At the Future Proof conference last week, Bond King Jeffrey Gundlach gave his expert take on some of the variables in the markets today.

It’s hard for to understand how Gundlach made his money with the amount of fear mongering he is promoting.

He is basically scared of everything in todays market including the stock market, the US dollar (UUP), the upcoming recession that still hasn’t hit, high housing prices, and layoffs just the name the start.

First, the unemployment rate is at 3.8% in the US so to say that this is a canary in the coalmine is quite hilarious.

Tech, even drastically over hired, and they had to take a machete to staff numbers just to get back to the 2020 employment levels.

I would even say that they need to go back to 2015 staff levels with artificial intelligence contributing more efficiency.

I hardly believe it’s time to ring to alarm on tech unemployment.

Look across the Atlantic where Spanish youth unemployment is 30% and Italians, on average, live with their parents until 45 years old because they can’t afford to move out of the house.

The United States is not that and will not become like that.

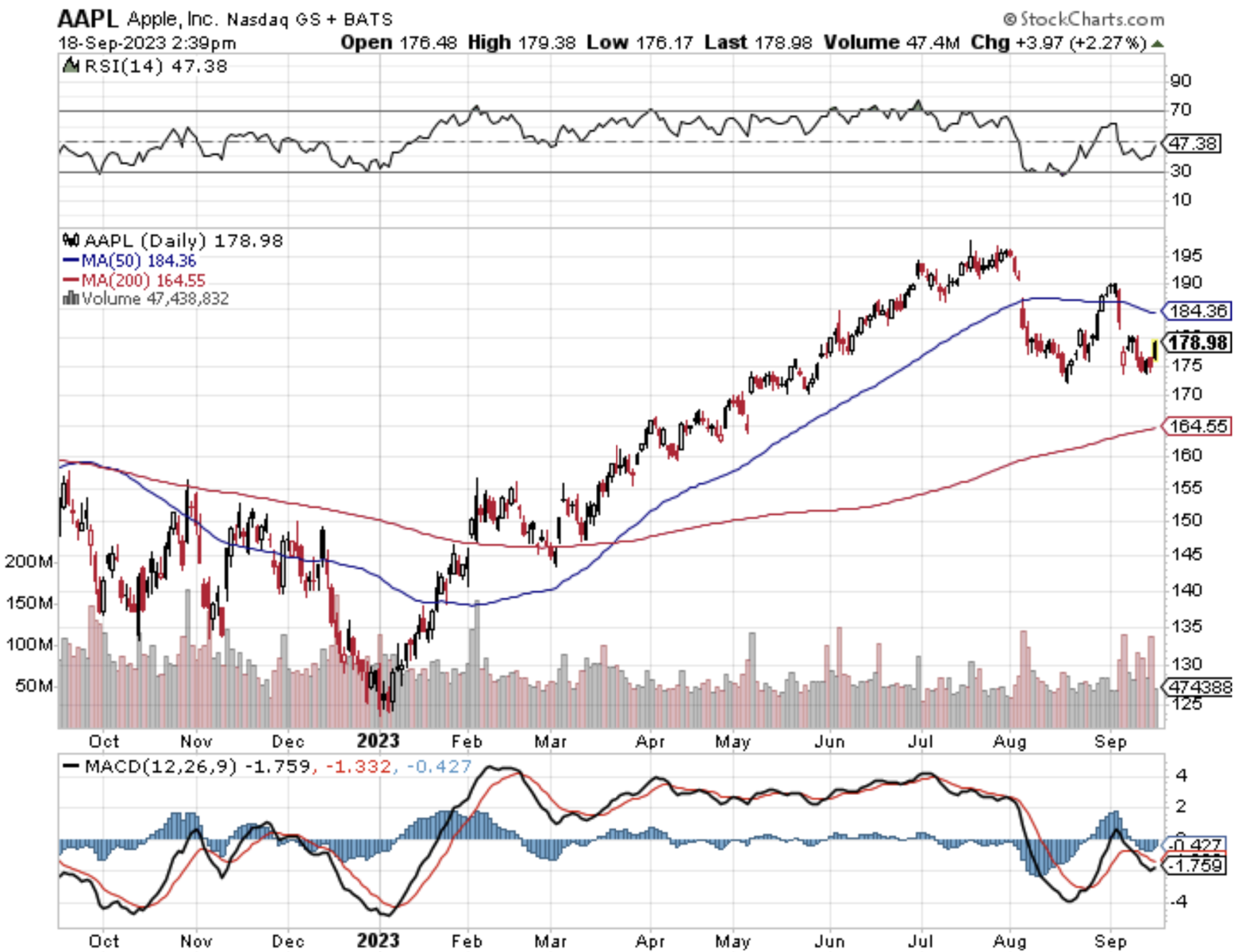

The Nasdaq Composite ($COMPQ) has surged 31% respectively this year, as investors price in the potential boost to companies from artificial intelligence and future cuts to interest rates.

However, they're overlooking "demons on the horizon," Gundlach cautioned.

We are nearing the top of the interest rate cycle and no other OECD economy has been able to push rates to 5.25% while keeping the economy churning.

Therefore, it might be plausible to say that the demons aren’t on the horizon, but in the rearview mirror.

Japan is still at 0% which has resulted in a massive invisible tax to the Japanese middle class which is basically the whole country.

He also noted the chilling effect of higher mortgage rates on the housing market, and the challenge for small businesses of having to refinance their debts at much higher interest rates.

It’s true that 7% mortgage rates has extraordinarily hit left wing coastal cities.

Combine high mortgage rates with work from home, and Silicon Valley has now moved everywhere with everyone becoming a digital nomad.

This has actually transferred new tech wealth to many other new areas such as Nashville, Austin, and of all places Boise, Idaho.

This trend can’t be understated and is now a growing contributor to the overall economy.

"The economy is definitely weakening" is something I definitely agree with Gundlach, but that doesn’t reveal the whole story.

The internals are slowing down from a very high peak which he failed to mention.

Instead of Microsoft (MSFT) cloud division Azure growing at 40% year over year, we are only getting about 18% these days.

Coming off of Himalayan highs is a tough pill to swallow when many tech investors often expect growth metrics of over 30% year over year, but that’s hard to achieve in 2023.

The strong dollar has also exerted a fierce deflation affect across many tech products making computers and so on cheap. Tech products in Europe and abroad are higher priced even though these places have incomes that a many times lower.

Relatively speaking, US tech companies and US consumers are better placed than any other comparable city or country in the world in the post-covid world.

Fear mongering never got anybody rich. US tech will continue to be the best of breed and in no plausible scenario will a foreign company or country knock any of the top 7 Silicon Valley tech firms off their perch in the next 30 years. I would even argue that as rates peak and interest rates expectation ratchet lower, tech stocks will become the safety trade again like it did in March.