The Crash Coming to a Market Near You

I?m sure that most of you are spending your free time devouring the utterly fascinating pages of Fifty Shades of Gray these days. I, however, am reading slightly different subject matter.

As obscure, academic and abstruse the ?Global Dollar Credit: Links to US Monetary Policy and Leverage? may sound, published by the Bank for International Settlements, it has been an absolute blockbuster among strategists at the major hedge funds.

And given the apocalyptic conclusions of the report, it might well rank as one of the best horror stories of the year, worthy of the bloodiest zombie flic.

I?ll give it to you it a nutshell.

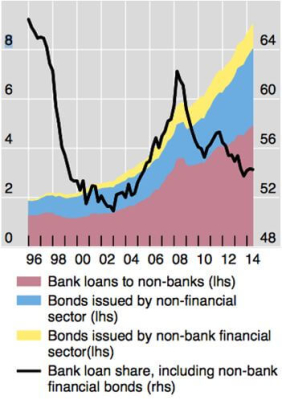

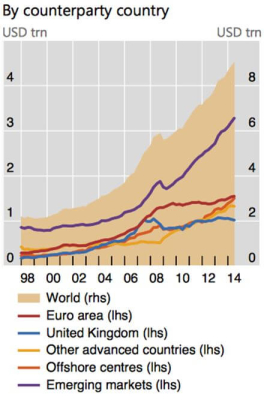

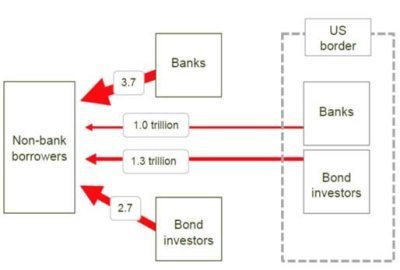

Corporate borrowers outside the US have ramped up their borrowing astronomically over the past 15 years, from $2 trillion to $9 trillion. This makes them extraordinarily sensitive to any rise in US interest rates and the dollar. Emerging market debt alone has doubled to $4.5 trillion.

Easy money has encouraged mal investment and overinvestment in projects that would have never seen the light of day if financing were not available at 1%. In other words, it is all a giant house of cards ready to collapse.

That could happen as soon as Wednesday, if the Federal Reserve removes the word ?patient? from its forward guidance.

I know a lot of you thrive on folk based economic theories you picked on the Internet based on monetarism, Austrian economics and the theories of Friedrich von Hayek, that all have the dollar collapsing under a mountain of debt.

In fact, the complete opposite has come true. The global economy has become ?dollarized,? with companies and governments in almost all nations relying on the buck as their principal means of financing.

The end result of all this has been to vastly expand the power of the Federal Reserve far beyond America?s borders. Even the smallest rise in US interest rates, like the ?% hike mooted for June, could trigger a cascade of corporate defaults around the world. Think of subprime, with a turbocharger.

We are already starting to see some cracks. The complete collapse of a number of emerging market currencies, like the Brazilian Real, Turkish Lira, South African Rand, Malaysian Ringgit and the Russian Ruble, has been accelerated by local borrowers rushing to buy back dollar before it appreciates further.

This is having a huge deflationary effect on the economies of many emerging nations.

Malaysia?s sovereign wealth fund has almost gone under after a series of bad bets against the dollar. There is thought to be another troubled dollar short coming out of Hong Kong worth $900 million.

This is forcing countries to liquidate their US Treasury Bonds to cover local losses.

Further exacerbating the situation has been the crash of the price of oil, which has turned producing countries from suppliers to takers of liquidity to the global credit markets. Russia alone sold $19 billion in the Treasury bond market in February, and is partially responsible for the sudden and dramatic rise in yields there.

The net net of all of this is to increase the risk of surprise blowups overseas, both by banks and the private borrowers. This will increase the volatility of financial instruments everywhere.

The Bank for International Settlements is an exclusive club of the world?s central banks. It is based in Basel, Switzerland, with further offices in Hong Kong and Mexico City. Its goal is it to coordinate policies among different nations.

The BIS was originally founded in 1930 to facilitate payment of German reparations following the Versailles Treaty ending WWI. As a regular groupie on the central banking scene, I have been reading the research publications for many decades.