The Market Outlook for the Week Ahead, or Are We In or Out?

Are we already in a recession or still safely out of one?

That is the question painfully vexing investors after the stock market action of the past seven weeks.

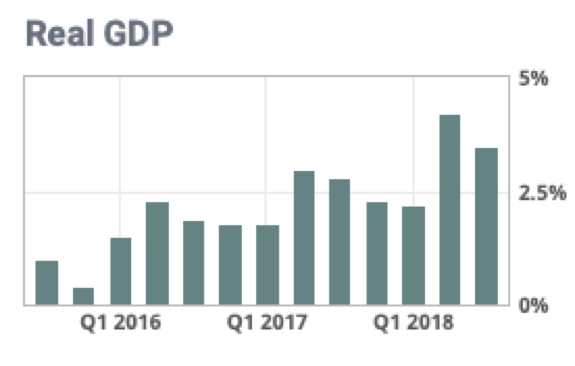

There is no doubt that the economic data has suddenly started to worsen, setting off recession alarms everywhere.

October Durable Goods were down a shocking 4.4%. Weekly Jobless Claims hit 224,000, continuing a grind up to a 4 ½ month high. Is the employment miracle ending? Goldman Sachs says growth is to drop below 2% in 2019, well below Obama era levels. Maybe that’s what the stock market crash is trying to tell us?

The Washington political situation continues to erode confidence by the day. We have already lost real estate, autos, energy, semiconductors, retailers, utilities, and banks. But as long as tech held up, everything was alright.

Now it’s not alright.

The tech selloff we have just seen was far steeper and faster than we saw in the 2008-2009 crash. You have to go all the way back to the Dotcom Bust 18 years ago to see the kind of price action we have just witnessed. The closely watched ProShares Ultra Technology Fund (ROM) has cratered from $123 to $83 in a heartbeat, off 32.5%.

Which begs the question: Are we already ten months into a bear market? Or is this all one big fake-out and there is one more leg up to go before the fat lady sings?

I vote for the latter.

If this is a new bear market, then it is the first one in history with the lead sectors, technology, biotechnology, and health care, announcing new all-time profits going in.

So, either Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google (GOOG) are all about to announce big losses in coming quarters, which they aren’t, or the market is just plain wrong, which it is.

Which leads us to the next problem.

Markets can be wrong for quite a while which is why I cut my positions by half at the beginning of last week. To quote my old friend, John Maynard Keynes, “Markets can remain irrational longer than you can remain liquid,” who lists his entire fortune in the commodities markets during the Great Depression.

To see this all happen in October was expected. After all, markets always crash in October. To see it continue well into November is nearly unprecedented when the strongest seasonals of the year kick in. This was the worst Thanksgiving week since 2011 when we were still a wet dog shaking off the after-effects of the great crash.

There are a lot of hopes hanging on the November 29 G-20 Summit to turn things around which could hatch a surprise China trade deal when the leaders of the two great countries meet. The Chinese stock market hit a one month high last week on hopes of a positive outcome. Do they know something we don’t?

There were multiple crises in the energy world. You always find out who’s been swimming without a swimsuit when the tide goes out. James Cordier certainly suffered an ebb tide of tsunami proportions when his hedge fund blew up taking natural gas (UNG) down 20% in a day.

Cordier got away with naked call option selling for years until he didn’t. All of his investors were completely wiped out. I have always told followers to avoid this strategy for years. It’s picking up pennies in front of a steamroller. Same for naked puts selling too.

The Bitcoin crash continued slipping to $4,200. I always thought that this was an asset class created out of thin air to absorb excess global liquidity. Remove that liquidity and Bitcoin goes back to being thin air, which it is in the process of doing.

Oil (USO) got crushed again, down an incredible 35.06% in six weeks, from $77 a barrel all the way down to $50 as recession fears run rampant. Panic dumping of wrong-footed hedge fund longs accelerated the slide. They all had expected oil to rocket to $100 a barrel in the wake of the demise of the Iran Nuclear Deal and the economic sanctions that followed.

Apparently, Saudi Arabia’s deal with the US now is that they can chop up all the journalists they want at the expense of a $27 a barrel drop in the price of oil. That will cut their oil revenues by a stunning $97 billion a year. That’s one expensive journalist!

Watch the price of Texas tea carefully because a bottom there might signal a bottom for everything including tech stocks. And I don’t see oil falling much from here.

As for performance, Thanksgiving came early this year, at least in terms of the skinning, gutting, and roasting of my numbers. If you do this long enough, it happens. Every now and then, markets instill you with a strong dose of humility and this is one of those time.

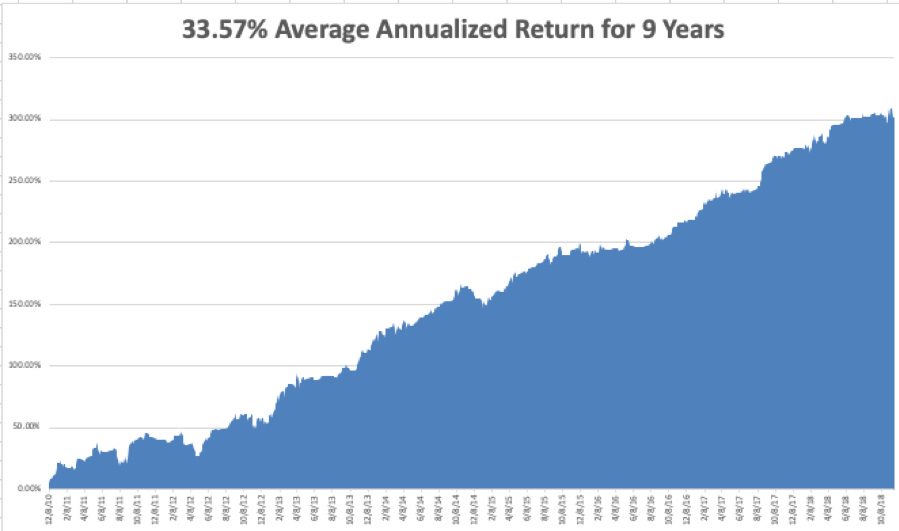

My year to date return dropped to +25.72%, and chopping my trailing one-year return stands at 31.71%. November so far stands at a discouraging -3.91%. And this is against a Dow Average that is down -2.01% so far in 2018.

My nine-year return withered to +302.19%. The average annualized return retraced to +33.57%.

The upcoming week has some important real estate data coming. However, all eyes will be upon the Friday G-20 announcement from Buenos Aires. Will the trade war with China end, or get worse before it gets better?

Monday, November 26 at 8:30 EST, the Chicago Fed National Activity Index is published.

On Tuesday, November 27 at 9:00 AM, the all-important CoreLogic Case-Shiller National Home Price Index is out. It will be interesting to see how fast it is falling.

On Wednesday, November 28 at 8:30 AM, Q3 GDP is updated. How fast is it shrinking?

At 10:30 AM the Energy Information Administration announces oil inventory figures with its Petroleum Status Report.

Thursday, November 29 at 8:30 we get Weekly Jobless Claims which have been on a four-month uptrend. At 10:00 AM, October Pending Home Sales are printed.

On Friday, November 30, at 9:45 AM, the week ends with a whimper with the Chicago Purchasing Managers Index.

The Baker-Hughes Rig Count follows at 1:00 PM. At some point, we will get an announcement from the G-20 Summit of advanced industrial nations.

As for me, I drove through the first blizzard of the year over Donner Pass to finally crystal clear skies of San Francisco. Long-awaited drenching rains had finally cleansed the skies. Every Tahoe hotel was packed with Californians fleeing the smokey skies.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader