“You have to be willing to be misunderstood if you’re going to innovate.” – Said Founder and CEO of Amazon Jeff Bezos

Mad Hedge Technology Letter

October 8, 2018

Fiat Lux

Featured Trade:

(A LONG-AWAITED BREATHER IN TECHNOLOGY),

(AMZN), (TGT), (NVDA), (SQ), (AMD), (TLT)

Taking profits - it was finally time.

The Nasdaq has been hit in the mouth the last few days and rightly so.

It was the best quarter in equities for five years, and a quarter that saw tech comprise up to a quarter of the S&P demonstrating searing strength.

It would be an understatement to say that tech did its part to drive stocks higher.

Tech shares have pretty much gone up in a straight line this year aside from the February meltdown.

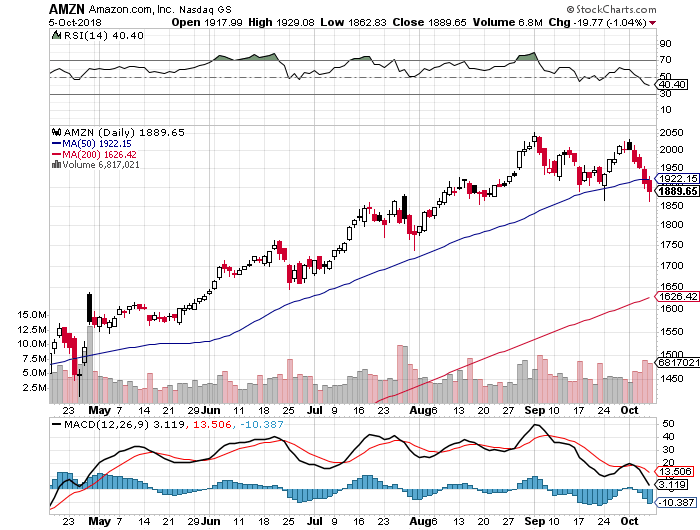

Even that blip only caused Amazon (AMZN) to slide around 10%.

After all the terrible macro news thrown on the market in spades – tech stocks held their own.

Not even a global trade war with the second biggest economy in the world which is critical to exporting products to America was able to knock tech shares off their perch.

At some point, 26% earnings growth cannot sustain itself, and even though the tech narrative is still intact, investors need to breathe.

Let’s get this straight – tech companies are doing great.

They benefit from a secular tailwind with every business pivoting to mobile and software services.

All that new business has infused and invigorated total revenue.

The negative reaction by technology stocks was based on two pieces of news.

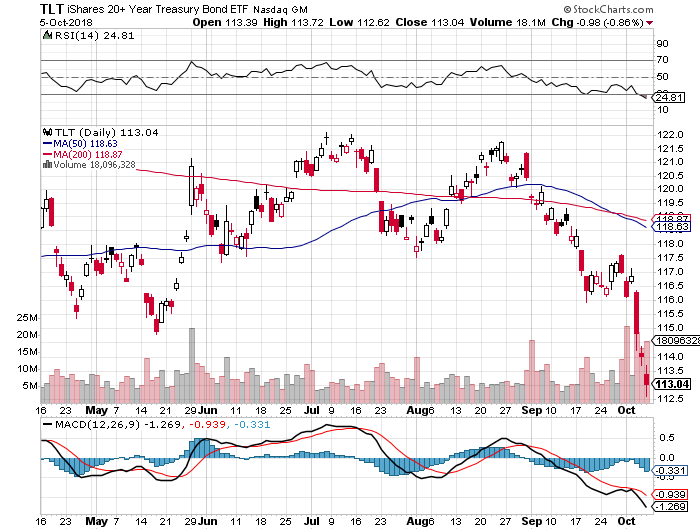

Interest rates (TLT) surging to over 3.2% was the first piece of news.

The increase in rates reinforces that the economy is humming along at a breakneck speed.

Yields are going up for the right reasons and this economy is not a sick one indeed.

As rates rise, other asset classes become more attractive such as CD’s and bonds.

The whole world is looking at the pace of rate rises because this will affect the ability for tech behemoths to borrow money to invest in their expensive well-oiled machines.

Three things are certain - the economy is hot, the smart money is buying on the dip now, and Amazon will still take over your home.

Even in a rising rate environment, Amazon is fully positioned to outperform.

