The Benefit of the Doubt Market

It is already January 24, and the S&P 500 has seen a grand total of two down days so far in 2012. Are we on the eve of one of the great bull markets of all time? Is it off to the races once again?

I follow dozens of fundamental and trading research services and the number that are flashing warning lights right now is close to an all-time high. For example, the AAII sentiment survey now shows that 46% of investors believe that the stock market will be high in six months, well above the 39% historic average. It has only been higher than this 11% of the time since 1990. The put/call ratio has collapsed, indicating that traders no longer see the need for expensive downside protection. It has not been this low since 1998.

A number of surprises have conspired to create this warm and fuzzy feeling. The ECB has engineered a stealth quantitative easing that is helping support asset prices worldwide, as the Federal Reserve did a year ago. The recent spate of European bond auctions has gone well. China surprised many (but not me) with a Q4 GDP of 8.9%.

It is not unusual to see a strong January, which is the most bullish month of the year by a large margin. Since 1928, the average January gain has been 1.69%, compared to 0.51% for all other months. As of this writing, we are up 4.8% month to date and it is definitely appearing overcooked. With the (SPX) up 22.8% in less than four months, it is normal to see data as sizzling as these. The last time traders were this positive was back in April, just ahead of a 25% swoon.

I think we are seeing the same ?benefit of the doubt? market that we saw 12 months ago. Many of the most conservatively run institutions, like pension funds, only change asset allocations once a year, usually in January. With the ten year Treasury bond yielding a pitiful 1.80% at the end of 2011, it forced a natural one time only reweighting out of bonds and into stocks. Much of that new money for stocks gets spent in January.

In additional, with S&P multiples at 12.3, close to a historic lows, many institutions are willing to raise market weightings from underweight to neutral. If the economy improves they will add to positions. If it doesn?t, they will dump what they just bought. I am betting on the latter.

I am looking to see how I could be wrong in this assertion and I am hard pressed to find out how. This morning, the International Monetary Fund predicted that a Europe falling into recession could chop as much as 2% off of world economic growth this year. Is there any way they can avoid a recession? Not with long term interest rates at 6%-14%, the ECB engineering a slow motion decline in short term rates, and the interbank lending rates in a catatonic state. And that is ignoring Greek bond rates at 35%.

Will China?s economy suddenly rebound to double digit growth rates once again? Not if Beijing has anything to say about it, which has been pouring cold water on the economy to extinguish the inflationary fires.

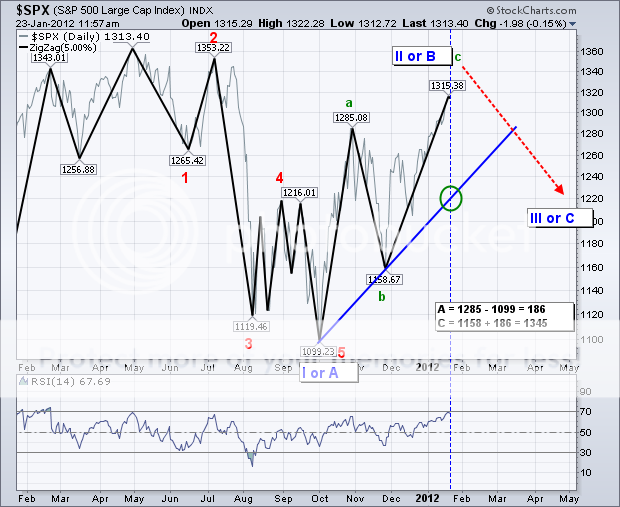

Calling the top in these speculative mini bubbles is always an impossible exercise. But it is safe to say that we are far closer to the top of this move than the bottom, and the next trade alert is far more likely to be a sell than a buy. If you don?t believe me, then take a look at the Elliot wave analysis by my friends at stockcharts.com. It predicts an (SPX) top on this move of 1345 to be followed by a sell off to the trendline at 1,280 at the least, to a complete breakdown of the move at the worst.

The Alarm Bells Are Ringing