in the back instead of passenger seating is pervasive.

Often navigating around narrow alleyways is inefficient for a four-wheel automobile, and as Uber sets its sights on being the go-to last mile deliverer of food and whatnot, building out this vibrant transport network is vital to its long-term vision.

In fact, Uber is not an online ride-sharing platform, it will be something grander and its Uber elevate division could showcase Uber’s adaptability by making air transport cheap for the masses.

As soon as the robo-taxi industry gathers steam, Uber will ditch human drivers for self-driving technology saving billions in labor costs.

As it stands, Uber keeps cutting the incentive to drive for them with rates falling to as low as an average of $10 per hour now.

The golden age of being an Uber driver is long gone.

Uber is merely gathering enough data to prepare for the mass roll-out of automated cars that will shuttle passengers from point A to B.

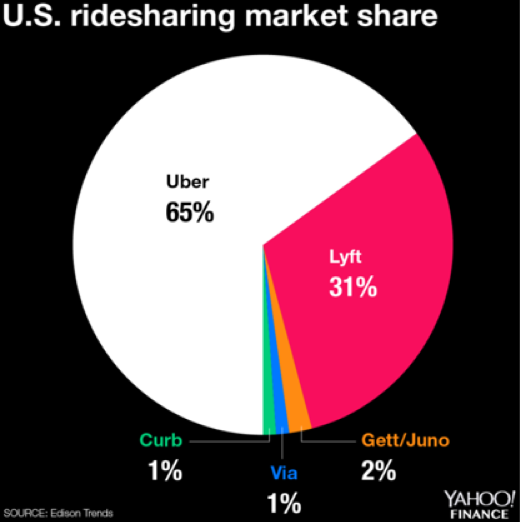

It doesn’t matter that Lyft has gained market share from Uber. Lyft’s market share was in the teens a few years ago and has rocketed to 31% taking advantage of management problems over at Uber to wriggle its way to relevancy.

It does not reveal how poor of a company Uber is, but it demonstrates that Uber’s network is spread over different industries and the sum of the parts is a lot greater than Lyft can fathom.

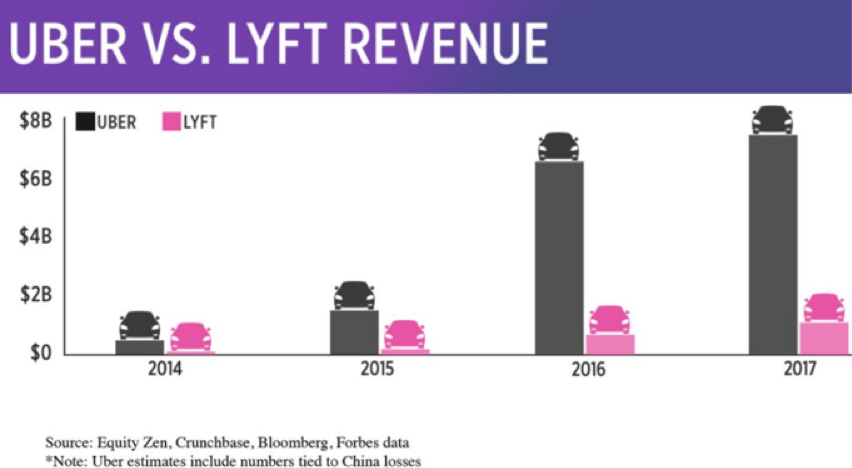

Lyft is a pure ride-share company and brings in annual revenue that is 4 times less than Uber.

Naturally, Uber loses a lot more money than Lyft because they have so many irons in the fire.

But even a single iron could be a unicorn in its own right.

CEO Dara Khosrowshahi recently talked about its Uber Eats division in glowing terms and emphasized that over 70% of the American population will have access to Uber Eats by the end of next year.

Uber’s position in the American economy as a pure next-generation tech business reverberates with its investors causing Khosrowshahi to brazenly admit that Uber “suffers from having too much opportunity as a company.”

Ultimately, the amped-up growth of the food delivery unit feeds back into its ride-sharing division. These types of synergies from Uber’s massive network effect is what management desires and dovetails nicely together.

In 2018 alone, 40% of Uber Eat’s customers were first-time samplers.

A good portion of these customers have never tried Uber’s ride-sharing service and when they travel for business or leisure, they later adopt the ride-sharing platform leading to more Uber converts.

Uber Freight has enabled truckers to push a button and book a load at an upfront price revolutionizing the process.

The online food delivery service is the place to be right now and it would be worth your while to look at GrubHub (GRUB).

Quarterly sales are growing over 50% and quarterly EPS growth was 61% sequentially for this industry leader.

Profit Margins are in the mid-20% convincingly proving that the food delivery industry will not be relying on razor-thin margins.

Charging diners $5 for delivery and taking a cut from the restaurateurs have been a winning strategy that will resonate further as more diners choose to munch in the cozy confines of their house.

Blitzscaling has led Uber to the online food delivery business and they are pouring resources into it to juice up profits before they go public next year.

The ride-sharing business is a loss-making enterprise as of now, and Uber will need to exhibit additional ingenuity to leverage the existing network to find strong pockets of revenue.

I believe they have the talent on their books to achieve finding these strong pockets making this company an intriguing stock to buy in 2019.