The Big Play in Cisco

You can’t steal the mojo from the company that sells network software and infrastructure equipment.

Cisco (CSCO) is effectively an indirect bet on people using the internet because companies need the network infrastructure to offer all the cool and useful services that tech provides.

Technology and the services that result from it continues to be at the heart of customer strategy and now more than ever, Cisco’s market-leading portfolio and differentiated innovation are resonating with them as they transform their IT infrastructure.

Cisco is also a fabulous bet on 5G as the most recent technologies like cloud, AI, IoT, and WiFi 6 among others are developing together to revolutionize the way business operates and delivers new experiences for customers and teams.

Cisco is fundamentally changing the way customers approach their technology infrastructure to address the rising complexity in their IT environments.

They have constructed the only integrated multi-domain intent-based architecture with security at the foundation.

This is designed to allow customers to securely connect their users and devices over any network to any application.

Enterprise networks today must be optimized for agility and heightened security, leveraging cloud and wireless capabilities with the ability to extract insights from the data and security integrated throughout.

Cisco is in pole position to deliver this to customers.

Last quarter saw the launch of new platforms expanding the enterprise networking assets with the launch of subscription-based WiFi 6 access points and Catalyst 9600 campus core switches purpose-built for cloud-scale networking.

By combining automation and analytics software with a broad portfolio of switches, access points, and controllers, Cisco is creating a seamless end-to-end wireless first architecture.

With the newest Catalyst 9000 additions, Cisco has completed the most comprehensive enterprise networking portfolio upgrade in their history.

Cisco rebuilt their entire access portfolio with intent-based networking across wired and wireless.

Cisco also now have one unified operating system and policy management platform to drive simplicity and consistency across networks all enabled by a software subscription model.

In the data center, their strategy is to deliver multi-cloud architectures that bring policy and operational consistency no matter where applications or data resides by extending Application Centric Infrastructure (ACI) and offering HyperFlex to the cloud.

According to Cisco’s official website, its HyperFlex product is “a converged infrastructure system that integrates computing, networking and storage resources to increase efficiency and enable centralized management.”

Cisco’s partnerships with Amazon Web Services (AWS), Google Cloud, and Microsoft Azure are great examples of how they continue to work with web-scale providers to deliver new innovation.

Some new additions are Cisco’s cloud ACI for AWS, a service that allows customers to manage and secure applications running in a private data center or in Amazon Web Services cloud environments.

They also expanded agreements with Alphabet (GOOGL) by announcing support for their multi-cloud platform Anthos to help customers build secure applications everywhere from private data centers to public clouds with greater simplicity.

Going forward, Cisco will integrate this platform with its broad data center portfolio, including HyperFlex, ACI, SD-WAN, and Stealthwatch cloud to deliver the best multi-cloud experience.

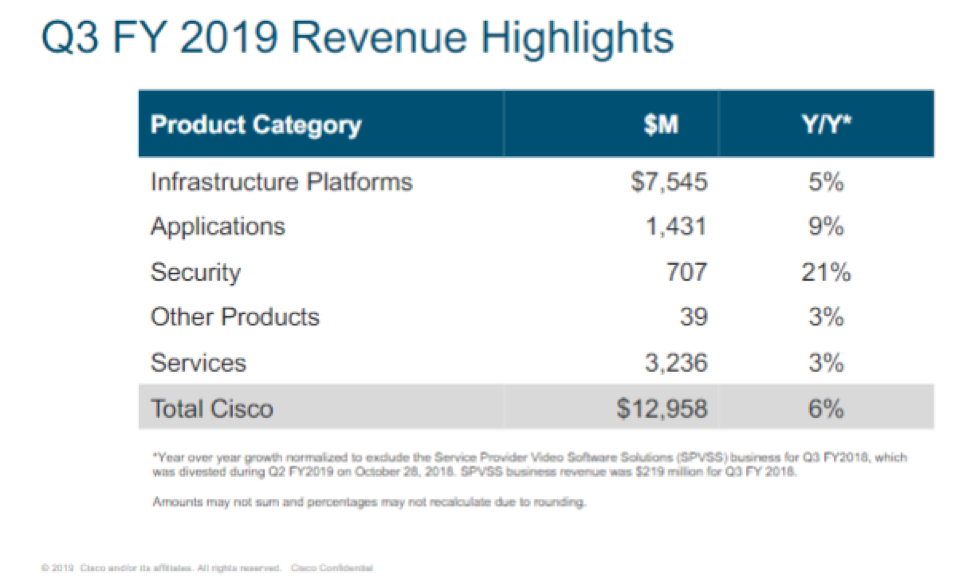

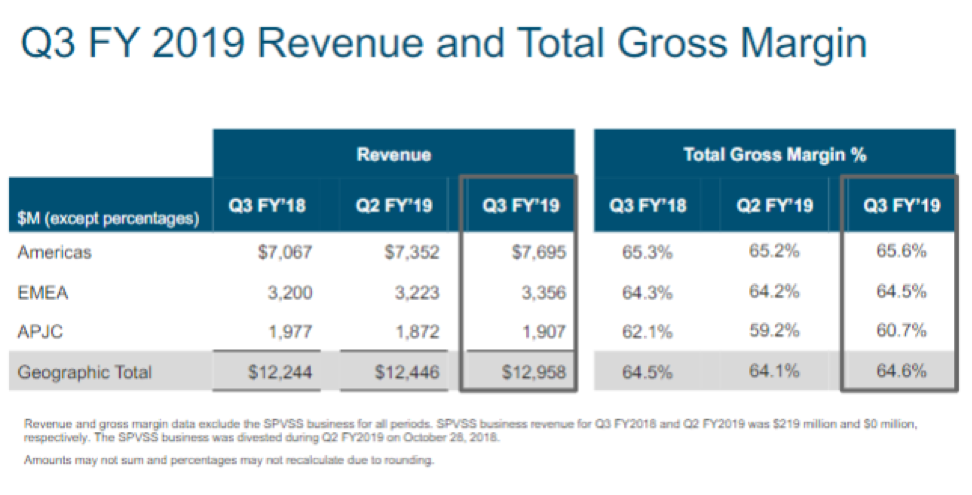

Organic growth has surpassed 4% for five straight quarters and expanded margins and positive guidance for the current quarter will reaccelerate PE multiples, increasing as more investors buy into the strong narrative.

CEO of Cisco CEO Chuck Robbins boasted on the call that “we see very minimal impact at this point based on all the great work the teams have done, and it is absolutely baked into our guide going forward” when referring to the headwinds of the global trade war.

It’s been quite the new normal for chip firms to guide down for the rest of 2019, and Intel’s (INTC) worries are emblematic of the growing challenges facing the tech industry.

Cisco bucked the trend by issuing strong forward guidance of 4.5% to 6.5% revenue growth in its fiscal fourth quarter, and earnings of 80 cents to 82 cents per share.

In an in-house survey, Cisco found that 11% of respondents have upgraded networking infrastructure and 16% expect to do so in the next 12 months.

The “minimal impact” of the trade war indicates to investors that even with negative tech sentiment brooding around the world, Cisco’s best in class tech infrastructure still cannot be sacrificed and the migration of companies to digital directly benefits Cisco who provides the building blocks for software and hardware tech companies to develop around.

Cisco even felt bold enough to hike prices giving consternation to current customers.

Both Juniper (JNPR) and Arista (ANET), lower quality network infrastructure companies, have indicated their enterprise businesses are growing faster than the overall market and Cisco’s price hike was probably a bad time to up margins in the current frosty climate.

Even more worrying is data that suggests a general Enterprise pause in spending at a minimum and could entrap the broader tech market as many capital expenditures could be put on hold in the late economic cycle.

Keep in mind that Cisco’s Catalyst 9000 line had an abnormally strong last fourth quarter due to brisk adoption accelerating meaning comps will be hard to beat in the next earnings report.

However, these are minor bumps on the road at a time when the major narrative is running smoothly and shows no signs of stopping.

Cisco shares will continue to rise if they continue to upgrade their products and back it up with their best of breed reputation that could spur more price hikes.

Investors should wait for dips to buy in this name until there are any signs of product quality erosion which I believe will not happen in 2019.