The Legacy Tech Company That's Worth Buying Now

Adobe (ADBE) will muscle through the upcoming earnings recession.

Tech profits are facing a stiff profit contraction leading to a potential drop of 0.75% next earnings season.

The bulk of the softness will come from, you guessed it, Apple’s (AAPL) debacle selling iPhones in China, alerting investors to take waning sentiment into consideration.

Adobe is one of your safest bets in 2019 that will experience market dispersion due to the decelerating nature of the global economy.

I feel like a broken record saying the best tech companies to own at this point in the economic cycle are enterprise software stocks benefitting from the migration to digital with bullet-proof balance sheets.

But it must be said.

Shantanu Narayen, President and CEO of Adobe, brilliantly summed up the effects of Adobe’s software by saying, “Adobe is fueling the creative economy, driving the paper-to-digital revolution and enabling businesses to transform through our leadership in customer experience management.”

Adobe, headquartered in San Jose, California, epitomizes the type of software company lapping it up as smaller companies understand the only means of survival is violently pulling the technology lever, particularly juicing up revenue through applying enhanced software.

Shares have exploded over 350% in the past 5 years as small businesses are blown away by Adobe’s dizzying array of creative, marketing, and analytics software, just to name a few.

Adobe shares still have more room to run as the economic cycle has been effectively extended through external macro forces.

A few weeks ago, Adobe reported weak guidance cushioning forecasts down a half notch.

Investors need to understand that the market is grappling with a potential earnings recession on the horizon possibly smothering a large swath of the economy.

Instead of throttling shares on next quarter’s earnings, Adobe felt it was prudent to front run the earnings weakness inherently found in their own model and guide down now.

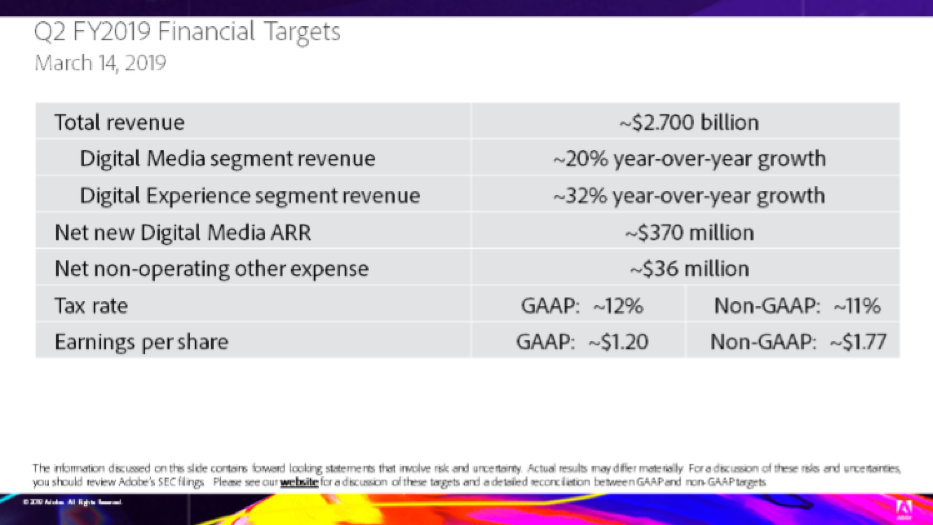

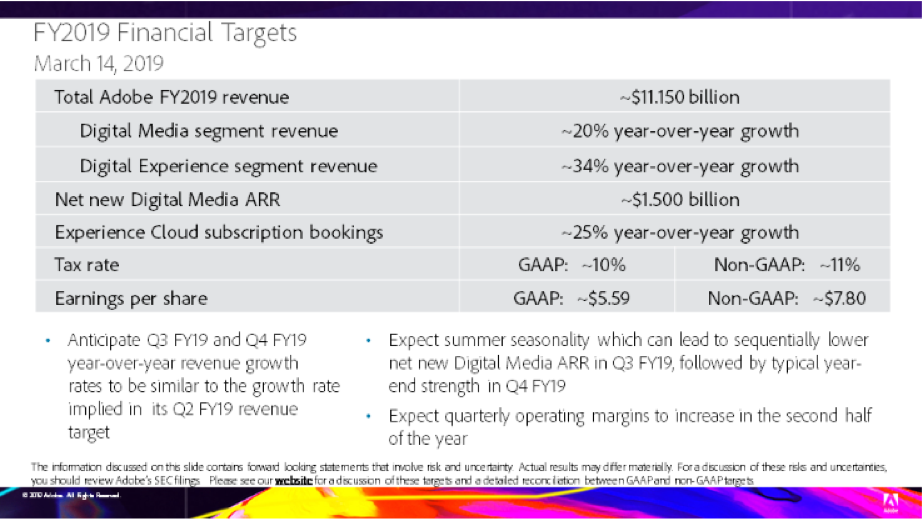

For the year 2019, Adobe forecasted earnings of $7.80 a share on sales of $11.15B with Digital Media Annual Recurring Revenue (ARR) of approximately $1.5B.

