Mad Hedge Technology Letter

June 14, 2023

Fiat Lux

Featured Trade:

(ANOTHER ONE TO ADD TO THE AI BANDWAGON)

(ORCL)

Mad Hedge Technology Letter

June 14, 2023

Fiat Lux

Featured Trade:

(ANOTHER ONE TO ADD TO THE AI BANDWAGON)

(ORCL)

We are starting to get to the overhype stage of AI in the short term because the sub-sector has gone too far too fast in such a short period of time.

Software company Oracle (ORCL) needs to be mentioned as another AI participant chomping at the bit.

ORCL has been quite the laggard for some time as their warehouse cloud system was considered behind the times.

It’s fair to say that the stock has benefited the most from the AI hype simply because its stock was priced so cheaply before it caught the AI bid.

Now they have finally told us how they will integrate generative AI into their products and this has triggered strong interest in the stock.

Oracle is offering its enterprise customers a way to build their own generative AI apps leveraging a company that is similar to OpenAi called Cohere.

Oracle will be embedding Cohere's generative AI technology into a bevy of its products and Cohere will be using Oracle's cloud to train, build, and deploy its generative AI models.

Cohere doesn't have an exclusivity contract with Oracle. Fellow investor Salesforce, for instance, already offers a service that embeds Cohere's chat capabilities into Salesforce. This is just one of the many AI tools Salesforce offers customers.

Oracle does have some of its own homegrown AI technology and uses it for features like its "autonomous" database where its cloud software detects and automatically solves problems.

Cohere is the only partner Oracle announced to power its generative AI services for customers.

Perhaps the main reason Cohere has emerged as an alternative to OpenAI is that it was founded by Aidan Gomez.

He was a research intern at Google Brain in 2017 when he co-authored a paper on a way of training AI models to improve their abilities to understand language.

His sharp ideas have become the basis for the generative AI tech that has so engulfed the industry today, including some models used by OpenAI.

Along with cofounders and fellow AI experts Nick Frosst and Ivan Zhang, Gomez founded Cohere in 2019 to bring Google-quality AI to the masses.

Oracle said that Cohere’s large language models will be directly integrated into Oracle’s cloud applications.

The company will add generative AI features not only to its flagship enterprise resource planning software, but also to applications for human resources, supply chain management, and customer experience management.

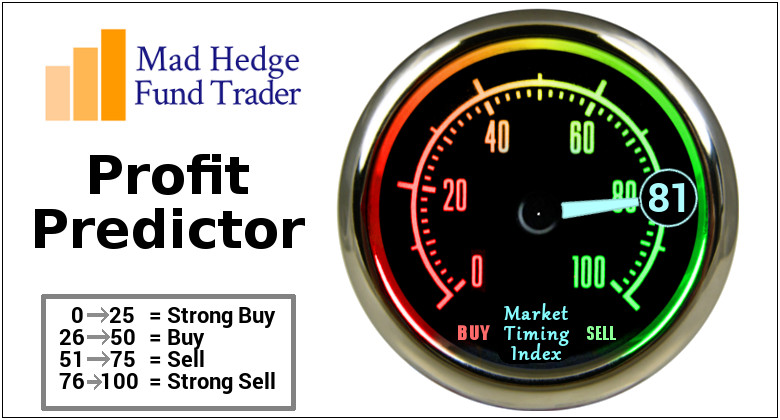

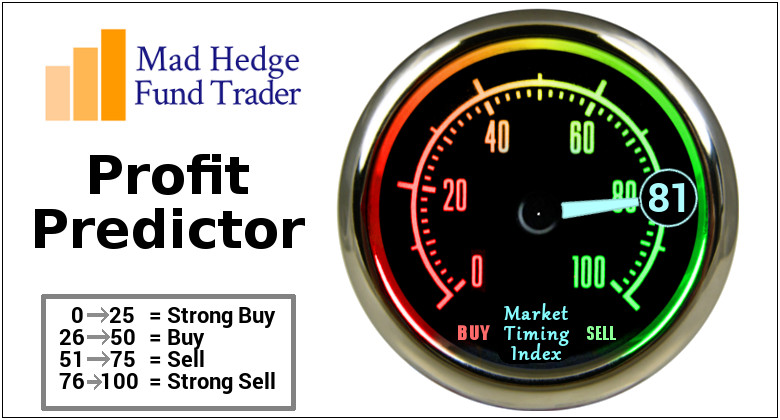

The tsunami of AI short-term hot money diving into stocks has been a boon for the tech this year.