The second catalyst to this correction was Amazon’s decision to hike its minimum wage to $15 per hour.

This could lay the path for workers around the country to demand higher pay.

The move was a misnomer as it will eliminate stock awards and monthly bonuses lessening the burden that Amazon actually has to dole out.

Call this a push – the rise in expenses won’t be material and realistically, Amazon can afford to push the wage bill by another order of magnitude, even though they will not.

This was also a way for Amazon founder Jeff Bezos to keep Washington off his back for a few months, and his generous decision was praised by government officials.

The wage hike underscores the strength of the ebullient American economy, and the consumer will benefit by recycling their wages back into Amazon and the wider economy.

Amazon makes up 50% of American e-commerce sales, and when workers are buying goods online, a good chance its coming from Amazon.

In an environment of full employment, the natural direction of wages is up, and this was due to happen.

You can also look at wage inflation as employees gaining at the expense of the corporation.

However, the massive deflationary trends of technology will also make this wage hike quite irrelevant over time as Amazon will automate more of their supply chain to make up for any wage hike that could damage revenue.

Amazon’s economies of scale give the Seattle-based company enough levers and buttons to push and pull to dilute expenses to make this a non-issue.

Each earnings call usually involves CFO of Amazon Brian Olsavsky explaining the acceleration of efficiencies in fulfilment centers bolstering the bottom line.

The stellar innovation in operational expertise moves up a level each quarter if not two levels.

Ultimately, though expensive on the surface, this won’t affect Amazon’s numbers at all, but more critically please the lower tier of workers who fight and scratch for their daily crust of bread.

This win-win scenario casts a positive image of Bezos in the public eye at a crucial time when he plans to recruit another legion of Amazon workers, as Amazon will shortly announce the location of their second American-based headquarter.

In fact, this turns the screws on the smaller retailers who must match the $15 per hour wage or confront a potential disaster of an entire workforce walking out and joining Amazon.

The mysterious Amazon-effect works in many shapes and sizes.

Big retailers like Target (TGT) have griped that it’s near impossible to find seasonal workers for the upcoming holiday season.

Moreover, if inflation remains moderate but contained – technology will power on.

And it will take more than a few prints of rising inflation to impress the Fed enough to expedite the raising of rates.

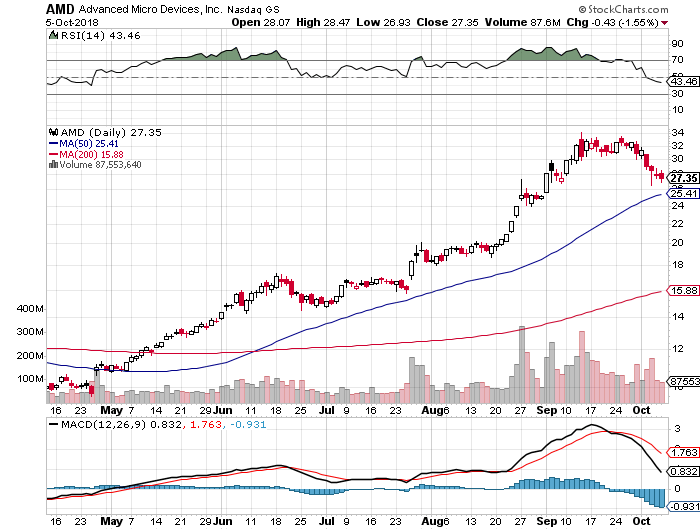

But it is safe to say that investors cannot expect the 100% up moves like in Amazon and Advanced Micro Devices (AMD) in one calendar year moving forward.

Technology has a plate full of challenges facing its share price as we move into the latter part of the fiscal year.

The challenges are two-fold - mid-term elections and navigating a smooth year-end.

Earnings should be good which is already baked into the pie, and the benefits of the tax cut have already worked itself through the system.

The furious pace of share buybacks will eventually subside too.

Management might finally bring out the spin doctors claiming the stronger dollar and worsening trade war is the reason to guide down.

At least tech companies doing business in China might follow this playbook.

Either way, tech shares are demonstrably sensitive right now and while the market needs tech to lead the way, the sector is exhausted from the burden of carrying the bulk of the load.

Freak-outs on rate surges have been a common experience for those old hands presiding over markets for decades.