The street forecasts earnings per share of $7.77 on sales of $11.16 billion this year.

The guides weren’t venomous by a long shot and will have no material effect, just a small blip on the radar making Adobe a great bet for beating next quarter’s earnings if they maintain the planned trajectory of expected growth.

Shares have made back up the $10 drop from the subsequent consolidation after the Q1 report, and I suspect that Adobe will run away to new highs going into next quarters earnings report.

It helps that Adobe is blowing away revenue records left and right and announced an audacious project to partner up with Microsoft (MSFT) to mutually bolster sales and marketing software capabilities to take on Salesforce (CRM).

LinkedIn integration will allow Adobe customers to find potential customers for business goods.

If the LinkedIn ad campaign flourishes, the customer will be able to use Microsoft's Dynamics 365 sales software to close the deals.

The precursor to this initiative was Adobe acquiring B2B software firm Marketo for $4.75B last year laying the groundwork for the LinkedIn partnership.

Integrating Magento within the existing Experience Cloud accounts was a meaningful contributor, and Marketo delivered solid results in their full quarter debut under the Adobe portfolio of assets.

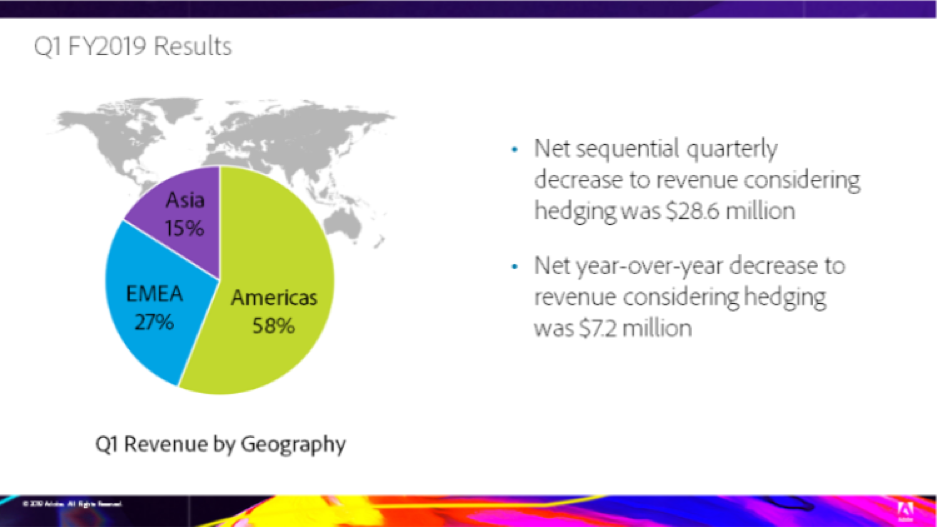

In Q1, Adobe pocketed $2.6B in revenue, a 25% improvement YOY resulting in $1.01B of cash flow from operations.

About 91% of revenue stemmed from a recurring source, and Adobe’s biggest division, the Creative division, grew to $1.49B, a 22% YOY improvement.

The $1.49B contributed by the Creative segment comprised of about 2/3 of total quarterly revenue.

The achievement was attributed to new net adds across all offerings, along all geographical fronts, and a ramp-up in subscription-based packages.

Other catalysts were average revenue per user (ARPU) increases, particularly in markets where price optimizations were introduced last year and service adoption including continued momentum with Adobe Stock, which again achieved greater than 20% YOY revenue growth.

The impact of lost deferred revenue stemming from the acquisitions of Magento and Marketo will absorb itself throughout the year creating a tailwind resulting in quarterly operating margins increasing in the second half of the year.

Adobe and Microsoft have proved that dangling useful legacy products such as Adobe’s PDF viewer and Microsoft Office have been perfect gateways into other software upsells like Adobe’s Photoshop and Microsoft’s Azure cloud products.

They have effectively harnessed the same road map to achieve success and don’t apologize for it.

Adobe didn’t have to reset expectations last quarter, but with their highest-grade software growing in the mid-20% and a chance to guide down because of the expected earnings recession, why not take the carrot offered to you?

The software firm is optimally positioned to overperform for the rest of the year, every selloff should be met with furious dip buying for this best of breed software.

I am bullish Adobe.