The Future Of Tech Stocks

Through the vast whole spectrum of public markets, the U.S. stock market, and specifically technology stocks, are dominating versus their peers from other countries.

Heck, even Apple, just one company from a small suburb in California, is valued at a price that is greater than the entire German economy.

Does that speak to how bad the German economy is, or does it speak to the potency of public tech companies in America?

The truth is probably a bit of both.

Then, take a second and try to absorb the fact that Apple hasn’t even integrated AI into its own products yet.

The future is bright for many tech stocks, and the rally will broaden out to non-Magnificent 7 stocks.

More granularly, the US will continue to lead by market cap share as artificial intelligence benefits expand beyond a few large tech names that have dominated the market rally over the past year to companies in various industries.

Revenue production and margin improvement will be the critical levers of expansion.

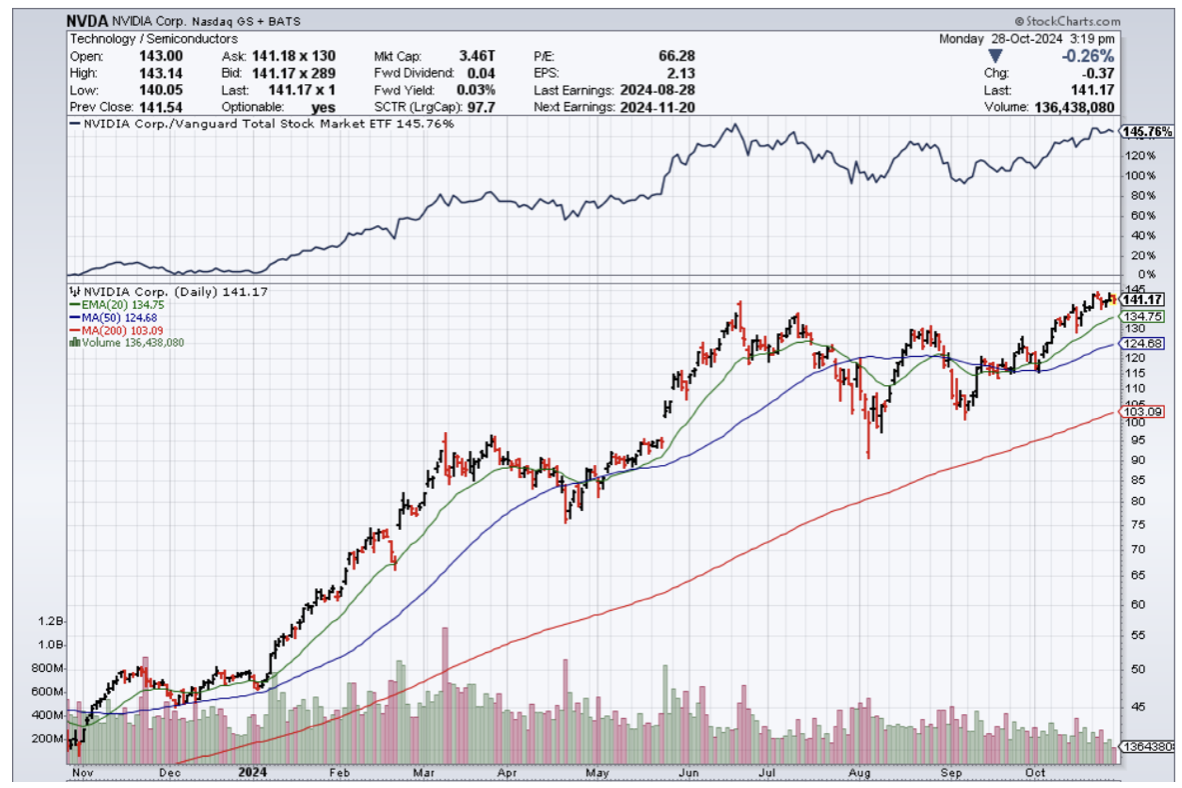

The first will come from the money pouring into AI benefiting companies outside of Big Tech. This plays out as tech companies buy AI chips from the likes of Nvidia (NVDA), and as they need more power, these AI operators are forced to spend with companies in the Utilities (XLU) and Energy (XLE) sectors.

As AI makes companies more efficient and eliminates the simplest work, eventually cutting down costs, US corporates should get a boost to profit margins.

Global equity markets, including retirement allocations to equities, are basically leveraged to Nvidia.

A non-US tech company will rise over the next decade and unseat the large tech companies currently driving the US market share, like Apple (AAPL), Nvidia, Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and Meta (META) are almost zero.

When we look at the revenue possibilities and understand that AI will directly cut expenses by creating efficiencies, it’s hard to see tech stocks do anything but go higher in the long term.

Even then, there will be some dips, and they should absolutely be characterized as buying opportunities.

Just look at a 3-month chart of Apple, and each month has presented a dip buying opportunity on August 6th, September 16th, and October 7th.

Apple stock is up 7.5% in the past 3 months.

When everyone complains that tech stocks are too expensive, well, they will get more expensive.

As long as leverage is able to be tapped, institutions will tap it and look for that asymmetric trade to the upside.

Tesla has also proved how hard it is to bet against tech and Elon Musk.

It usually is a terrible idea.

The setup to Tesla’s earnings meant a very low bar, and Musk jumped over it to the tune of a 22% pop in Tesla stock.

Tech is clearly in a secular bull trend, and trying to get artsy to squeeze in a microdip on the short side usually has meant a loss-taking event.

Why even try?

It’s my job to tell readers to bet on tech going to the upside, especially the quality companies that accelerate revenue by harnessing the superpowers of AI.