These are all the staples of a 9th year bull market.

Typical late stage topping action is normal in economic cycles.

After the dust settles, the overreaction will give way to great buying opportunities at great prices, albeit it in the higher quality names.

The chip sector is still one to avoid unless the names are Advanced Micro Devices or Nvidia (NVDA).

Legacy companies have always been a no-go.

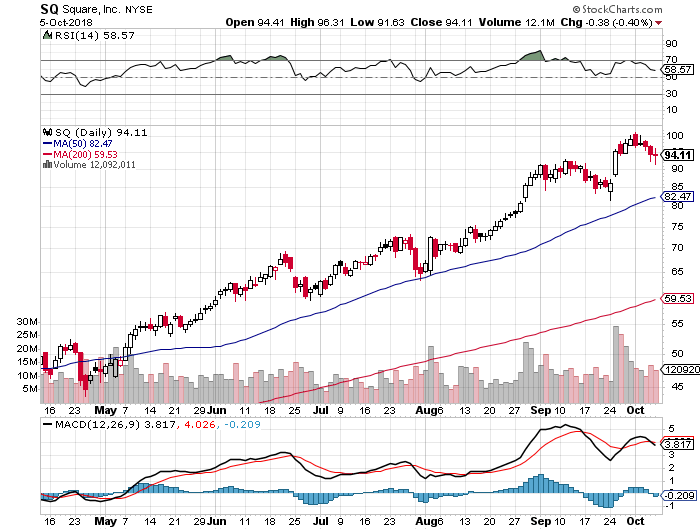

If you want hyper-growth, fin-tech name Square (SQ) would be an ideal candidate.

If buy and hold is your cup of tea, any 10% discount would be a great entry point in any of these quality companies.

“I hope Puerto Rico munis go lower so I can buy more.” – Said Founder of DoubleLine Capital Investment Firm Jeffrey Gundlach three years ago.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

October 4, 2018

Fiat Lux

Featured Trade:

(HOW SOFTBANK IS TAKING OVER THE US VENTURE CAPITAL BUSINESS),

(SFTBY), (BABA), (GRUB), (WMT), (GM), (GS)

One of the few people who can magnify pressure on the venture capitalists of Silicon Valley is none other than Masayoshi Son.

What a ride it has been so far. At least for him.

His $100 billion SoftBank Vision Fund has put the Sand Hill Road faithful in a tizzy – utterly revolutionizing an industry and showing who the true power broker is in Silicon Valley.

He has even gone so far as doubling down his prospects by claiming that he will raise a $100 billion fund every few years and spend $50 billion per year.

This capital logically would flow into what he knows best – technology and the best technology money can buy.

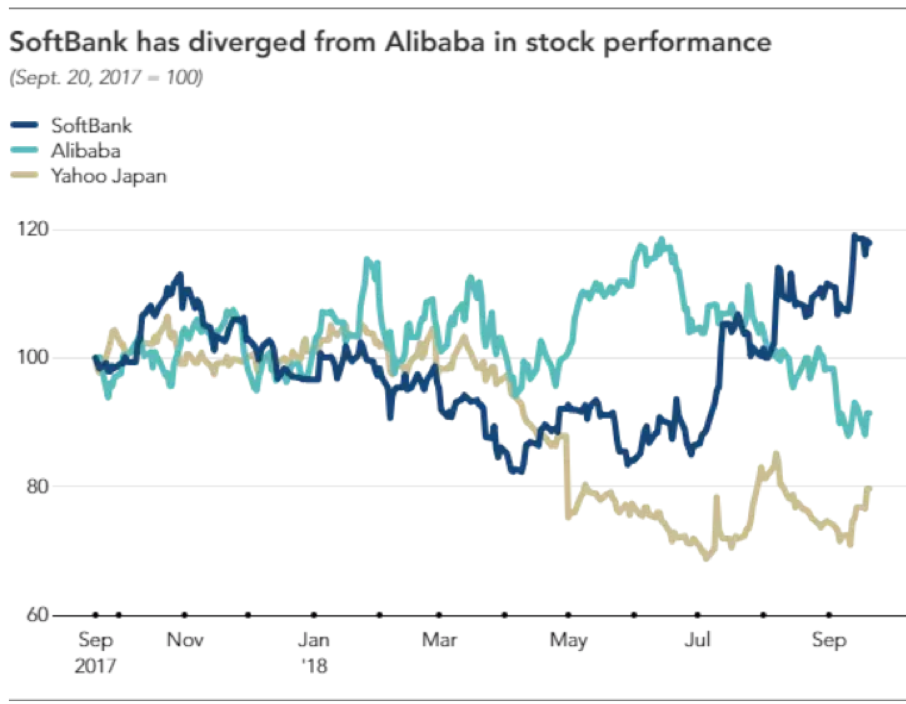

As Yahoo Japan and Alibaba (BABA) shares have floundered, SoftBank’s stock has decoupled from the duo displaying explosive brawn.

