The Corn Crash Continues

Pit traders of the ags are bruised, battered, and broken, in the wake of Thursday?s US Department of Agriculture crop report showing that there is a whole lot more food out there than anyone imagined possible.

Corn was the real shocker. It has long been a nostrum in the ag markets that high prices cure high prices, and that is exactly what is happening now. In the wake of last summer?s spectacular drought induced shortages, which saw corn prices nearly double, farmers rushed to expanding plantings in 2013. The government expects that some 97.3 million acres will be sown this year, the most since the Dust Bowl days of 1936.

The government agency boosted estimates of stockpiles nearly 10%, from 5 to 5.4 billion bushels. Demand from ethanol makers has collapsed as they have priced themselves out of the market, leading to the closure of nearly 10% of the country?s fermenting facilities. Purchases by ranchers as feedstuff for cattle have been weak. These are enormous upward revisions. Prices took a 10%, limit move down on Friday, and are taking another dive today.

Even though the numbers were not as dramatic for the other grains, their prices suffered as well. Some of the new corn is being grown at the expense of soybeans, which saw a small decline in plantings. But prices took a dump anyway. Wheat (WEAT) has amazingly dropped below the summer, 2012 lows. The ag ETF (DBA), which includes the machinery and fertilizer companies, has performed the worst of all, and is threatening a new three year low. Virtually the entire 2012 ag bubble has been given back.

The long term bull case for food could not be more compelling (click here for ?Is Food the New Distressed Asset??). The world is producing people faster than the food to feed them. The global population is expected to rise from 7 to 9 billion by 2050. Half of that increase will happen in countries that are unable to feed themselves, like the Middle East.

Food consumption in the US isn?t dropping anytime soon. According to Yahoo data, ?Plus sized swimsuits? searches were up 530% in March.

There is also a huge emerging market play here. Rising standards of living mean better diets. Better food requires more calories and water to grow. To raise one pound of beef, you need 2,200 gallons of fresh water. It is true that if everyone in China eats one extra egg a day, the entire continent of Africa has to starve.

I have been ignoring the ags since last summer, when, if you didn?t get in during the first week, you missed the entire drought play. Since then I dipped in on the short side in corn, playing the slow unwinding of the price bubble.

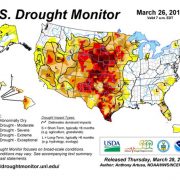

With this collapse, the long side is now, at last, back on the table. Let the current selloff shake itself out. Then, take a look at some long plays in case the global warming trade returns this summer. Nine of the ten past years have been the hottest in history. Why should this year be any different? If Texas governor, Rick Perry, says something isn?t happening with the environment, you can pretty much count that it is.

If you have any doubts, take a look at the latest drought monitor map below, which shows long-term arid conditions persisting in most of the Midwest.