The Fat Lady is Singing for the Japanese Yen

?Oh, how I despise the yen, let me count the ways.? I?m sure Shakespeare would have come up with a line of iambic pentameter similar to this if he were a foreign exchange trader. I firmly believe that a short position in the yen should be at the core of any hedged portfolio for the next decade, but so far every time I have dipped my toe in the water, it has been chopped off by a samurai sword.

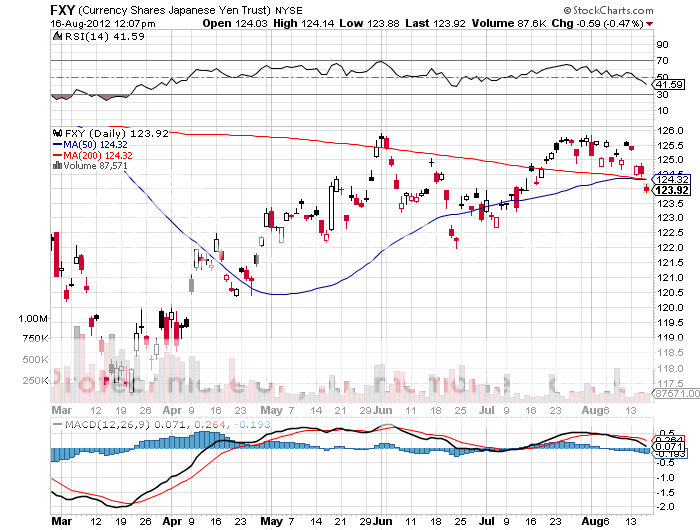

But now the 200 day moving average has been decisively broken, suggesting that the death of the yen may finally be at hand.

I was heartened once again this week when friends of mine in Tokyo told me that the loose money crowd at the Bank of Japan was slowly gaining in ascendance. Japanese exporters are getting hammered by the strong yen, accelerating the hollowing out of Japanese manufacturing, further adding to the country?s real unemployment rate. It has become a major political problem for the Noda administration.

To remind you why you hate all investments Japanese, I?ll refresh your memory with this short list of the problems bedeviling the country:

* With the world?s structurally weakest major economy, Japan is certain to be the last country to raise interest rates.

*As tsunami reconstruction money runs out, the economy is juddering to a halt. This week, the Ministry of Finance announced that Q2 GDP plunged from a 5.5% annual rate to only 1.4%.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world?s worst demographic outlook that assures its problems will only get worse. They?re not making Japanese any more.

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt exceeding 240% of GDP, or 120% when you net out inter-agency crossholdings, Japan is at the top of the hit list.

* The Japanese long bond market, with a yield of 0.86%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji, if they must, to get the yen down and bail out the country?s beleaguered exporters.

When the big turn inevitably comes, we?re going to ?185, then? ?100, ?120, and eventually ?150 to the US dollar. That could take the price of the leveraged short yen ETF (YCS), which last traded at $42.73, to over $100.? But it might take a few years to get there. The fact that the Japanese government has come on my side with this trade is not any great comfort. Many intervention attempts have so far been able to weaken the Japanese currency only for a few nanoseconds.

If you think this is extreme, let me remind you that when I first went to Japan in the early seventies, the yen was trading at ?305, and had just been revalued from the Peace Treaty Dodge line rate of ?360. To me the ?79.20 I see on my screen today is unbelievable, and unsustainable.

Noted hedge fund manager Kyle Bass says he is already in this trade in size. All he needs for it to work is for Japan to run out of domestic savers essential to buy the government?s domestic yen bond issues, who have pitifully had sub 1% yields forced upon them for the past 17 years. Then the yen, the bond market, and the stock market all collapse like a house of cards. Kyle says that could happen at any time.

It?s All Over For the Yen