The Death of Passive Investing

Passive investing, or piling all your money in major stock indexes like the S&P 500 (SPX) or the Dow Average (INDU), just got killed off by the bear market.

The days when you could just index and then go play golf for the rest of the day are gone for good.

Rest in Peace.

On a good day, your investments reliably underperformed the indexes, less management fees and hidden expenses. Even indexers have to work to earn a living.

That was fine as long as the indexes went up like clockwork, as they did almost every year for the last 12 years. Enter Covid-19. Many individual investors will instantly have heart attacks when they opened their annual pension fund and 401k statements.

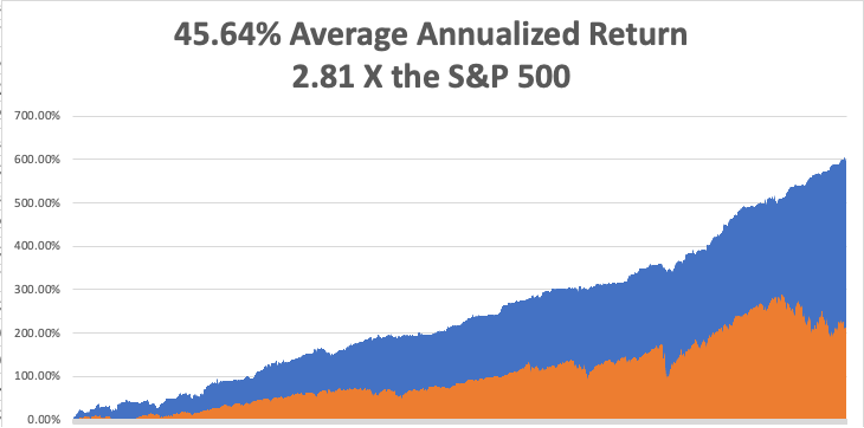

I have to admit that I was getting pretty sick of index investing. People like me would slave over their computers all day long in some years barely beating the returns of those who never lifted a finger. That is now ancient history.

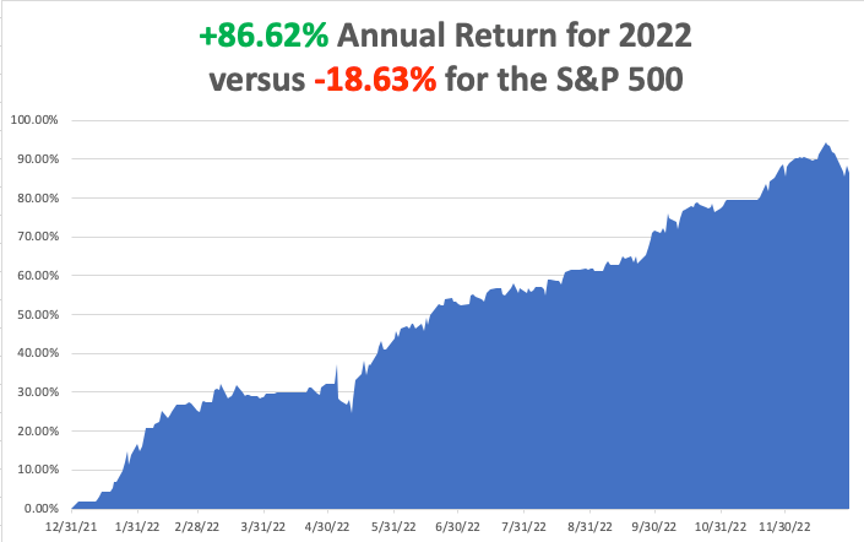

Look no further than my own performance year to date. Last year, I managed to clock an 86.62% gain, compared to a pitiful 18% for the Dow Average. 2023 could be another great year for me.

How will your index fund perform when US pandemic deaths hit over 1 million as reported by Johns Hopkins University?

The global pandemic is creating a brave new world on countless fronts, and management of your retirement funds is no different. Passive investing will be replaced by active investment whereby educated individuals pick winning stocks and judiciously avoid the awful ones.

The bad news is that you will have to work harder to oversee your nest egg. The good news is that you will make a lot more money. The difference between passive and active investment is now greater than at any time in history, and that chasm is set to increase.

While the bull market allowed all stocks to go up equally, the new one is totally different. There is about to be a huge differentiation between winners and losers like never seen before. The difference between the wheat and the chaff will be enormous.

Those who figure out the new game early will prosper mightily. Those who don’t will crash and burn.

I have been fighting a daily battle with some of my own subscribers, as they are arguing that the biggest gains will simply be made from buying the biggest losers.

I’m not buying that logic for a nanosecond. Many of the worst performers are never coming back to their former glory, such as airlines, cruise lines, hotels, movie theaters, restaurant chains, and casinos. Sure, they may have a brief dead cat bounce off the bottom for a trade. But the long-term outlook for these ill-fated industries is grim at best.

No, the future lies in buying Teslas and Rolls Royces at KIA prices. Come in today and these distressed levels and you may earn as much as 15% a year for the next decade.

You know the companies I am talking about, the ones I have been covering at great length in Global Trading Dispatch, The Mad Hedge Technology Letter, and the Mad Hedge Biotech & Healthcare Letter. If you are missing any of these publications, please feel free to pick them up at our store. Please note that all our prices are going up substantially soon.

This is going to lead to a very interesting future. Those who continue to index are looking at years of subpar performance. Those who go active and do it the right way are going to be looking pretty.

It’s going to be a fun decade. The Roaring Twenties have only just begun.

Good Luck and Good Trading,

John Thomas

Mad Hedge Fund Trader