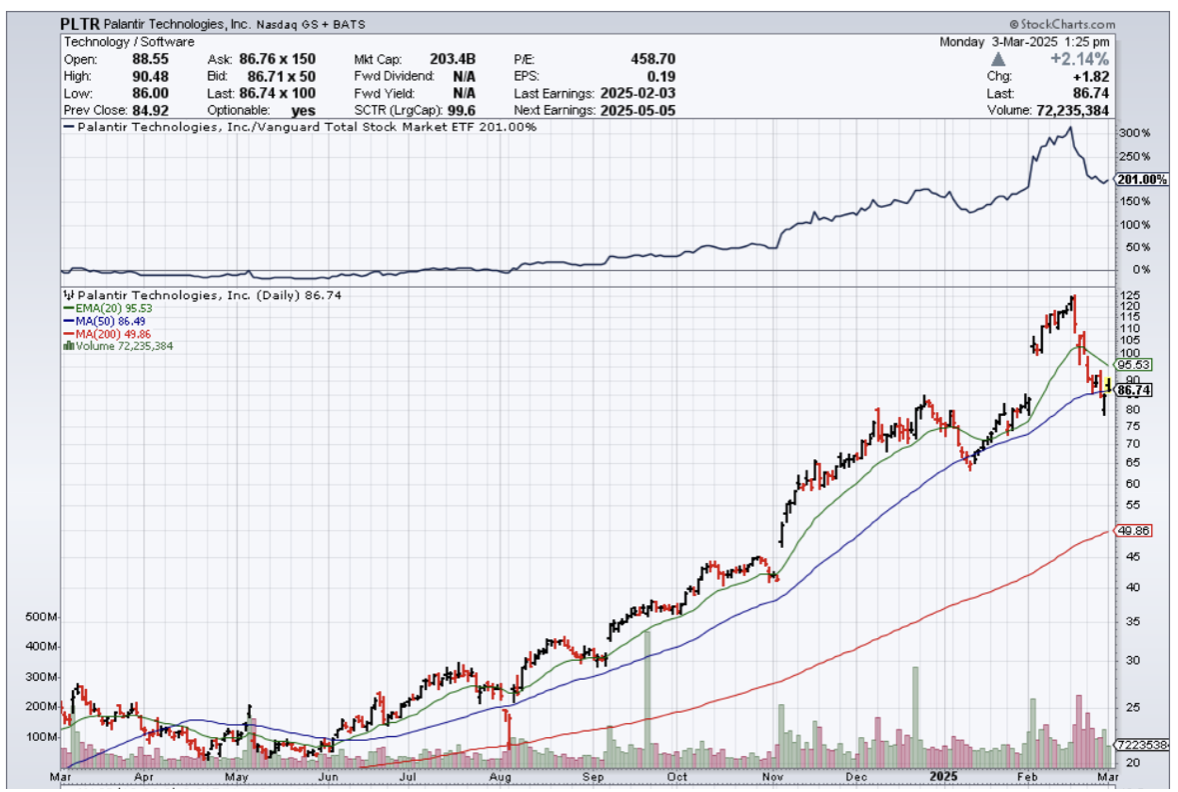

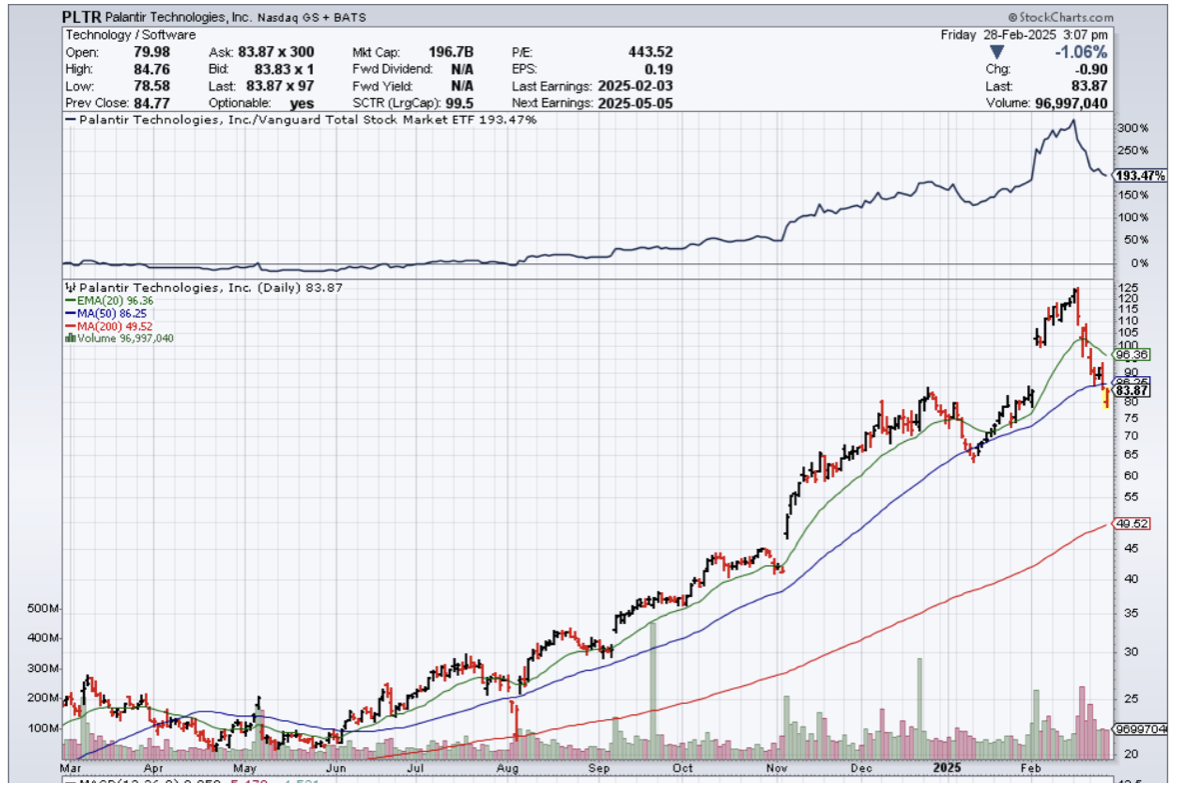

Even with Palantir’s short-term pullback of 30%, the stock is still up 16% year to date, showing how potent the price action of the stock really is.

There is a lot to like about PLTR, especially its connection to the White House.

Lost in all the commotion of the sell-off, this is a legit AI company, and companies of this ilk are fetching massive premiums on the open market.

Therefore, I wouldn’t view this firm with a glass-half-empty type of price trajectory because legit AI companies get bought up on the dip for a reason.

Much of the downdraft in shares has to do with all the federal budget cuts.

The amount of fraud that occurred is staggering, but I don’t think the feds will throw out the baby with the bath water.

These companies aids in the security of the United States through software, and I don’t think this business is going away anytime soon.

I also don’t believe any cuts from the federal government will hurt PLTR.

This company is not syphoning off taxpayer funds and has a lot of credibility in business circles.

The artificial intelligence (AI) company is growing quickly, but due to its reliance on government contracts, investors are worried that potential budget cuts at the Department of Defense and other government agencies could hurt the business. Despite the drawdown, Palantir is still valued at over $195 billion.

New Secretary of Defense Pete Hegseth said he aims to cut 8% from the defense budget every year for the next five years. That is not a one-time cut of 8% but five consecutive years of cuts.

Hegseth is starting with civilian workers, aiming to cut over 5,000 people from the payroll. Investors took this as a negative sign for Palantir and other defense contractors, breaking the momentum of the stock.

In 2024, Palantir generated $1.57 billion in revenue from government contracts, making it only a small part of the federal budget. Despite the current administration's proposed cost cuts, I still expect this figure to grow in the coming years.

In recent years, government contracts have also become a shrinking share of Palantir's top line. A push into the commercial sector has been very successful, with the company winning hundreds of customers for its AI and software tools.

U.S. commercial revenue grew 64% year over year in Q4 2024 to $214 million, and the commercial segment now makes up 45% of overall sales. While the government segment is still growing, the commercial side is growing even faster.

The commercial market is simply much larger and could provide a $10 billion-plus revenue opportunity for Palantir. Last quarter, its backlog for U.S. commercial contracts grew 99% year over year to $1.79 billion.

Any weakness at the government level could be made up by private sector businesses.

Once looking at the real numbers, PLTR is the real deal, and one of its founders, Peter Thiel, is the mentor to the United States Vice President JD Vance.

Ultimately, I felt a bullish position is worth the risk in the short-term, and I believe by March 21, the stock should stay above $72.50.