SoftBank’s stock is up 30% in the past few months and I can tell you it’s not because of his Japanese telecommunications business which has served him well until now as his cash cow.

Yahoo Japan, in which SoftBank owns a 48.17% stake, has existing synergies with SoftBank’s Japanese business, but has experienced a tumble in share price as Son turns his laser-like focus to his epic Vision Fund.

His tech investments are bearing fruit and not only that, Son revealed his Alibaba investment is about to clean up shop to the tune of $11.7 billion next year shooting SoftBank shares into orbit.

A good portion of the lucrative windfall will arrive from derivatives connected to the sale of Alibaba, and the other 60% comes from the paper profits finally realized in this shrewd piece of business.

Equally paramount, SoftBank’s Vision Fund hauled in $2.13 billion in operating profits from the April-June quarter underscoring the effectiveness of Masayoshi Son’s tech ardor.

Son said it best of the performance of the Vision Fund saying, “Results have actually been too good.”

So good that after this June, Son changed his schedule to spend 3% of his time on his telecom business down from 97% before June.

His telecommunications business in Japan has turned into a footnote.

It was the first quarter that Son’s tech investments eclipsed his legacy communications company.

Son vies to rinse and repeat this strategy to the horror of other venture capitalists.

The bottomless pit of capital he brings to the table predictably raises the prices for everyone in the tech investment world.

Son’s capital warfare strategy revolves around one main trope – Artificial Intelligence.

He also strictly selects industry leaders which have a high chance of dominating their field of expertise.

Geographically speaking, the fund has pinpointed America and China as the best sources of companies. India takes in the bronze medal.

Unsurprisingly, these two heavyweights are the unequivocal leaders in artificial intelligence spearheading this movement with the utmost zeal.

His eyes have been squarely set on Silicon Valley for quite some time and his record speaks for himself scooping up stakes in power players such as Uber, WeWork, Slack, and GM (GM) Cruise.

Other stakes in Chinese firms he’s picked up are China’s Uber Didi Chuxing, China’s GrubHub (GRUB) Ele.me and the first digital insurer in China named Zhongan International costing him $500 million.

Other notable deals done are its sale of Flipkart to Walmart (WMT) for $4 billion giving SoftBank a $1.5 billion or 60% profit on the $2.5 billion position.

In 2016, the entire venture capitalist industry registered $75.3 billion in capital allocation according to the National Venture Capital Association.

This one company is rivalling that same spending power by itself.

Its smallest deal isn’t even small at $100 million, baffling the local players forcing them to scurry back to the drawing board.

The reverberation has been intense and far-reaching in Silicon Valley with former stalwarts such as Kleiner Perkins Caufield & Byers breaking up, outmaneuvered by this fresh newcomer with unlimited capital.

Let me remind you that it was considered standard to cautiously wade into investment with several millions.

Venture capitalists would take stock of the progress and reassess if they wanted to delve in some more.

There was no bazooka strategy then.

SoftBank has thrown this tactic out the window by offering aspiring firms showing promise boatloads of capital up front even overpaying in some cases.

Conveniently, Son stations himself nearby at a nine-acre estate in Woodside, California complete with an Italianate mansion he bought for $117.5 million in 2012.

It was one of the most expensive properties ever purchased in the state of California even topping Hostess Brands owner Daren Metropoulos, who bought the Playboy Mansion from Hugh Hefner in 2016 for $100 million.

If you think Son is posh – he is not. He only fits himself out in the Japanese budget clothing brand Uniqlo. He just needed a comfortable place to stay and he hates hotels.

In August, SoftBank decided to top off the $4.4 billion investment in WeWork, an American office space-share company, with another $1 billion leading Son to proclaim that WeWork would be his “next Alibaba.”

