The Great Ethanol Boondoggle

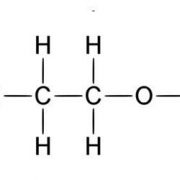

One of my biggest disappointments with the Obama administration so far is his continued support of the ethanol boondoggle. The program was ramped up by the Bush administration to achieve energy independence by subsidizing the production of alcohol from domestically grown corn. Add clean burning moonshine (yes, it's the same alcohol - C2H5OH), whose combustion products are carbon dioxide (CO2) and water (H2O), to gasoline and emissions also go down.

The irony is that if you include all the upstream and downstream inputs, the process consumes far more energy than it produces. It also demands massive quantities of fresh water, which someday will become more valuable than the oil the ethanol is supposed to replace, turning it into toxic waste.

Few consumers are aware of how big the ethanol industry has grown in such a short period. Ethanol consumption of corn has soared from 1.6 billion bushels in 2006 to an anticipated 4.3 billion bushels this year. Ethanol's share of our total corn crop has skyrocketed from 14% to nearly 40% during the same period. Corn grown for ethanol now occupies 10% of the total arable land in the US.

Ethanol's impact on food prices has been huge. It is the sole reason why corn is trading at the $7 handle, instead of $3. You also have to add in the inflationary effects on downstream grain consumers, like the food manufacturers and the cattle industry. While spendthrift, obese Americans burn food so they can drive chrome wheeled black Hummers to Wal-Mart, much of Africa and Asia starve. A global food crisis is not that far off.

This ignores the reality that Brazil, the world's largest ethanol producer, can ferment all the ethanol it wants at one third our cost because they make it from much more efficient sugarcane, which has five times the caloric content of corn. They also have ideal weather. However, protective import quotas and tariffs prevent meaningful quantities of foreign ethanol imports.

Bush financed all of this wasteful pork, because Iowa has an early primary, giving it an outsized influence in selecting presidential candidates, and has two crucial Senate seats as well. Well, it turns out that Obama needs Iowa even more than Bush, where the Democrats are ahead 3-2 in the House, and have a tie in the Senate (1-1), so the ethanol program not only lives on, it is prospering.

Ethanol has become such of big industry that it now commands a fairly large footprint in Washington, fielding armies of lobbyists to keep the subsidies and tax breaks flowing from the appropriate agricultural committees. The problem for the rest of this is that once these lobbies become entrenched they are almost impossible to get rid of. Think of an advanced case of scabies. Remember the tobacco lobby?

Better to drink ethanol than burn it, I say.