The Cleanest Internet Play Out There

Check out GoDaddy (GDDY).

It’s a general bet on more people using the internet.

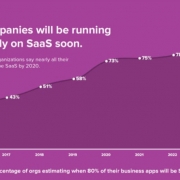

This trade dovetails nicely with my broader thesis of the dramatic migration to digital.

Brick and mortar stores will have no choice but to create a unique website and one of the most prominent web hosting services is GoDaddy.

The Mad Hedge Technology Letter is even powered by its services.

Lately, I’ve been all about this digital migration mantra and we are in the early innings of this seminal trend.

I gave you Cisco (CSCO) as a hot pick which is a bet on an increase in enterprise software business.

This is more of a question of how fast than if or when.

Are you ready for 5G?

The technology is on the verge of rolling-out to select cities around the US, and it will juice of web usage simply because users can navigate around more in a smaller time window.

GoDaddy was established by fellow Marine Bob Parsons in Baltimore 22 years ago and before GoDaddy, Parsons sold off his financial software services company, Parsons Technology to Intuit for $65 million.

He then launched Jomax Technologies which later morphed into GoDaddy in 1999 when employees were collaborating to change the company name and someone jokingly shouted out, "How about Big Daddy?"

Sadly, when the company found out that domain name had already been registered, Parsons replied, "How about Go Daddy?" and that was that.

What do I like about GoDaddy’s financials?

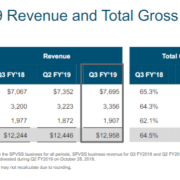

Better than expected profitability.

EPS forecasts were beaten handily with the company posting 24 cents, almost a double of the forecasted 13 cents.

Estimates of $693.5 million for the top line were marginally beaten by $2.3 million.

The company gave positive all-important guidance indicating robust momentum.

The firm is expecting $3 billion in 2019 sales and that is after doing $2.23 billion of sales in 2017.

Management has kept sales growth strong with a 3-year sales growth rate of 19%.

Customer renewal strength and higher average revenue per user (ARPU) growth is resonating with investors, and fused with higher operating margin could propel this firm’s shares higher.

ARPU mushroomed to $148.00 up 7% YOY while total customers rose 7% bringing the total customer base to over 18.5 million.

In 2018, over 1 million new customers were lured into the ecosystem.

The reason for this successful rise in domestic ARPU is enhanced site and product experiences, interactions focused on details and conversational marketing.

In a tech climate where a good portion of company outlooks are tepid at best, GoDaddy didn’t mince its words offering a better than expected positive outlook.

The financials look solid but allow me to explain a little more about its core products.

Almost 35% of websites on the internet is already constructed using WordPress’s platform and GoDaddy is the biggest host of paid WordPress at the end of last year.

GoDaddy’s supported WordPress offering automates the entire process of operating a secure WordPress website making it easy to use and highly popular to its customer base.

The role GoCentral's, GoDaddy’s flagship DIY website building product, plays is expanding as its numerous features increase and efficient performance is a consistent highlight for the firm.

The journey started in 2017 when GoDaddy established this service as a simple website building tool.

Concrete foundations were set and this service was integrated across a myriad of relevant third-party platforms while boosting product functions that are seeing outsized growth.

Daily entrepreneurs can now produce robust websites and carry out syndicate marketing across the e-commerce landscape.

The tandem of WordPress and GoCentral are growing subscriptions more than 40% YOY.

North America and Canada are the main revenue drivers, but international business is a wide-open opportunity waiting for management to pick off whether that's Latin America, Asia, or even in the Middle East.

The strategy for Europe is extracting the capability and product portfolio of North America, whether it be conversational marketing or features like security, backup, malware scans, plug-ins, and proactively migrate it to Europe because the model in America is obviously working and using that model will be a great development point.

Mexico and Brazil possess great growth potential and Asia continues to be about customer adds because the willingness to pay is different.

Competitor Wix (WIX) lately announced a shift in strategy, removing Domain Connect, and some of the low-end products and saying that they're going to come after WordPress.

But Chief Executive Officer of GoDaddy Scott Wagner is not worried about this nascent threat and is sure that this is the case of GoDaddy is in control of its own destiny than Wix being a viable threat.

As long as the company reinvests in its offerings and maximizes the user experience, Wix has a long way to go to compete with WordPress and are substantially smaller than GoDaddy.

And as GoDaddy keeps working on offering great value propositions and expanding the ecosphere with integrated and high-quality software, the stock is bound to jump further.

The momentum is palpable with this website hosting service a top player in its industry.

Wait for a pullback to buy some shares.