Part of these artificial intelligence executives going on record to sound out the problems with AI is mostly to protect themselves if this weird digital experiment goes disastrously wrong.

They have mostly said that AI going rogue is a real possibility and could end mankind.

Obviously, we hope that doesn’t happen.

Much of the tech market gains this year have been because of the technology surrounding AI.

Strip that out and the gains will look paltry.

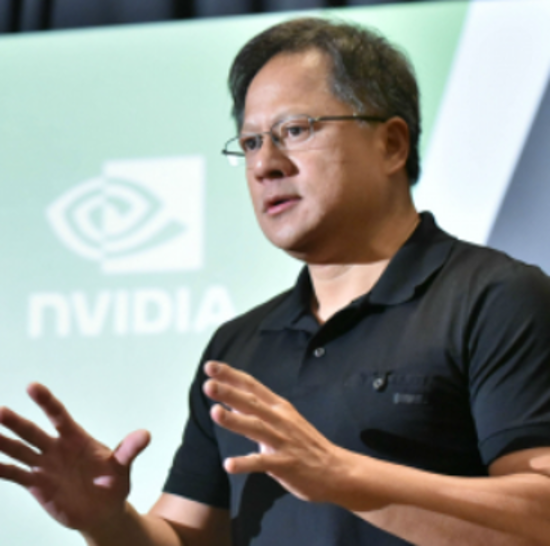

A good example is Nvidia (NVDA) offering legendary guidance to the demand of their chips because of the need to install them in AI-based technology.

The AI narrative truly has legs – it will be the theme that defines 2023 in technology stocks.

The Big 7 tech stocks will possess explosive qualities to their stock precisely because of this thesis.

Then there is the fear of missing out (FOMO).

Every financial advisor is pitching AI as an investment of a lifetime – something that cannot be missed by their clients.

Therefore, I do expect meteoric legs up in shares of Nvidia, Apple, Microsoft, Tesla, Amazon, Facebook, and Google in 2023.

These 7 stocks dominate the tech market and the generative AI gains will mostly manifest themselves in these 7 tech firms.

Yet there are dangerous concerns that AI could also destroy these companies and the internet which we interface with, because the changes could erode the trust in platforms by populating fake photos like deep fakes.

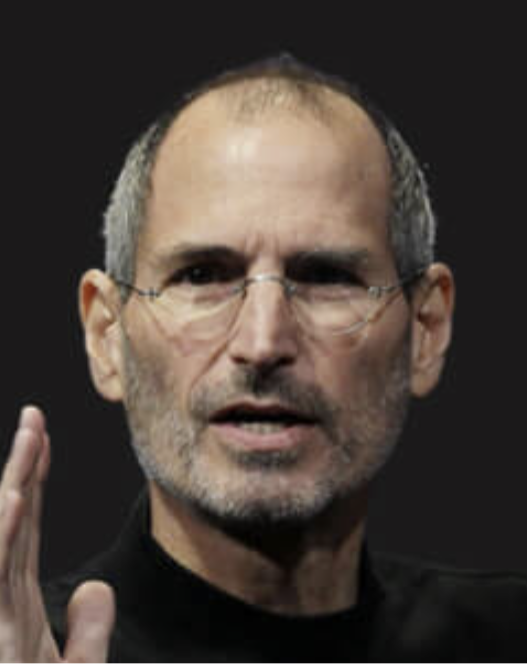

In Washington speech, Brad Smith calls for steps to ensure people know when a photo or video is generated by AI.

Brad Smith, the president of Microsoft, has said that his biggest concern around artificial intelligence was deep fakes, realistic-looking but false content.

Smith called for steps to ensure that people know when a photo or video is real and when it is generated by AI, potentially for harmful purposes.

For weeks, lawmakers in Washington have struggled with what laws to pass to control AI even as companies large and small have raced to bring increasingly versatile AI to market.

Last week, Sam Altman, CEO of OpenAI, the startup behind ChatGPT, told a Senate panel in his first appearance before Congress that the use of AI interferes with election integrity is a “significant area of concern,” adding that it needs regulation.

Lawmakers need to ensure that safety brakes be put on AI used to control the electric grid, water supply and other critical infrastructure so that humans remain in control.

It’s hard to know what is fake and real these days. Fake photos of politicians getting attacked or fake videos of tigers roaming around freely in Times Square New York look weirdly authentic.

AI is getting so good that nobody knows what is real anymore.

