Mad Hedge Technology Letter

October 31, 2018

Fiat Lux

Featured Trade:

(IBM’S PUTS ON A RED HAT)

(RHT), (IBM), (AMZN), (MSFT), (GOOGL), (ORCL)

Mad Hedge Technology Letter

October 31, 2018

Fiat Lux

Featured Trade:

(IBM’S PUTS ON A RED HAT)

(RHT), (IBM), (AMZN), (MSFT), (GOOGL), (ORCL)

What took you so long, Ginni?

That was my first reaction when I heard International Business Machines Corporation (IBM) was making a big strategic shift by purchasing open source cloud company Red Hat (RHT) in a landmark $34 billion deal.

Ginni Rometty, IBM’s CEO since 2012, has presided over persistent negative sales growth and has done zilch for investors to conjure up some type of lasting hope for this company.

Not only has Rometty failed to grow the top line, but with an underwhelming 3-year EPS growth rate of -2%, the execution and performance haven’t been there as well.

Somehow and someway, she has maintained an iron-clad grip on her job at the helm of IBM and her legacy at IBM will be wholly determined by the failure or success of this Red Hat acquisition.

IBM shares sold off on the news as shareholders digested this bombshell.

Rometty took a hatchet to share buybacks and suspended them for 2020 and 2021 alienating a segment of their loyal shareholder base.

I can tell you one thing about this move – it smells of desperation and it won’t vault IBM into the conversation of Amazon (AMZN) Web Services or the Microsoft (MSFT) Azure.

The biggest winner of this deal is Red Hat’s CEO Jim Whitehurst who has been dangling the company for sale for a while.

Alphabet (GOOGL) was in the mix and had the opportunity to snag a last-second deal, but it never came to fruition.

The 63% premium IBM must pay for a company who only grew quarterly sales 14% YOY and quarterly EPS by 10% is expensive, but that is where we are with IBM.

Clearly overpaying was better than doing nothing at all.

IBM continues to hemorrhage sales and stopping the blood flow is the first step.

Rometty was responsible for the utter failure of artificial intelligence initiative Watson whose terrible management was a key reason for its implosion.

Analyzing this historic company gave me insight into the pitiful causing me to write a bearish story on IBM last month. To read that story, please click here.

Not only was the agreed price exorbitant, but Red Hat’s stock was trending south even before the interest rate induced sell-off rocked the tech sector of late.

Red Hat missed on sales revenue forecasts and offered weak guidance.

It could be the case that Whitehurst was actively seeking a buyer because he felt that Red Hat would go ex-growth in the next few years.

Red Hat was rumored to be on the market for quite a while looking to fetch a premium price for a company starting to stagnate with its visions of grandeur growth.

Rometty’s career-defining moment is high-risk and high-reward and is born out of being cornered by leading tech companies leaving IBM in their dust.

The deal finally allows IBM to return back to sales growth which will occur two years later, and Rometty will finally have that monkey off her back for now.

But the bigger question is will Rometty still have her job in two years if this experiment becomes toxic.

My guess is that Red Hat CEO Jim Whitehurst is automatically the next in line for the IBM throne if Rometty missteps, and piling on pressure will force IBM to evolve or die out.

And even though they will return back to growth, 2% growth is no reason to do cartwheels over.

The real work starts now and it will take years to turn around this dinosaur.

On the brighter side, the massive deals instantly improve sentiment that was flagging for years and puts IBM back on the map.

The synergies between IBM and Red Hat could be robust.

Red Hat can surely help IBM become a higher-quality hybrid cloud solutions company.

Models like this are the industry standard as luring a company into your cloud is one thing, but being able to cross-sell a plethora of extra add-on software services in the cloud is the necessary path to raising profitability.

IBM also inherits a slew of talented software engineers that it can mobilize for innovative cloud products. Red Hat’s products such as JBoss middleware and the OpenShift software for deploying applications in virtual containers could make IBM’s hybrid cloud more appealing and could help retain customers with the additional offerings.

Doubling down on the software side of the business was a strategy I pinpointed at the Mad Hedge Lake Tahoe conference and deals like this highlight the value of this type of assets.

There is a hoard of legacy tech companies like Oracle (ORCL) that is in dire need of such strategic injections and fresh ideas.

This won’t be the last deal of 2018, other cloud deals could shortly follow.

On the other side of the coin, hardware deals have turned rotten quickly with stark examples such as Hewlett-Packard’s (HPQ) $25 billion acquisition of Compaq, Microsoft’s $7.2 billion disastrous buy of Nokia’s mobile handset business and Google’s unimpressive $12.5 billion deal for Motorola Mobility that they later unloaded to Chinese PC company Lenovo.

Investors must be patient if IBM has any chance of completing this turnaround.

