The Market Outlook for the Week Ahead, or The Titanium Market

It is not true that this is a Teflon market, rising almost every day for four months.

It is a titanium market.

The more worries placed in front of us, the faster it rises. And this is happening in the face of falling earnings. This can only end in tears. The only question is how many pennies we can pick up in front of the steam roller before we get run over.

Here’s another sobering prediction. Goldman Sachs’ David Kotick expects that a Democratic win in this year’s election will cause S&P earnings to drop from $169 in 2019 to $163 in 2021, the result of rising corporate tax rates.

Take the earnings multiple down from the present 20 to 15 times earnings where it was three years ago, and the stock index can plummet by 25%.

These are numbers to take seriously, especially given that the president is behind the front runners by 14 points in the national polls.

It all underlines the rising risk that the election poses to the market. Everyone I know to a man is pulling money out of the market, and inquiries about long volatility strategies (VIX) are rising daily.

The general agreement is that in 2020, we are going to have to work a lot harder for a lot less money. There isn’t going to be a repeat of the 28% gain we saw in 2019.

If there is, you want to sell all your stocks and your home, change your name, and move to Brazil, where there is no extradition treaty, because the following crash will be so enormous that no one will be spared.

The end of January 2018 comes to mind, which, after a meteoric move, markets plunged 17%.

Cash is a position, it is an opinion, has option value, and it is probably the best one of all to have right now. You can’t take advantage of any 17% dives if you go into them fully invested. I believe that once the New Year equity allocation is done, we could have a problem.

Risk exploded with the US assassination of an Iran general, with the country vowing revenge. Airline stocks globally went into free fall, and oil prices soared. Wildly overbought markets got their comeuppance, with the Mad Hedge Market Timing Index at an all-time high of 97. Wait three days for markets to price this in. I told you 2020 would be harder!

Gold approached a seven-year high on Iran attack, as over-leveraged traders scrambled for cover. So far, gold and oil are the trades of the decade, which is only seven days old. Keep buying (GLD) on dips, oil (USO) not so much. $1,927 an ounce, here we come!

Tesla deliveries hit new high in Q4, to a record 112,000. There was clearly a stampede before the $3,250 per vehicle clean air subsidy expired at yearend. Musk also cut prices 16% to $43,000 for the Shanghai-made Model 3, creating another stampede there. Keep buying (TSLA) on dips.

The Tesla market cap just peaked at $86 Billion, with the stock at an incredible $490 a share, making it the most valuable American car company in history. What is 25% of the global car market worth in a decade? Apparently quite a lot.

Netflix won big in the Golden Globes, capturing 17 nominations, with Amazon Prime close on their tail. It’s all about content streaming now. If they can only figure out how to take on Disney Plus and Apple Plus. Avoid (NFLX), buy (DIS) and (AMZN).

The S&P Case Shiller National Home Price Index rose 2.2% in October. Phoenix (5.8%), Tampa (4.9%), and Charlotte, NC (4.8%) showed biggest gains. Only San Francisco was down, the victim of lost SALT deductions. Housing still has another decade to run. Buy (LEN) on dips.

Boeing backs simulator training as a path back to flightworthiness for the 737 MAX. As a former flight instructor myself, this is what I have been advocating all along. Whenever things start to improve for Boeing, another crash happens as did with an antiquated 737 in Tehran last week, accidentally shot down by their own people. Keep buying dips in (BA).

The ADP Report showed a red-hot December, with 202,000 private sector job gains. If so, interest rate rises may come sooner than you think.

I never thought I’d say this, but the Mad Hedge Trade Alert Service has made no money so far this year. Of course, the year is only seven trading days old.

Buying the Mad Hedge Market Timing Index at 90 and selling it at 97 is not my kind of market. Nor should it be yours. The money being made now is very high-risk.