The Nasdaq has gone from strength to strength and outpacing the other indices has meant it’s been the only game in town in 2023.

With the likes of Tesla in the green for 13 straight sessions, it’s hard to see when this pandemonium ends.

Surely, there will be a pullback at some point but the good news keeps getting shoved in my face and traders are inclined to buy.

The regional bank crisis also provided an extra swath of liquidity that was largely pumped into the stock market and the Fed’s quantitative tightening dramatically curtailed.

Even though tech stocks are oversold including Oracle, my analysis has shown that traders are waiting for any and every dip to add to their long tech positions.

Put ORCL down as another tech stock to buy on the dip.

“If you're offered a seat on a rocket ship, don't ask what seat.”- Said Former Chief Operating Officer of Facebook Sheryl Sandberg

Mad Hedge Technology Letter

June 12, 2023

Fiat Lux

Featured Trade:

(GREEDFLATION WINS OUT)

($COMPQ), (UBER)

Tech companies are doing well and so is the overall stock market.

It doesn’t make sense to listen to all the doomsday personalities going on national TV to scare us out of making money.

Just zone them out – they are useless.

Back in the real world, the excellent performance is great news for holders of US tech stocks who have been carrying the load in 2023.

The tech-based Nasdaq index ($COMPQ) has returned 27% YTD and anyone betting on an “earnings recession” has had their head handed to them.

Mr. Market has continued to look through any risk presented and shrugging it off like it doesn’t matter.

We have been waiting for that recession which hasn’t arrived for almost 3 years now.

People will have to continue to wait too as the job numbers have been excellent.

Instead, we should focus on why tech companies are doing so well and what makes their balance sheets tick.

In a widespread industry survey, 89% of respondents said US companies have been raising prices in excess of their own costs since the pandemic began in 2020. Almost four out of five said that tight monetary policy is the right way to tackle profit-led inflation.

The surge in corporate markups cannot be understated and tech companies have done exceptionally well with Uber (UBER) rides more costly as just one little example among many.

Margins soared in the initial pandemic years, and have defied convention by remaining historically high since then.

The unique circumstances of the pandemic – severe supply constraints, followed by an unprecedented burst of stimulus-fueled demand – lie behind the widening of profit margins, which hit 70-year highs in the US.

Even if margins come down a little because customers start to balk at high prices, the price reductions will be most likely incremental.

Standard economic theory holds that profit margins are “mean-reverting’’ – in other words, they tend to be pulled back to normal levels. It’s supposed to work like this: An industry with high profits should attract new entrants, with increased competition forcing margins lower.

However, many tech companies are operating as de-facto monopolies in their subsector and possess an unprecedented amount of pricing power for the products they sell.

This has led to the idea more colloquially known as “greedflation.’’

Until a rising backlash against monopolies or oligopolies triggers buyer protests, the tech playbook should be to buy those companies that look most similar to monopolies.

Ultimately “greedflation’’ is great for holders of tech stocks and not necessarily good for US consumers.

Clearly, there is a profit honeymoon with the likes of big tech raking in the dough.

They can even push out aggressive and abstract products like the Apple VR headset for $3,500 per clip.

That’s not a defensive strategy as well as absorbing billions to develop the product.

Coupled with the lust for anything generative AI, the conflation with higher margins has triggered a momentous rally in tech stocks.

As we narrow down our paths for the rest of the year, a demonstrative easing cycle is setting up promising to catapult tech stocks another leg up from current levels.

The considers that inflation is dropping fast from 5% to 4% and projections could find us in the 3%-ish range in the next month or two which is a strong tailwind for tech stocks.

It’s hard to see where the sellers come in and I would continue to buy every small dip in every quality tech stock name.

“Take risks now. Do something bold. You won’t regret it.” – Said CEO of Tesla Elon Musk

Mad Hedge Technology Letter

June 9, 2023

Fiat Lux

Featured Trade:

(SHOULD YOU BUY CARVANA?)

(CVNA)

The biggest takeaway I took from the used car platform Carvana’s (CVNA) latest earnings report is: who is dumb enough to buy an old car and get fleeced for $6k?

Apparently, $6k is what CVNA earns per unit in gross terms now.

But hey, if paying a broker $6k is what it takes to buy a used car then so be it.

The problem I have with the $6k gross per unit is how much further can that number go?

My bet is not much.

How much higher broker fees can Americans absorb?

My bet is not much more.

Just doing simple math means that for a $20,000 used car purchase, adding on the Carvana service would mean it costs $26,000 to the end buyer.

Sure, for some people like me and you it’s not a big deal, but I don’t believe this can scale well or efficiently as a tech platform.

That being said, it’s quite a corporate achievement for such gaudy margins and one that meant CVNA’s share exploded to the upside rising 44% on the news.

The stock is down 18% today highlighting the volatile nature of the stock.

Revenue fell 25% to $2.6 billion, but total gross profit rose 14% to $341 million.

The update helped reassure investors that the stock would be able to avoid bankruptcy after plunging as much as 99% from its peak in 2021 on slowing growth and mounting losses, especially as interest rates rise and used car prices fell for much of last year.

Carvana didn’t give guidance for net income but said adjusted earnings before interest, taxes, depreciation and amortization would be $50 million in the current quarter — way above the consensus analyst estimate of a $3.6 million loss — and gross profit per unit would be a record of more than $6,000.

Carvana’s $8.7 billion debt load as of March 31 has been a big problem for the company, which recently scrapped a debt exchange offer that would have reduced its burden because creditors held out for a better deal.

The interest on Carvana’s debt cost the company more than $2,000 per car in the first quarter, which is one reason it reported a loss of $286 million despite gross profit per vehicle sold of more than $4,000.

From peak to trough, Carvana lost 99% of its value as used car prices fell, the company made an ill-timed acquisition of the ADESA auction business, and creditors began preparing for a bankruptcy.

Although in the short term the stock is having a nice bounce, that doesn’t mean the stock’s appreciation is sustainable in the long run.

I do believe the bounce is just the proverbial dead cat bounce and ok for a quick trade and quick profit.

In a world where big tech is really crushing it, small tech needs that extra little bit of juice or special sauce to navigate the iron clad balance sheets of Silicon Valley.

Selling used cars is hard to digitize and I believe this platform will continue to burn cash on the road to a never ending feedback of explaining why it can’t be profitable.

Sell this one on the bounce.

Mad Hedge Technology Letter

June 7, 2023

Fiat Lux

Featured Trade:

(BRINGING UP THE TECH REAR)

(COIN)

I’ll never forget when Mad Money’s Jim Cramer boasted that he “liked Coinbase (COIN) to $475” and to keep “doubling down” as the stock went lower.

Funny how things you say come back to haunt you.

COIN is the American crypto exchange that just got charged with operating as an unregistered broker, operating an unregistered exchange, and operating as an unregistered clearing agency.

Not only that, the SEC specifically scolded them for selling digital tokens with no value such as offering the sale of unregistered securities (SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO).

COIN was at the right place at the right time when crypto blew up to $65,000 and now it is certainly the inverse of that situation.

COIN is now languishing at $51 per share after a 12% selloff and a far cry from the $475 price that Jim Cramer lusted over and gushed to viewers about how much value there was at almost 500 per pop.

The crackdown is certainly not over and SEC commissioner Gary Genseler appears to be on a mission to make digital tokens and the industry supporting it a living hell.

Gensler warned banks to steer clear of crypto because of potential risks to the financial system, making it harder for US citizens to invest.

Paul Grewal, the company’s top lawyer, has previously said that those tokens aren’t securities.

A federal regulator also alleged that Coinbase acted as an exchange, broker-dealer, and clearinghouse all without registering with the SEC for any of those roles.

A virtual currency may fall under the SEC’s remit if investors buy it to fund a company or project with the intention of profiting from those efforts. That determination is based on a 1946 US Supreme Court decision defining investment contracts.

The big takeaway here is the extent to which the SEC thinks crypto is just an utter fraud.

The future appears dim if the SEC keeps bashing this nascent industry.

Digital tokens offer no intrinsic value and deliver no cash flow to shareholders simply because there is nothing to cash flow from.

How can an investor cash flow from a piece of stored code that doesn’t offer actionable software like a photo viewer or music editor?

It’s software that doesn’t do anything but then packages itself as a store of value because we should trust it for no apparent reason--and it’s not even backed by any government.

The SEC goes into the specific coins which they think aren’t securities; and the list is long, which is highly detrimental to COIN’s business.

The tech sector has been roaring in 2023 and the biggest and strongest companies have seen their valuations shoot to the sky.

The knock-on effect is that the bar has been set extremely low for tech companies, but COIN has failed to jump over the low bar.

Tech firms can’t do IPOs easily at 5% interest rates hence even smaller companies like Roblox (RBLX) and Uber (UBER) performing admirably this year in the Nasdaq.

I am still highly bullish on technology stocks, but COIN and Robinhood or anyone else getting investigated by the SEC or Federal government is a hard pass for me.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.