Listening to Rometty talk about this deal clearly reveals that she is hyping it up for something way bigger than it actually is.

Let’s not forget that Rometty’s tenure as CEO began in 2012 when IBM shares were trading north of $200 and she has presided over the company while the stock got pulverized by almost 30%.

It pains me that she is the one given the chance to turn the company around after years of underperformance.

Let’s not forget that at the end of 2017, IBM only had a 1.9% share of the cloud infrastructure, about 25 times smaller than Amazon Web Services.

The costly nature of the deal could also put a dent into IBM’s dividend, alienating another swath of its hardcore shareholder base.

Historically, IBM has had minimal success with transformative M&A and the industry competitors dominating IBM magnify the poor management performance headed by Rometty.

Rometty declaring that this deal means IBM will be “no. 1 in hybrid cloud” is overly optimistic, but this is a move in the right direction and could keep IBM spiralling out of control.

A return to sales growth might help stem the bleeding of its downtrodden share price, but Amazon and Microsoft are too far ahead to catch.

Investors will need to wait and see if the synergies between IBM’s and Red Hat’s products are meaningful or not.

“Growth and comfort do not coexist.” – Said CEO of IBM Ginni Rometty

Mad Hedge Technology Letter

October 30, 2018

Fiat Lux

Featured Trade:

(HOW ARTIFICIAL INTELLIGENCE WILL ENHANCE OR DESTROY YOUR PORTFOLIO)

(TSLA), (AMZN), (FB)

Anti-AI physicist Professor Stephen Hawking was a staunch supporter of preserving human interests against the future existential threat from machines and artificial intelligence (AI).

He was diagnosed with motor neuron disease, more commonly known as Lou Gehrig's disease, in 1963 at the age of 21 and sadly passed away March 14, 2018, at the age of 76.

Famed for his work on black holes, Professor Hawking represented the human quest to maintain its superiority against quickly advancing artificial acculturation.

His passing is a huge loss for mankind as his voice was a deterrent to AI's relentless march to supremacy. He was one of the few who had the authority to opine on these issues. Gone is a voice of reason.

Critics have argued that living with AI poses a red alert threat to privacy, security, and society as a whole. Unfortunately, those most credible and knowledgeable about AI are tech firms. They have shown that policing themselves on this front is remarkably unproductive.

Mark Zuckerberg, CEO of Facebook (FB), has labeled naysayers as irresponsible and dismissed the threat. After failing to prevent Russian interference in the last election, he is exhibiting the same defensive posture translating into a de facto admission of guilt. His track record of shirking accountability is becoming a trend.

Share prices will materially nosedive if AI is stonewalled and development stunted. Many CEOs who stake careers on doubling or tripling down on AI cannot see it die out. There is too much money to lose.

The world will see major improvements in the quality of life in the next 10 years. But there is another side of the coin in which Zuckerberg and company refuse to delve into the dark side of technology.

Defective Amazon (AMZN) Alexa has been producing unexplained laughter because of a mistaken command to start laughing. Despite avoiding calamity, these small events show the magnitude of potential chaos capable of haywire AI functions. If one day, a user attempts to order a box of tissues and Alexa burns down the house, who is liable?

Tesla's (TSLA) CEO Elon Musk has shared his anxiety about robots flipping the script on humans. Elon acknowledges that AI and autonomous vehicles are important factors in the battle for new technology. The winner is yet to be determined as China has bet the ranch with unlimited resources from Chairman Xi.

Musk has hinted that robots and humans could merge into one species in the future. Is this the next point of competition among tech companies? The future is murky at best.

Bill Gates noted that robots should be taxed like humans. This reflects the bubble in which the ultra-elite reside. This comment implies that humans and robots are on the same level and shows a severe lack of empathy for the 40% of working Americans who will be replaced by machines over the next 10 years.

The West is comprised of a deeply hierarchical system of winners and losers. Hawking's premise that evolution has inbuilt greed can be found in the underpinnings of America's economic miracle.

Wall Street has bred a culture that is entirely self-serving regardless of the bigger system in which it finds itself.

Most of us are participating in this perpetual money game chase because our system treats it as a natural part of life. AI will help more people do well in this paper chase to the detriment of the majority.

Quarterly earnings performance is paramount for CEOs. Return value back to shareholders or face the sack in the morning. It's impossible to convince anyone that America's capitalist model is deteriorating in the greatest bull market of all time.

Wall Street has an insatiable hunger for cutting-edge technology from companies that sequentially beat earnings and raise guidance. Flourishing technology companies enrich the participants creating a Teflon-like resistance to downside market risk.

The issue with Professor Hawking's work is that his time frame is too far in the future. Professor Hawking was probably correct, but it will take 25 years to prove it.