Son continued to say that WeWork is “something completely new that uses technology to build and network communities.”

The rise of remote workers is taking the world by storm and this bet clearly follows this trend.

The unlimited coffee and beer found in the new Japanese Roppongi WeWork office that opened earlier this year was a nice touch.

WeWork plans to open 10-12 offices in Japan by the end of 2018.

Thus far, WeWork is operating in over 300 locations in over 20 countries.

Revenue is growing rapidly with the $900 million in 2017 a 12-fold improvement from 2014.

The newest addition to SoftBank’s dazzling array of unicorns is Bytedance, a start-up whose algorithms have fueled news-stream app Jinri Toutiao’s meteoric rise in China.

The deal values the company at $75 billion.

It also runs video sharing app Douyin, and overseas version TikTok.

Bytedance’s proprietary algorithm, serving to personalize streams for users, is the best in China.

They have been able to insulate themselves from local industry giants Tencent and Alibaba.

TikTok has piled up over 500 million users and brilliant investment like these is why Son revealed that the Vision Fund’s annual rate of return has been 44%.

SoftBank’s ceaseless ambition has them in the news again with whispers of investing in a Chinese online education space with a company called Zuoyebang.

China’s online education market is massive. In 2017, this industry pulled down over $33 billion in revenue, and 2018 is poised to break $55 billion.

Zuoyebang has lured in Goldman Sach’s (GS) as an investor.

This platform allows users to upload homework questions for third party assistance – the name of the app literally translates into “homework help.”

Cherry-picking off the top of the heap from the best artificial intelligence companies in the world is the secret recipe to outperforming your competitors.

At the same time, aggressively throwing money at these companies has effectively frozen out any resemblance of competition. Once the competition is frozen out, the value of these investments explodes, swiftly super-charged by rapidly expanding growth drivers.

How can you compete with a man who is willing to pay $300 million for a dog walking app?

Venture capitalist funds have been scrambling to reload and mimic a Vision Fund-like business of their own, but its not easy raising $100 billion quickly.

This genius strategy has made the founder of SoftBank the most powerful businessman in the world.

Son owns the future and will have the largest say on how the world and economies evolve going forward.

Mad Hedge Technology Letter

October 3, 2018

Fiat Lux

Featured Trade:

(OUR HOME RUN ON SQUARE),

(SQ), (V), (AMZN), (GRUB), (SPOT), (MSFT), (CRM), (AAPL)

Pat yourself on the back if you pulled the trigger on Square (SQ) when I told you so because the stock has just lurched over an intra-day level of $100.

It was me aggressively pushing readers into buying this gem of a fin-tech company at $49. To read that story, please click here (you must be logged in to www.madhedgefundtrader.com).

Since then, the price action has defied gravity levitating higher each passing day immune to any ill-effects.

The Teflon-like momentum boils down to the company being at the cross-section of an American fin-tech renaissance and spewing out supremely innovative products.

At first, Square nurtured the business by targeting the low hanging fruit– small and medium size enterprises in dire need of a strong injection of fin-tech infrastructure.

It largely stayed away from the big corporations that adorn billboards across the Manhattan skyline.

That was then, and this is now.

Square is going after the Goliath’s fueling a violent rise in gross payment volume (GPV).

Modifying themselves for larger institutions is the next leg up for Square.

They recently inaugurated Square for Restaurants for larger full-service restaurants.

Business owners do not need technical backgrounds to operate the software and integrating Caviar into this program emphasizes the feed through all of Square’s software.

Dorsey has built an ecosystem that has morphed into a one-stop shop for comprehensively running a business.

Migrating into business with the premium corporations offers an opportunity to augment higher margin business.

This is the lucrative path ahead for Square and why investors are festively lining up at the door to get a piece of the action.

The downside with an uber-growth company like Square are lean profits, but they have managed to eke out three straight quarters of marginal spoils.

However, the absence of profits can be stomached considering the total addressable market is up to $350 billion.

Grabbing a chunk of that would mean profits galore for this too hot to handle company.

Expenses are always a head spinner for Silicon Valley firms and attracting a dazzling array of engineers to spin out breathtaking profits can’t be done on the cheap.

The Cash app download figures are sizzling and is one of the most popular apps in the app store.

