Keeping up with the Joneses – that’s what Amazon is doing with its foray into generative artificial intelligence.

Its cloud division AWS is building a $100 million AI center to go toe to toe with increasing competition in cloud infrastructure services

The upcoming AWS Generative AI Innovation Center will become the heart and soul of Amazon experts in AI and machine learning.

This is a seismic strategic move for Amazon whom we have heard very little about in the generative AI sphere so far.

However, most people in the know understand that Amazon wouldn’t let this get away from them and use time wisely to concoct something worthy enough to show they have some skin in the game.

Unsurprisingly, AMZN shares were up relative to other big tech companies in a down week last week on the Nasdaq.

AMZN shares haven’t had quite the mojo that stocks like Tesla or Microsoft have had this year and this call to action is an aggressive step towards the vanguard of technological development.

I highly applaud the management at AMZN for this chess move.

In generative AI, algorithms are used to create new content, such as audio, code, images, texts, simulations, and videos.

Amazon said Highspot, Twilio, Ryanair, and Lonely Planet will be among the first users of the innovation center. With the new center, the company expects to hijack additional cloud services amidst increasing competition in the cloud infrastructure market.

Enterprise spending on cloud solutions reached $63 billion worldwide in the first quarter of 2023, up 20% from the same quarter last year.

Microsoft and Google had the strongest year-over-year growth rates, gaining 23% and 10% in worldwide market share, respectively. Amazon, the leader in cloud infrastructure, kept its 32% market share in Q1.

Amazon recently debuted Bedrock, an AI solution that allows customers to build out their own ChatGPT-like models.

The company also announced the upcoming Titan, which includes two new foundational models developed by Amazon Machine Learning.

Tech is largely downsizing staff and firing diversity officers and other woke positions, but the one area that is pushing for greater numbers is artificial intelligence data scientists and a bevy of LinkedIn posts show they are on the lookout to poach talent.

Amazon, who crushed Microsoft and Google in the business of renting out servers and data storage to companies and other organizations, enjoys a commanding lead in the cloud infrastructure market.

However, those rivals are early into generative AI, even though Amazon has drawn broadly on AI for years to show shopping recommendations and operate its Alexa voice assistant.

Amazon also failed to create the first popular large language model that can enable a chatbot or a tool for summarizing documents.

One challenge Amazon currently faces is in meeting the demand for AI chips. The company chose to start building chips to supplement graphics processing units from Nvidia (NVDA), the leader in the space. Both companies are racing to get more supply on the market.

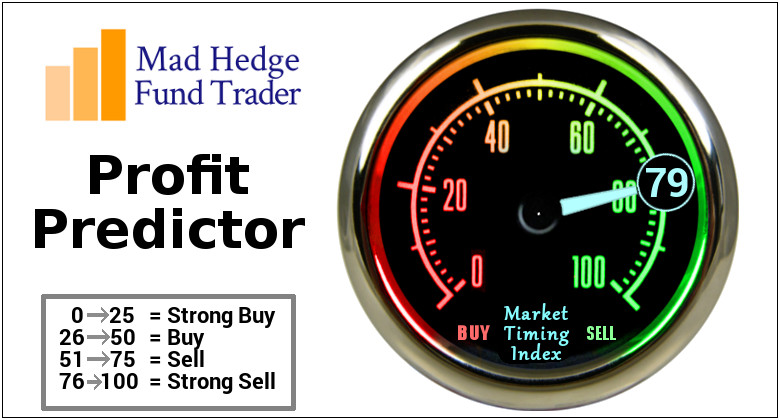

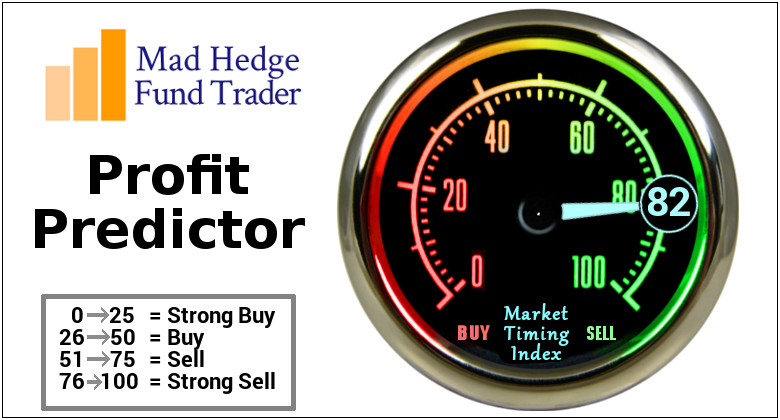

At a technical level, Amazon shares and the rest of tech shares are quite overbought in the short term.

Last week was a modest pullback between 1-2% in the Nasdaq and I view that as highly bullish because of its orderly nature and lack of volume.

No panic selling is what we want for the markets to optimize the next bullish entry point.

After the modest price action digests fully, I do expect another dip-buying shopping spree for tech shares.

Stay patient and stay hungry.