The Future of AI Patents and Law

The world is rapidly shifting into a new paradigm where not only do people invent, but people also build artificial intelligence that can invent.

This will have massive ramifications for the business world and the tech industry which is the avant-garde of the business world.

Recent decisions from South Africa and Australia that an artificial intelligence machine can be listed as inventor on a patent could spur these two locales into being one of the most competitive tech scenes in the world.

The U.S. and Europe will need to figure out what it means to be an inventor.

Registering A.I. as an inventor could potentially mean that multinational corporations won’t shoulder the blame if some sort of insidious experiment with A.I. goes horribly wrong crushing half of mankind.

It also opens up the possibility of some “A.I. invented” app triggering 1000X growth delivering prosperity to half of mankind.

The wide range of possibilities is enough to keep one up at night, and the deeper knock-on effect is that A.I. is now prime for game time.

It’s true that the past interactions of A.I. have been bush league, and simply, the technology wasn’t enough along to make a dent in the universe.

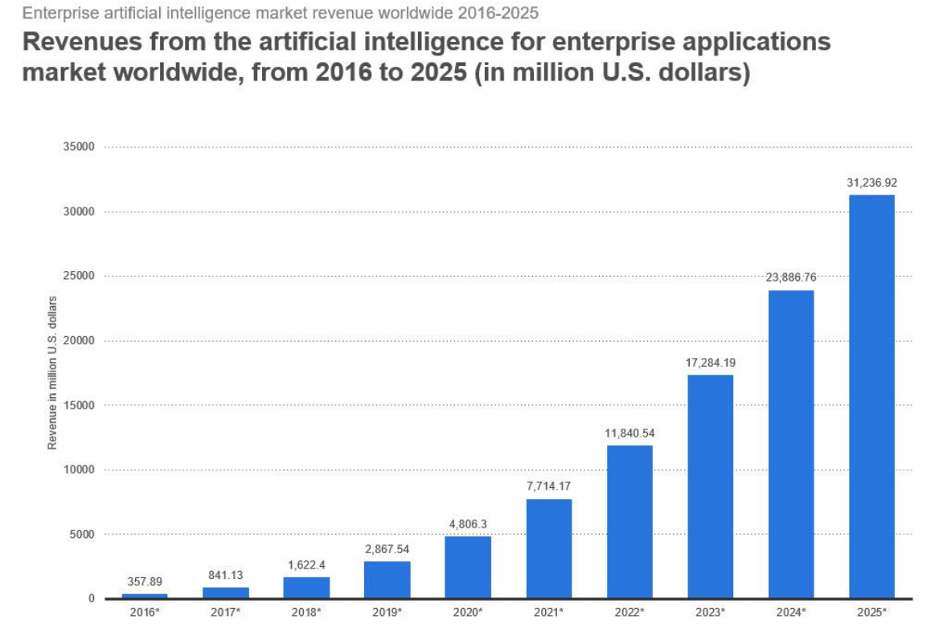

However, the rapid acceleration of not only the quantity of A.I., but the increasing quality of A.I. means that countries will need to make some high stakes business decisions on where A.I. fits into the law and patent system.

Courts in the U.S. and U.K. are expected to issue rulings later this year, and policymakers are gathering information on how to deal with the rising use of AI.

Another piece to the puzzle is how China will treat A.I. and the knock-on effects on American consumers and American businesses.

This sub-sector has been identified as one of the “must-win technologies of the future” by the U.S. administration.

China also leads in A.I. as it relates to facial recognition and has a database of 1.3 billion citizens to pull data from.

China is pursuing a centrally controlled strategy with hyperlocal implementation. Values and goals are set from above, and resources are made available.

At the local level of municipalities, cities and provinces, regional administrations compete for the new AI clusters.

The result is a national and regional administrative state that works closely with research, investors, and industry to build a successful AI ecosystem.

The implementation of the national strategy varies greatly from region to region. While cities such as Tianjin and Shanghai have already launched multi-billion-dollar AI city Venture Capital funds and had entire districts and islands built for new AI companies. Other provinces are still in the process of learning and development.

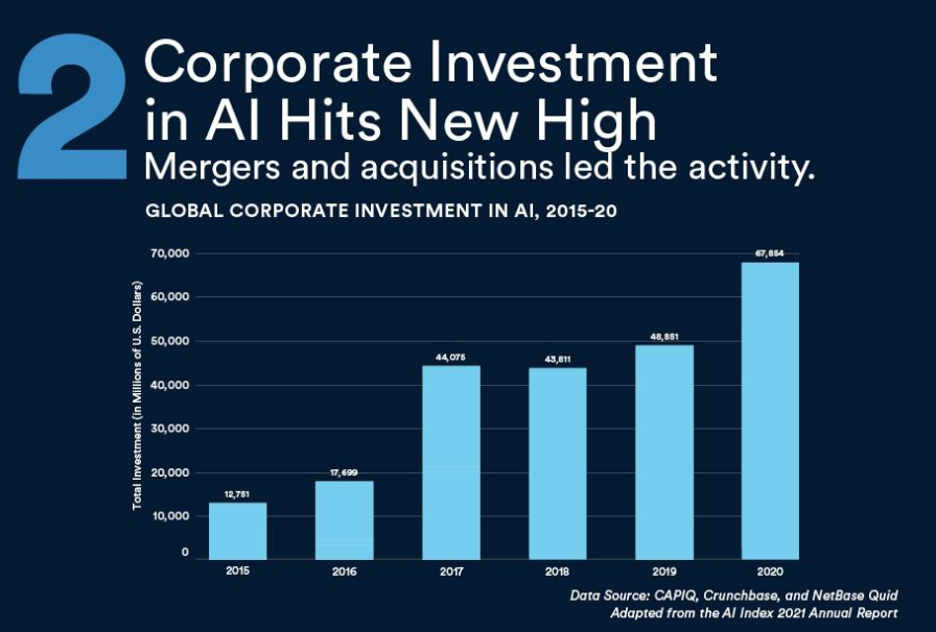

As it stands now, American corporations are acutely aware of incorporating AI into their business models and the risks associated with it.

In either case, American companies need a verdict and the initial framework of how to treat A.I. in terms of who owns the patents and what that means, or they risk falling behind places like China who are hellbent on being the first A.I. superpower.

Just look at social media companies that otherwise would be on the hook for the costs associated with negative content on their platforms if it weren’t for cheeky legislation better known as Section 230.

Section 230 is a section of title 47 of the U.S. Code enacted as part of the United States Communications Decency Act which generally provides immunity for website platforms from third-party content.

Imagine if all companies were protected from anything negative that A.I. manufactured and not only with social media.

One could extrapolate that this could be horrendous for the health of many social communities, but one could also understand how investors could win out big time if a flood of capital nosedived into controversial projects that became money generators.

Tech companies, especially the big 6, have the capital and connections in Washington to advance the initiative.

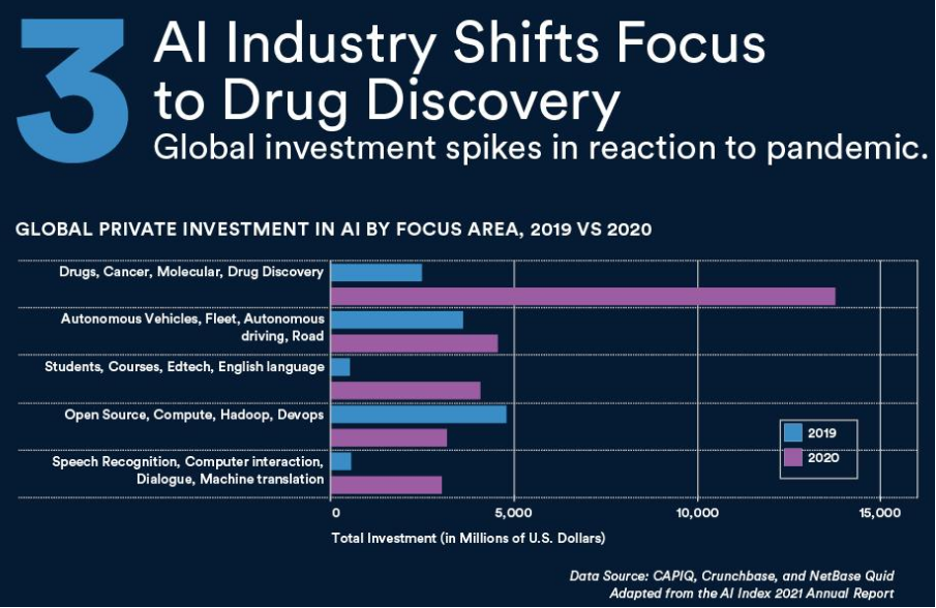

Drug discoveries for diseases like cancer have been of massive interest for AI researchers with scientists hoping to leverage the technology to discover cures for complex diseases.

It’s not surprising to see companies like Apple, Google, Microsoft, and so on get in on the health game with the revenue potential for these future health solutions and medicines in the 10s of trillions of dollars.

Another project that comes to mind that would benefit from AI law is Elon Musk-supported Neuralink.

Elon Musk wants everyone to get brain surgery. Specifically, he wants everyone to get a brain implant — the brain-machine interface created by his company, Neuralink. He says it will be able to solve any number of medical conditions — including paralysis, anxiety, and addiction.

A project like this is high risk — a lot could go wrong with it.

But what if the law was set up to just allow investors to write off the externalities and fiscal costs of a failed project?

U.S. District Judge Leonie Brinkema has ruled that this type of legislation faces an “uphill battle” in overturning a rejection by the U.S. Patent and Trademark Office.

A U.K. court heard arguments in July on the same question. The European Patent Office has scheduled a hearing in December.

These rulings also have massive consequences in where the new Silicon Valley migrates to and if the rules are favorable in South Africa, what’s stopping Facebook from exploring an opening of a Cape Town subsidiary?

Not much is the answer.

Artificial intelligence uses a machine to perform steps that mimic the work of a human mind but at exponential speed and performance.

AI computers can identify new drug molecules or new uses for old drugs, but it still takes human researchers to develop those results into a new medicine.

Many bigwigs in Silicon Valley have already clearly stated that the U.S. “lacks the comprehensive IP policies it needs for the AI era and is hindered by legal uncertainties in current U.S. patent eligibility and patentability doctrine.”

The issue of inventorship is just a small part of the dilemma over how to deal with AI, such as what types of AI software are eligible for a patent and who owns the massive amounts of data required to “teach” the machines.

A decision clarifying which AI inventions are eligible for patenting would be impactful.

Ultimately, AI is a high-stake game that gets more important by the day.