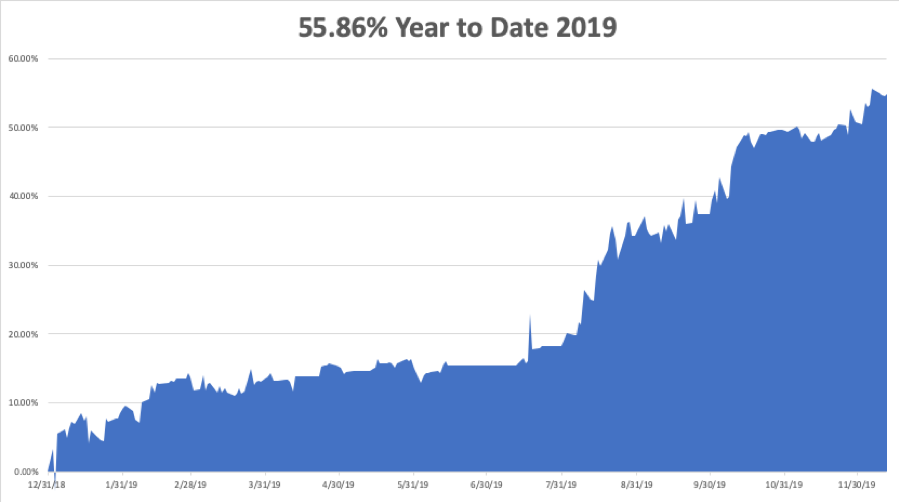

Better to sit on your laurels of a 55.86% profit last year and wait for a better entry point.

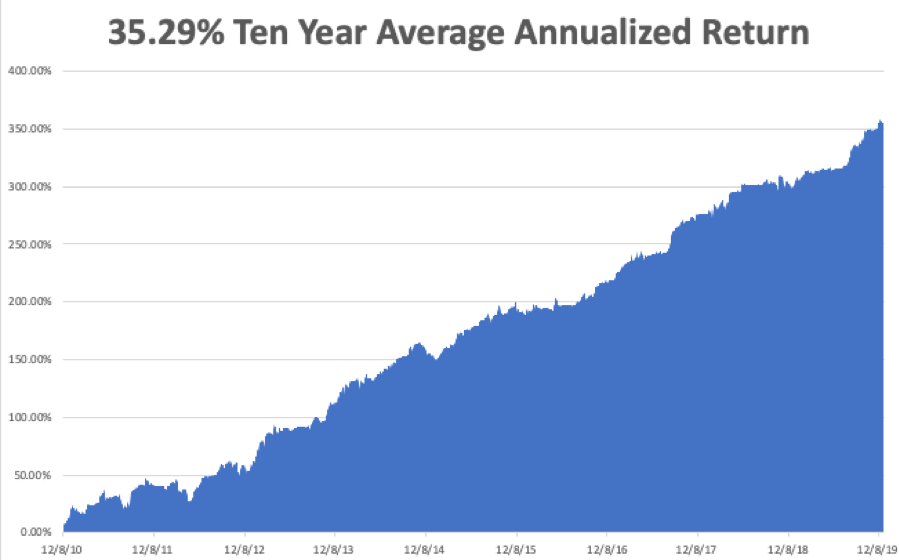

My Global Trading Dispatch performance held steady at +356.91% for the past ten years, an all-time high. My 2019 year-to-date came in at a final +55.86%. We closed out December with a market beating +4.97% profit. My ten-year average annualized profit ground back up to +35.28%.

The coming week will be a noneventful one on the data front, with only housing data gaining our attention..

On Monday, January 13 at 9:00 AM, Consumer Inflation Expectations for December are out.

On Tuesday, January 14 at 7:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, January 15, at 6:15 AM, New York State Manufacturing is announced.

On Thursday, January 16 at 8:30 AM, Weekly Jobless Claims come out. December Retail Sales are published at 9:30.

On Friday, January 17 at 9:30 AM, December Housing Starts s are printed. At 10:30 Industrial Production is released.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I will be leading an Orienteering class in San Francisco this weekend, teaching 20 Boy Scouts how to use a compass and navigate over a ten-mile course. Hey, how bad can it be? I found California! Spoiler alert: after a ten-mile hike, we end up at the Ghirardelli Square Chocolate factory at Fisherman’s Wharf.

When I applied for the position, I listed as qualifications 50 years as an FAA commercial pilot and navigator, and a stint as a Marine Corps combat pilot.

They accepted me on the spot.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader