The Market Outlook for the Week Ahead, or The Bull Ages

I asked a hedge fund friend of mine the other day about his favorite positions for 2022. His answer surprised me: cash.

Maybe it’s just me in my old age, but it seems we are having to work harder and harder to get fewer and fewer returns from the stock market.

Maybe it’s the increasing age of the bull, now 14 months since the last 10% correction. It is not a child anymore, or even a teenager, but more likely thirty something.

Is there a middle age crisis around the corner? While its performance will still be OK, its best years are clearly behind us. In other words, it’s a lot like you and me.

Perhaps it is the recent onslaught of black swans hitting the financial system: oil shocks, threatened Russian invasions, shocking 6.8% inflation, and Fed flip-flopping that are causing the recent reticence.

But here we are with a Dow Average at $35,970, exactly where we were two months ago. There has been a lot of Sturm und Drang, but no net movement.

Maybe this is all to test the faithful and to flush out all the hot money, which we clearly did the previous week. 2022 will be one of the highest growth years in American history, in excess of a 5% real rate.

In a year, the pandemic will be gone, supply chain problems fixed, international trade resumed, corporate profits and the stock market will be at all-time highs, and most workers will have just obtained the biggest pay increases in their lives. The only unknown is how much of this performance has already been pulled forward into 2021.

Still, we have little choice but to press ahead with our longs. With overnight rates still near zero, there are few other high-gaining investments, such as residential real estate. The funny thing is that real estate people are buying stocks because homes have gotten so expensive, while stock market people are buying second and third homes because shares have become so dear.

I call it the “grass is always greener on the other side of the fence” syndrome. It is always a sign of impending trouble.

Cogitating over this, I think I’ll go for my second helping of eggnog and my third mug of hot buttered rum.

CPI Sizzles at 6.8% YOY, the highest since 1982, after a 0.8% pop in November. Virtually everything saw big increases, with used trucks up 30%. The Fed now has more incentive to accelerate the taper and bring forward interest rate hikes. The shock was already priced into the bond market which barely moved.

ADP Soars to 11 Million Job Openings, up 431,000 in October, the most on record. Companies are screaming for new staff. If you are a computer programmer or truck driver, the world is your oyster. Resignations are declining. There are a staggering 254,000 openings in Accommodations and Food Industries, and another 45,000 in nondurable goods manufacturing. State & Local Government shrunk job openings by 115,000. It’s a sign of extreme vigor in the economy.

Weekly Jobless Claims Dive to 184,000, down an amazing 43,000 on the week, a new post-pandemic low and a 52-year low. Things are definitely getting better.

Omicron Fades as a market concern, as a 1,200-point move up in the Dow in two days proves. This was probably the last dip of 2021. Now that the bottom is in, look for volatility to fade from here into yearend. I kept all my positions in the last meltdown, both in financial and tech longs and bond shorts.

Pfizer Says Boosters Work Against Omicron, as I suspected, which is why you saw the biggest two-day rally in stocks this year. The booster increases your immunity 1,000 times. I’d buy (PFE) but it is already up 25% in a month.

Ford Stops Taking Orders for the F-150EV, as demand has been so overwhelming. Now all they have to do is make one. It’s the hottest selling Ford product since the Mustang hit the road in 1964, when the Beatles launched their first US tour. A lot of talk but little output. It’s all PR. Tesla has a 12-year head start, but (F) will probably keep going up as it transforms from a hardware manufacturer to a software company.

Why Elon Musk Hates Hydrogen, which he calls “fool cells”. I tell people to just google the term “Hindenburg”. Electricity is infinitely scalable while hydrogen isn’t, and certainly won’t be able to compete economically after the next tenfold improvement in battery densities.

US Home Prices to Keep Rising, but at only half the 2021 rate. I’ll take another 10% gain in my home value. The generational shortage of housing should keep house prices rising for another decade. Buy (TOL), PHM), and (KBH) on dips, which has resorted to lotteries to halt bidding wars.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

