The Death of the Bond Vigilantes

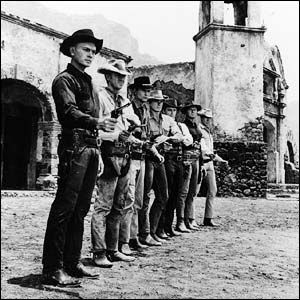

Back in the seventies and eighties, when inflation was soaring well into double digits, the markets were regularly punished by a band of gun slinging traders known as the ?bond vigilantes.? Hard asset prices were running amuck, and there was a laser like focus on the growth of the money supply.

We have just witnessed the largest expansion of the monetary base in history. The Federal Reserve?s balance sheet has ballooned from $800 million to an incredible $2.8 trillion in a mere three years. So where are the bond vigilantes?

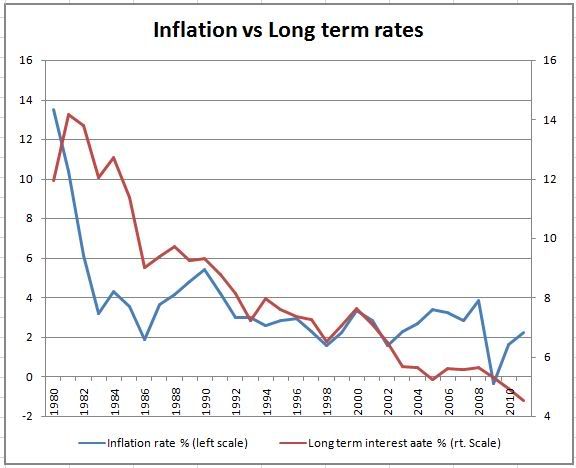

The answer is that they were all rounded up and lynched by Paul Volker decades ago. As much as commodity prices rise, the Consumer Price Index remains dead in the water at a 2% annual rate, a shadow of the 14% we saw 30 years ago. And no, it is not a government conspiracy, no fudged numbers, that are keeping the reported inflation rate so low.

The problem is, quite simply, your salary. For every $2 dollars? worth of commodity price inflation we are seeing, there are $3 worth of wages declines. Talk to any businessman, and he will tell you that wages account for at least 50% of his total costs, while commodity cost inputs are only 10%-15%.

Commodity prices can be roaring, but as long has globalization drives down wages at home, as it has for the last 30 years, their overall impact will be modest, at best. So add it all together, and you get an inflation rate that is stagnant at low single digits. You are obviously not working hard enough.

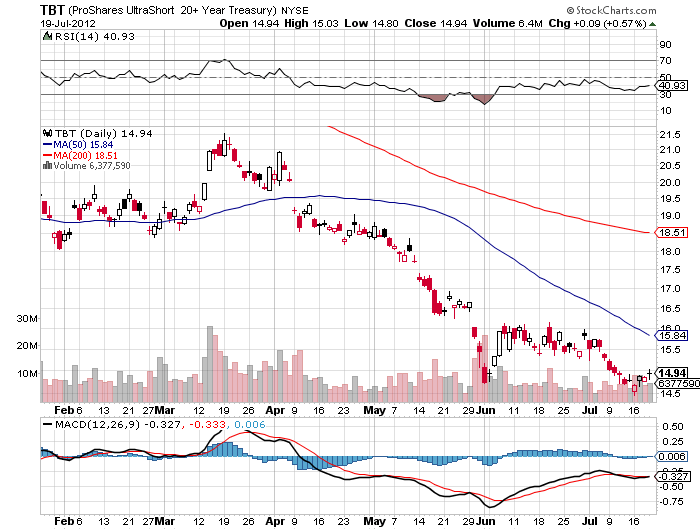

I am interested in all this because I have a dog in this fight. I happen to be short out of the money call spreads on the Treasury bond ETF (TLT). I also have more than a passing interest in the (TBT), a leveraged ETF that bets that the Treasury bond interest rates will rise and prices will fall. I used to think that a resurgence of inflation would take it from the current $14.50 to $200. I don?t believe that anymore. I instead think we will see a rise only to $43, which equates to a ten year Treasury bond yield of 4.10%, up from today?s 1.45%.

That is still a potential gain of nearly 300%, which is better than a poke in the eye with a sharp stick in this zero return world. And that middling profit will not be delivered by a reincarnation of the inflation beast, but by the sheer volume of issuance of bonds demanded by our enormous budget deficits.

The Bond Vigilantes: Gone But Not Forgotten