Square’s marketing strategy is also turning a corner getting out their name leading to sale conversions.

These are just several irons in the fire.

The last two years has seen this stock double each year, could we be in for another double next year?

If measured by growth, then I see why not.

Growth is the ultimate acid test deciding whether this stock will be dragged down into the quick sand or let loose to run riot.

Other second-tier tech firms in the middle of a sweet growth spot pack a potent punch like Spotify (SPOT) and Grubhub (GRUB) which are growing annual sales around 50-60%.

Material profits are also irrelevant for the aforementioned tech juggernauts.

Square is expanding at the same fervent pace too, and the hyper-growth only makes payment processors like Visa (V) quasi-jealous of such staggering numbers.

And when Square trots out numbers to the public like that with (GPV) shooting out the roof, the stock does nothing but go gangbusters.

Either way, Square has popularized making credit card payments through smartphones and that in itself was a tough nut to crack amongst tough nuts.

Square also has a line-up of impressive point-of-sales products such as Caviar.

In fact, merchant sellers are adopting an average of 3.4 Square software apps with invoices, loans, marketing, and payroll software being the most beloved.

Square also offers other software that can handle back office tasks and manage inventory.

The software and services business is on pace to register over $1 billion in sales in 2019.

The breadth of functions that can boost a company’s execution highlights the quality of software Dorsey has produced.

I always revert back to one key ingredient that all tech companies must wildly indulge in to fire up the stock price – innovation.

Innovation in bucket loads is something all the brilliant tech firms crave such as Microsoft (MSFT), Amazon, and Salesforce (CRM).

Overperformance starts from the top and trickles down to the people they hand pick to manage and run the businesses.

Jack Dorsey is right up there with the best of them and his influence cannot be denied or ignored.

His stewardship over his other company Twitter (TWTR) is sometimes worrisome because of a pure scheduling conflict, but it’s obvious which company is having a better year.

Square steers clear of the privacy and regulatory minefields handcuffing Twitter.

And it could be safely assumed that Dorsey enjoys his afternoons more at Square than his mornings across the street at Twitter where he is bombarded by heinous problems up the wazoo.

When you conjure up an up-and-coming company that could rattle the establishment, Square is one of the first companies that comes to mind.

Some analysts even argue this company deserves to be lifted into the vaunted Fang group.

I would say they are on their merry way but they just aren’t big enough to command a spot on the Fang roster.

I have immense conviction this stock will be a deep influencer of our time, and its diversified software offerings add limitless dimensions underpinning massive revenue streams.

In Q2, the subscription revenue grew 127% YOY underscoring the success the software team is having, crafting productive apps applicable to business owners.

Business owners can even take out a loan through Square Capital which issues micro-loans to small business owners.

In need of financing? Ring up Dorsey’s company for a few quid.

Starkly contrasting Square in the payment processors space is Visa (V).

Visa is not a hyper-growth company going ballistic, but a stoic behemoth unperturbed.

The 3.283 billion visa cards that adorn its insignia represents scintillating brand awareness and efficiency.

When Tim Cook was asked if Apple (AAPL) plans to disrupt Visa, he smirked and said, “People love their credit cards.”

This is a prototypical steady as she goes-type of company.

They do not offer micro-loans to small businesses or dabble with any of the murky sort of products that can be found on the edge of the risk curve.

They are a safe and steady pure payment processor.

Its network can digest 65,000 transactions per second and is universally cherished as a brand around the world.

All of this led to an operating margin of 66% in 2017.

Square has identified other parts of the payment process to snatch and do not directly compete with Visa.

They partner with Visa and pay them a processing fee.

Subsequently, Square is paid a merchant fee after the payment is approved.

Visa has a monopoly and a moat around their business as wide as can be.

Square is a different type of beast – growing uncontrollably and hell-bent on spawning a revolutionary fin-tech paradigm shift.

The question is can Square eventually turn payment heavyweights like Visa on its head?

The path is fraught with booby traps and as Square generates the projected sales and bolsters its revenue, it could start to encroach on these legacy processors too.

Yet, it’s too early to delve into that threat yet.

Enjoy the ride with Square and better to lay off this potent stock until a better entry point presents itself.

This stock will go higher. Giddy-up!

“Should kids check phones at dinner? I don't know. To me, that's a parenting choice.” - Said Google CEO Sundar Pichai

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.