The world is quickly changing as science fiction becomes reality. The year 2019 will signal the real beginning of AI in tangible form when autonomous fleets flood main streets.

People on Wall Street are a product of the system in place and earn a tremendous amount of money because they proficiently execute a specialized job. Traders are busy focusing on how to move ahead of the next guy.

Firms building autonomous cars are free to operate as is. Hyper-accelerating technology spurs on the development of AI, machine learning and enhanced algorithms. Record profits will topple and investors will funnel investments back into an even narrower grouping of technology stocks.

Professor Hawking said we need to explore our technological capabilities to the fullest in order to avoid extinction. In 2018, exploring these new capabilities still equals monetizing through the medium of products and services.

This is all bullish for equities as the leading companies associated with AI will not be subject to any imminent regulation, blowback or government intervention.

The only solution is keeping companies accountable by a function of law or creating a third-party task force to regulate AI.

In 2018, the thought of overseeing robots sounds crazy. However, by 2019, it might be as normal as uncontrollable laughter from your smart home.

Mad Hedge Technology Letter

October 29, 2018

Fiat Lux

Featured Trade:

(THE DIGITAL NOMAD ISSUE)

"As tech leaders, we have to admit that we are hugely disconnected with our nation. I don't like it but have to recognize this issue," - said current CEO of Uber Dara Khosrowshahi in 2016.

Mad Hedge Technology Letter

October 25, 2018

Fiat Lux

Featured Trade:

(HOW ENVIRONMENTALISTS MAY KILL OFF BITCOIN),

(BTC), (ETH), (TWTR), (SQ)

If Jack Dorsey's proclamation that bitcoin will be anointed as the global "single currency," it could spawn a crescendo of pollution the world has never seen before.

In a candid interview with The Times of London, Dorsey, the workaholic CEO of Twitter (TWTR) and Square (SQ), offered a 10-year time horizon for his claim to come to fruition.

The originators of cryptocurrency derive from a Robin Hood-type mentality circumnavigating the costly fees and control associated with banks and central governments.

Unfolding before our eyes is a potential catastrophe that knows no limits.

Carbon emissions are on track to cut short 153 million lives as environmental issues start to spin out of control while the world's population explodes to 9.7 billion in 2050, from 8.5 billion people in 2030, up from the 7.3 billion today.

All these people will need to barter in bitcoin, according to Jack Dorsey.

Cryptocurrency is demoralizingly energy-intensive, and the recent institutional participation in crypto server farms will exacerbate the environmental knock-on effects by displacing communities, destroying wildlife, and climate-changing carbon emissions.

This seemingly controversial means to outmaneuver the modern financial system has transformed into a murky arms race among greedy cryptocurrency miners to use the cheapest energy sources and the most efficient equipment in a no-holds-barred money grab.

Bitcoin and Ethereum mining combined with energy consumption would place them as the 38th-largest energy consuming country in the world - if they were a country - one place ahead of Austria.

Mining a bitcoin adjacent to a hydropower dam is not a coincidence. In fact, these locales are ground zero for the mining movement. The common denominator is the access to cheap energy usually five times cheaper than standard prices.

Big institutions that mine cryptocurrency install thousands of machines packed like a can of sardines into cavernous warehouses.

In 2015, a documentary detailed a large-scale foreign mining operation with an electricity outlay of $100,000 per month creating 4,000 bitcoins. These are popping up all over the world.

An additional white paper from a Cambridge University study uncovered that 58% of bitcoin mining comes from China.

Cheap power equals dirty power. Chinese mining outfits have bet the ranch on low-cost coal and hydroelectric generators. The carbon footprint measured at one mine per day emitted carbon dioxide at the same rate as five Boeing 747 planes.

The Chinese mining ban in January set off a domino effect with the Chinese mining operations relocating to mainly Canada, Iceland, and the United States.

Effectively, China has just exported a tidal wave of new pollution and carbon emissions.

Bitcoin is mined every second of every day and currently has a supply of approximately 17 million today, up from 11 million in 2013.

Bitcoin's electricity consumption has been elevated compared to alternative digital payment currencies because the dollar price of bitcoin is directly proportional to the amount of electricity that can profitably be used to mine it.

To add more granularity, miners buy more servers to maintain profitability then upgrade to more powerful servers. However, the new calculating power simply boosted the solution complexity even faster.

Mines are practically outdated upon launch and profitability could only occur by massively scaling up.

Consumer grade personal computers are useless now because the math problems are so advanced and complicated.

Specialized hardware called Application-Specific Integrated Circuit (ASIC) is required. These mining machines are massive, hot, and guzzle electricity.

Bitcoin disciples would counter, describing the finite number of bitcoins - 21 million. This was part of the groundwork laid down by Satoshi Nakamoto (a pseudonym), the anonymous creator of bitcoin when he (or they) constructed the digital form of money.

Nakamoto could not have predicted his digital experiment backfiring in his face.

The bottom line is most people use bitcoins to literally create money out of thin air in digital form, rather than using it as a monetary instrument to purchase a good or service.

That is why people mine cryptocurrency, period.

Now, excuse me while I go into the weeds for a moment.

Enter hard fork.

A finite 21 million coins is a misnomer.

A hard fork is a way for developers to alter bitcoin's software code. Once bitcoin reaches a certain block height, miners switch from bitcoin's core software to the fork's version. Miners begin mining the new currency's blocks after the bifurcation creating a new chain entirely and a brand-spanking new currency.

Theoretically, bitcoin could hard fork into infinite new machinations, and that is exactly what is happening.

Bitcoin Cash was the inaugural hard fork derived from the bitcoin's blockchain, followed by Bitcoin Gold and Bitcoin Diamond.

Recently, the market of hard fork derivations includes Super Bitcoin, Lightning Bitcoin, Bitcoin God, Bitcoin Uranium, Bitcoin Cash Plus, BitcoinSilver, and Bitcoin Atom.

All will be mined.

The hard fork phenomenon could generate millions of upstart cryptocurrency server farms universally planning to infuse market share because new currencies will be forced to build up a fresh supply of coins.

If Peter Thiel's prognostication of a 20% to 50% chance of bitcoin's price rising in the future is true, it could set off a cryptocurrency server farm mania.

By the way, Thiel also believes that there is a 30% chance that Bitcoin could go to zero.

A surge in the price of bitcoin results in mining cryptocurrency operations everywhere by any type of electricity, especially if the surge maintains price stability. Even mining in Denmark, where one finds the world's costliest electricity at $14,275 per bitcoin, would make sense.

Recently, miners' appetite for power is causing local governments to implement surcharges for extra infrastructure and moratoriums on new mines. Even these mines built adjacent to hydro projects are crimping the supply lines, and consumers are forced to buy power from outside suppliers. Miners are often required to pay utility bills months in advance.

By July 2019, mining will possibly need more electricity than the entire United States consumes. And by February 2020, bitcoin mining will need as much electricity as the entire world does today, according to Grist, an environmental news website.

Geographically, most locations around the world were profitable based on May's bitcoin price of $10,000.

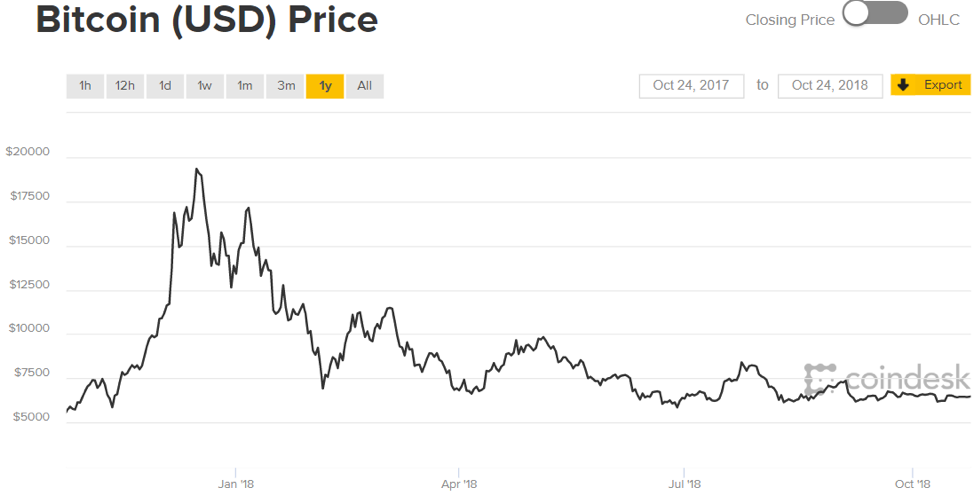

However, the sudden slide down to $6,400 reaffirms why the Mad Hedge Technology Letter avoids this asset class like the plague.

The most unrealistic operational locations are distant, tropical islands, such as the Cook Islands at $15,861, to mine one bitcoin.

If you'd like to drop your life and make a fortune mining bitcoin, then Venezuela is the most lucrative at $531 per bitcoin.

As bitcoin's nosedive perpetuates, Venezuela might be the last place on earth with mining farms.

Who doesn't like free money? Set up a few devices, crank up the power, collect the coins, pay off the electricity bill, pocket the difference and hopefully the world - or Venezuela - hasn't keeled over by then.

"If privacy is outlawed, only outlaws will have privacy," - said Philip R. "Phil" Zimmermann, Jr., creator of the most widely used email encryption software in the world.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.