The Market Outlook for the Week Ahead, or Battling the Coronavirus

I am writing this to you from the first-class cabin of Quantas Airlines on the nonstop flight from Melbourne, Australia to San Francisco, a 14-hour flight. While my flight from the US to the Land Down Under was packed, the return was half empty, great for free upgrades.

It has been a daunting day. I was originally scheduled to transfer on my flight from Perth to Sydney. But my plane there was found to be contaminated with Coronavirus and had to be decontaminated. I quickly rerouted.

I ended up sitting next to a research doctor who worked for San Francisco based-Gilead Sciences (GILD) and was returning from Wuhan, China, the epicenter of the virus. Since all flights from China to the US are now banned, he had to route his return home via Australia.

What he told me was alarming.

The Chinese are wildly understating the spread of the Coronavirus by perhaps 90% to minimize embarrassment to the government, which kept the outbreak secret for a full six months.

Bodies are piling up outside of hospitals faster than they can be buried. Police are going door to door arresting victims and placing them in gigantic quarantine centers. Every covered public space in the city is filled with beds and the roads are empty. Smaller cities and villages have set up barriers to bar outsiders.

He expected it would be many months before the pandemic peaked. It won’t end until the number of deaths hits the tens of thousands in China and at least the hundreds in the US.

The good news is that Gilead Sciences has an antiviral agent it developed for the other Coronaviruses, MERS and SARS, years ago which may be effective against the present epidemic. The company has already sent a planeload of the drug to China for immediate testing, which my new friend escorted.

The world has learned a lot since the West African Ebola outbreak of 2013. The Coalition for Epidemic Preparedness Innovation (CEPI) set up in response to that disease is now leading the charge against Corona.

A lab in Australia was able to isolate the virus in a month. The AIDS virus took ten years. It only required another day to sequence the genome. That has greatly shortened the time for the development of a vaccine and a cure. It will take a year to mass produce enough vaccine to inoculate the world. That will be too late to save the many in China who have already perished.

Needless to say, the impact on the global economy will be immense. As we learned from the trade war, take China out of the equation and many things don’t work anymore.

The country’s GDP growth rate is expected to plunge from 6% to 2% this quarter, and possibly zero. Factories have closed, disrupting supply chains globally. The car industry is most affected, with Hyundai in South Korea already shutting down production for lack of parts.

Travel and tourism shares, like airlines (DAL), casinos (WYNN), and cruise lines (CCL), (RCL) have also been hard hit.

US stocks are taking notice, but slowly. It seems that massive Quantitive Easing by the Federal Reserve is enough to head off even a global pandemic, at least for now. This will not last. We have already seen one 600-point down day and a (VIX) spike to $21. There will be more.

Despite the fact that we may be facing the end of the world, the Mad Hedge Trader Alert Service managed to catapult to new all-time highs.

My long volatility positions I picked up when the Volatility Index (VIX), (VXX) was a lowly $12, brought in a double or a triple for most holders in a mere two weeks.

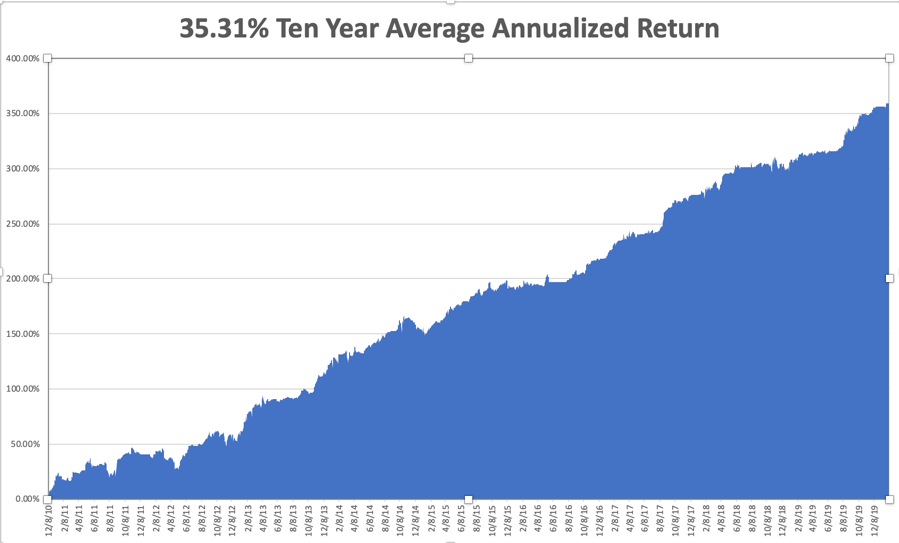

My Global Trading Dispatch performance rose to a new high at +358.96% for the past ten years. My trailing one-year return rose to +48.59%. We closed out January with a respectable +3.11% profit. My ten-year average annualized profit ground back up to +35.31%.

All eyes will be focused on Corona, the virus, not the beer. The weekly economic data are virtually irrelevant now.

On Monday, February 10 at 1:00 PM, US Consumer Inflation Expectations are out.

On Tuesday, February 11 at 12:00 PM, JOLTS Job Openings for December are released.

On Wednesday, February 12, at 12:00 PM, Federal Reserve Chairman Jerome Powell testifies in front of congress.

On Thursday, February 13 at 8:30 AM, Weekly Jobless Claims come out. US Core Inflation for January is published.

On Friday, February 14 at 10:30 AM, Retail Sales for January are printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, after my epic voyage home, I’ll be catching up on my sleep, dealing with the 16 hours of jet lag from Western Australia.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader