The Chinese Yuan Takes a Hit

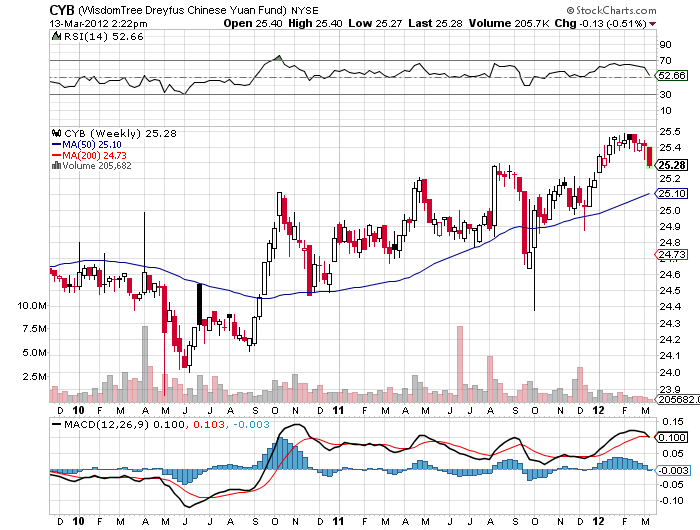

Long time readers of this letter are well aware of my advice to hold cash in the Chinese Yuan ETF (CYB) for the past four years. Those who followed my advice profited nicely.

The Yuan to you and me is known domestically in China as the ?renminbi?, or people?s currency. China has a quasi-fixed exchange rate against the US dollar that limits movement to just a couple of percent a year.

Since the People?s Bank of China removed a decade long dollar peg in 2005, it allowed a very gradual rise in this band of 2-3% a year. That is a vastly superior return compared to the zero interest Americans currently earn from money market funds, cash management accounts, or through buying Treasury notes with up to two year maturities.

This week, rumors roiled the marketplace that the government might slow, or even stop, this drip by drip appreciation. The trigger was a shocking $$31.5 billion February trade deficit, the largest monthly figure since 1998, primarily caused by the recession in Europe, its largest export market. The (CYB) reacted by plunging nearly 1% overnight.

One thing is certain. A free floating Yuan would be at least 50% higher than it is today, and possibly 100%. I can say this in confidence having watched the Japanese yen appreciate from ?360 to the dollar to ?75 while running a trade surplus of similar magnitude for the past 40 years, an increase of almost 400%.

In fact, the desire to prevent foreign hedge funds and speculators from making a killing in the market is a not a small factor in Beijing?s thinking to keep its currency artificially undervalued. The Chinese Central bank governor, Zhou Xiaochuan, says he won?t entertain a revaluation for the foreseeable future. He is no doubt thinking about the millions of Chinese workers who would lose their jobs if their exporting employers? razor thin profit margins are vaporized by a stronger currency.

The Americans say they need a stronger Yuan now. And now the matter has become a campaign issue, with candidate Mitt Romney saying he would label China a ?currency manipulator? on day one in office, not a nice thing to say to the country that is supposed to fund the bulk of his promised tax cuts. Obama has responded in kind, filing a WTO complaint on Chinese export restrictions of rare earth metals essential for our manufacture of electric cars.

I think you could see continued weakness in the Yuan as long as Europe is in the penalty box, slowing the Middle Kingdom?s economic growth. But this is merely a short term dip in a long term trend.

Buy the Yuan ETF on weakness. Just think of it as a cash management tool with an attached lottery ticket. If the Chinese continue to stonewall liberalization of their currency, you will get the token 2%-4% annual revaluation the swaps have been discounting. Given the massive $250 billion annual trade surplus the Middle Kingdom is now running with the US, the chances of a prolonged fall in the Yuan against the dollar are minimal. If they cave, then you could be in for a home run.

Is China a Good Parking Place for Cash?