Tesla Sets the Tone

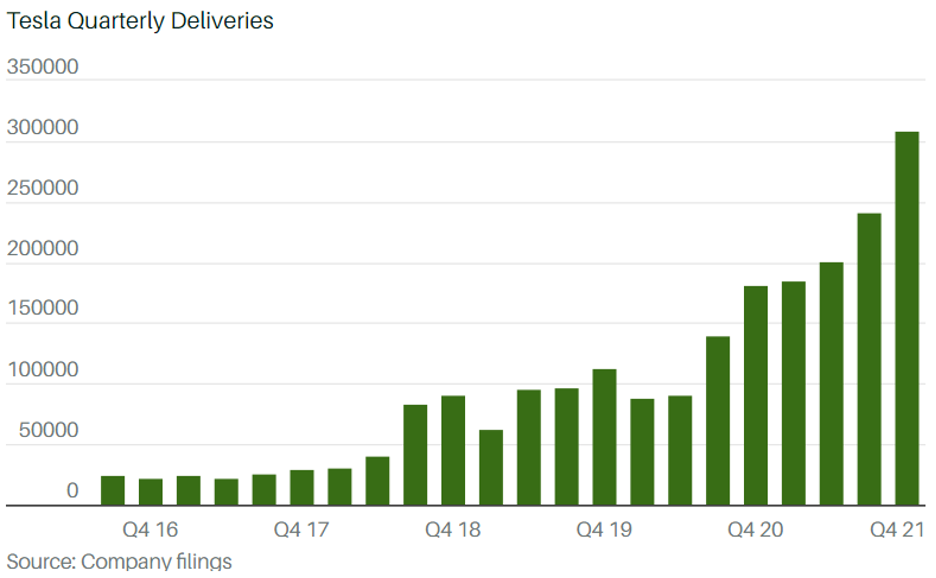

The 87% year-over-year increase in Tesla deliveries this past quarter really sets the tone for Tesla for rest of 2022.

They are picking up where they left off last year and Tesla’s stock price at the end of the year could be substantially higher than it is now.

It’s been a while since I’ve heard from the Tesla haters — and if you remember correctly, there were angry flocks of them up until just recently.

But that’s what overperformance will do to the naysayers, ironically. They’ve never been this quiet, and rightly so, after crushing delivery expectations by 12%

In the same quarter last year, they registered 180,000 deliveries, and the math is stunning with the company adding an extra nominal 128,000 this past quarter to 308,000 units at a time where supply chain shocks and semiconductor shortages are rocking the EV industry.

This leads me to believe that if Tesla can carve out stellar performance at the height of snarled supply chains, imagine what they can do when the world isn’t clogged up.

We must take it seriously when management predicts 50% gains in deliveries year over year for the foreseeable future and what I mean by that is — multiyear.

Ultimately, there is a strong correlation between accelerating Tesla deliveries and an appreciating Tesla stock price and readers shouldn’t overcomplicate things.

The rest is just fluff and readers need to zone it out.

Readers also get the added bonus that Tesla easily outperforms the S&P benched against any standard metric and they are in online brokerage Robinhood’s top stocks to buy based on the data from their own traders.

The delivery beats against consensus are also widening for Tesla who just in 2020 was only able to overdeliver unit deliveries by 3%, which is no small feat, but the under-promising and over-delivering is getting more impressive by the quarter which is the hallmark of a great company with over 10% beats versus consensus the norm today.

The average consensus for gross 2022 deliveries of about 1.4 million looks highly attainable if Tesla can keep up at this clip, which I have faith they can.

Fortifying their already enviable position is the success of the Shanghai Gigafactory, and the potential to sell 60,000 Tesla’s to Chinese customers this year.

Gazing into our 2022 crystal ball, the EV story and the narrative underpinning it look healthy and, more importantly, sustainable.

Over the past decade, the EV market has gone from a drip of EV choices to a full-out avalanche of options on the US market these days.

Recent surveys back up the concept of insatiable thirst for new EV buyers, and higher oil prices have added an extra turbocharger to EV demand.

A private survey showed that the percentage of U.S. adults who say they would consider purchasing an EV in the next 10 years has seen active growth over the course of 2021, as announcements of new models and new charging infrastructure add gloss to the already emerging industry.

One might surmise that this could be the year of an EV inflection point when it comes to getting bums in EV seats.

This could be the year where the numbers gap up and put gas-powered engines in the rear-view mirror.

The number of options in 2022 starts from roughly 62 models currently available to at least 100 later this year.

But U.S. consumers love to buy pickup trucks, crossovers, and SUVs, and their dramatic arrival on the EV market is one of the main reasons 2022 could be unprecedented for adoption.

The next big blockbuster launch — Ford (F) is beginning production on its F-150 Lightning pickup truck in Spring 2022, giving consumers the option of purchasing an electric version of the best-selling car in the country.

58% of Gen Z and 60% of Millennials have shown a willingness to dip into the future EV market, and by that purchase time, options will be everywhere.

The one true knock against Tesla is the lack of developing a Tesla pick-up truck. Their much-hyped “Cybertruck” has been delayed now over a year to the end of 2022 because of continuous bumps in the supply chain.

This could turn out to be another cash cow for Tesla, with potential Cybertruck revenues topping $400 million in 2023, potentially rising to about $7 billion by 2026.

The takeaway from the Cybertruck project is that Tesla is still in the early stages of its growth cycle, and will be expanding at a 50% rate while ingratiating its diehard audience with more products than they can handle.

Tesla products are backlogged to the hills, try inputting a new Tesla X for online purchase, and their official website spits out an estimated delivery date of January 2023.

That’s how great this product is, so don’t diminish it or its ever-higher stock price.

It’s high for a reason and will be higher in the future.