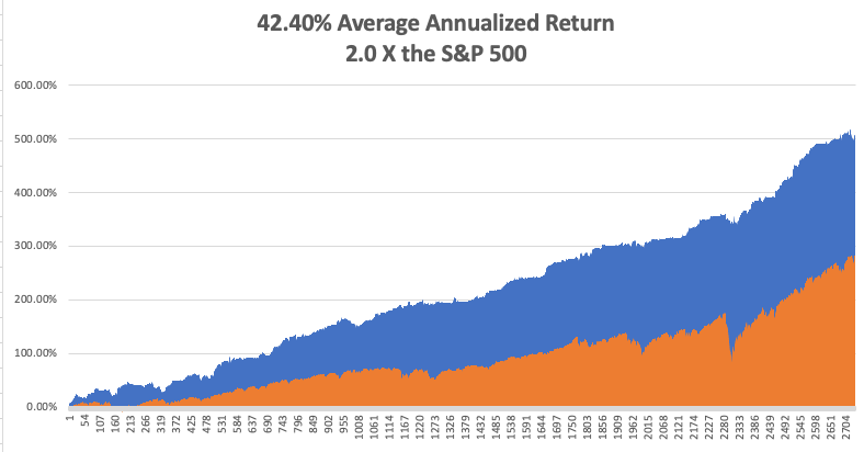

With the pandemic-driven meltdown on Friday, my November month-to-date performance bounced back hard to 9.47%. My 2021 year-to-date performance recovered to 86.23%. The Dow Average is up 17.55% so far in 2021.

I used a collapse in bond prices to take profits on my 20% position in bonds. I kept my long in (JPM),(GS), and (BAC). I am 70% in cash. I will be using any further volatility spikes to add positions in the coming week.

That brings my 12-year total return to 508.78%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return has ratcheted up to 42.40%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 50 million and rising quickly and deaths close to 800,000, which you can find here.

On Monday, December 13 at 8:00 AM, Consumer Inflation Expectations are out.

On Tuesday, December 14 at 8:30 AM, the Producer Price Index for November is published.

On Wednesday, December 15 at 8:30 AM, the Retail Sales for November are printed. At 11:00 AM, the Federal Reserve announces its interest rate decision.

On Thursday, December 16 at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, December 17 at 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, one of the benefits of being married to a British Airways stewardess in the 1970s was unlimited free travel around the world. Ceylon, the Seychelles, and Kenya were no problem.

Usually, you rode in first class, which was half empty, as the British Empire was then rapidly fading. Or you could fly in the cockpit where, on long flights, the pilot usually put the plane on autopilot and then went to sleep on the floor, asking me to watch the controls.

That’s how I got to fly a range of larger commercial aircraft, from a Vickers Viscount VC-10 to a Boeing 747. Nothing beats flying a jumbo jet over the North Pole on a clear day, where the unlimited view ahead is nothing less than stunning.

When gold peaked in 1979 at $900 an ounce, up from $34, The Economist magazine asked me to fly from Japan to South Africa and write about the barbarous relic. That I did with great enthusiasm, bringing along my new wife, Kyoko.

Sure enough, as soon as I arrived, I noticed long lines of South Africans cashing in their Krugerrands, which they had been saving up for years in the event of a black takeover.

There was only one problem. My wife was Japanese.

While under the complicated apartheid system, Chinese were relegated to second class status along with Indians, Japanese were treated as “honorary whites” as Japan did an immense amount of trade with the country.

The confusion came when nobody could tell the difference between Chinese and Japanese, not even me. As a result, we were treated as outcasts everywhere we went. There was only one hotel in the country that would take us, the Carlton in Johannesburg, where John and Yoko Lennon stayed earlier that year.

That meant we could only take day tips from Joberg. We traveled up to Pretoria, the national capital, to take in the sights there. For lunch, we went to the best restaurant in town. Not knowing what to do, they placed us in an empty corner and ignored us for 45 minutes. Finally, we were brought some menus.

The Economist asked me to check out the townships where blacks were confined behind high barbed-wire fences in communities of 50,000. I was given a contact in the African National Conference, then a terrorist organization. Its leader, Nelson Mandela, had spent decades rotting away in an island prison.

My contact agreed to smuggle us in. While blacks were allowed to leave the townships for work, whites were not permitted in under any circumstances.

So, we were somewhat nonplussed Kyoko and I were asked to climb into the trunk of an old Mercedes. Really? We made it through the gates and into the center of the compound. On getting out of the trunk, we both burst into nervous laughter.

Some honeymoon!

After meeting the leadership, we were assigned no less than 11 bodyguards as whites in the townships were killed on sight. The favored method was to take a bicycle spoke and sever your spinal cord.

We drove the compound inspecting plywood shanties with corrugated iron roofs, brightly painted and packed shoulder to shoulder. The earth was dry and dusty. People were friendly, waving as we drove past. I interviewed several. Then we were smuggled out the same way we came in and hastily dropped on a corner in the city.

Apartheid ended in 1990 when the ANC took control of the country, electing Nelson Mandela as president. A massive white flight ensued which brought people like Elon Musk’s family to Canada and then to Silicon Valley.

Everyone feared the blacks would rise up and slaughter the white population.

It never happened.

Today, South Africa offers one of the more interesting investment opportunities on the continent. The end of apartheid took a great weight off the shoulders of the country’s economy. Check out the (EZA), which nearly tripled off of the 2020 bottom.

Kyoko passed away in 2002 at age 50.

Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader