The 30-Year View on What's Happening Today.

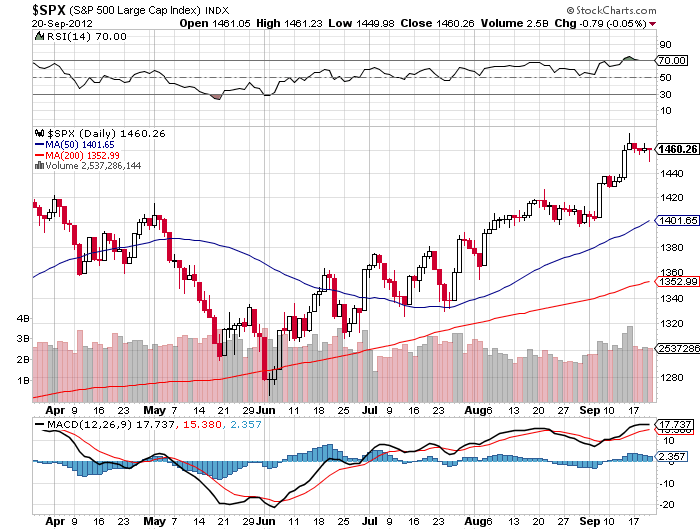

Take a look at the 30 year chart of the S&P 500 below, and it?s clear that the market is approaching a critical juncture. With the closely watched index closing at 1,460 today, we are a mere 140 points from the iron ceiling that has been unassailable for the past 13 years.

The chart is a roll call of past disasters for American investors. The 2000 peak was the apex of the Dotcom Bubble. The 2006 high water market defined the end of the Housing Bubble. Since March 9, 2009, a scant 15 days after president Obama took office, the index has soared by a record breaking 119%.

Something tells me this won?t go down in history as the ?Great Obama Bull Market?. Maybe it will become known as the ?Quantitative Easing Bubble? or the ?Bernanke Bubble?. Only future armchair economic historians will know for sure.

The chart clearly defines the last lost decade for stocks, as well as the second missing decade we are currently in. If the US economy were growing at a nice 3% annual clip, I would say that we are taking a run at the 13 year high, will breakout to the upside, and quickly tack on 10%-20% from there.

Unfortunately, that is not the world we live in. In fact, we are growing at half that rate on a good day, and are facing major challenges ahead. Bernanke?s announcement of QE3 last week (although he never used that precise term), will give markets the juice to take a serious run at 1,600 in the coming six months. But then, I think the fundamentals will cause it to fail once again.

Even the best case scenario for the resolution of the fiscal cliff at year-end takes a minimum of 3.5% out of GDP growth next year. The economies of Europe, China, and Japan remain in free-fall. U.S. corporations may be about to deliver their first YOY zero earnings growth in three years.

All of this sets up a recession in 2013 that will be tough to avoid. This is why U.S. companies are loathe to hire, have crimped capital spending at half of their historic levels at $2 trillion, and are sitting on cash mountains. They are obviously running scared.

The shock of the magnitude of this QE3 will get digested and fully priced in by the markets by Q1, 2013, right around the time the (SPX) is peaking short of 1,600. Then, one of the greatest shorting opportunities of the century will set up. I hate to sound like a broken record, but ?Sell in May and go away? is likely to work for the fourth year in a row. Except this time, you might not want to come back until August of 2014.

Is This a SELL Signal?