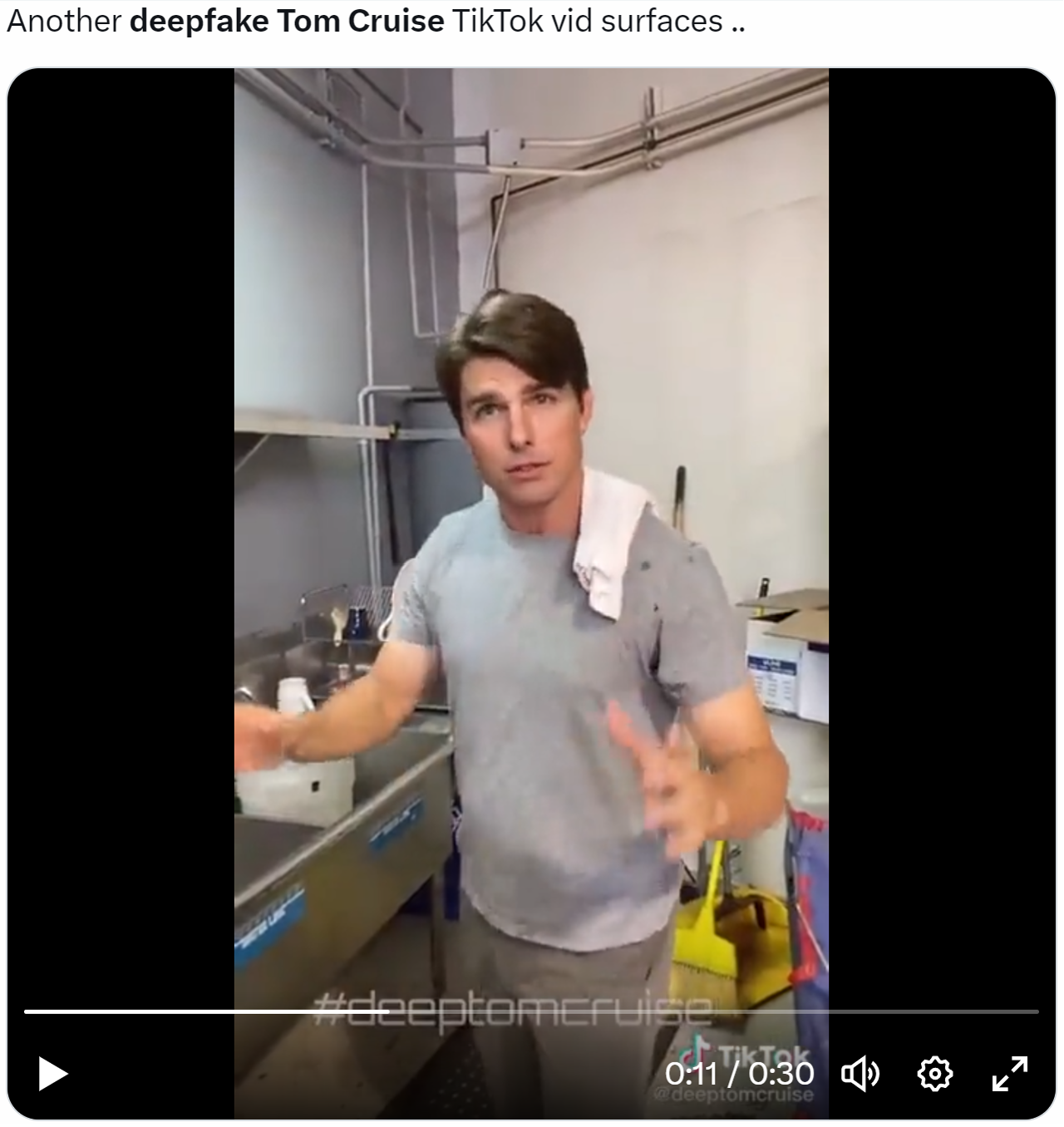

I’m sure some of you saw the recent Tom Cruise deep fake where the fake Tom Cruise is telling the audience that he does a lot of “industrial clean up” along with his own stunts. Honestly, I could not tell it was fake, and most people wouldn’t. It caught me – hook, line, and sinker.

As it stands, ride this generative AI to riches in the short-term, but be aware that this technology could blow up the internet or make the internet unusable because of security and trust reasons.

DEEPFAKES LOOK AND SOUND TOTALLY REAL IN 2023