The Market Outlook for the Week Ahead, or The World of Twos

We now live in a world of twos. Economic growth is at 2%. Unemployment rate is at 2%. Inflation is at 2%.

And we may soon be facing the cruelest two on all. The stock market may only gain 2% this year, next year, and the year after that. For that’s what a world of twos creates: a stock market that goes virtually nowhere.

This is why I have lately been advising my concierge clients to start checking out one-year CD rates at their local bank, which are now paying 3%-4%. In a world where the stock market offers 2% of upside versus 20% of the downside, you buy CDs all day long.

Certainly, my Mad Hedge Market Timing Index leads one to such a sobering conclusion, which now reads at a very high 70. Another way of describing this highly successful algorithmically driven indicator is that there are new longs now that have only a 30% chance of making money, while 70% of short positions should end up in the green.

That’s not enough for me to go either way. Above 80 or below 20 are the sweet spots for me. And topping processes can run as long as three months. We are only two months into the current one (there’s that damn number two again!).

Let me elaborate. On the one hand, I am loathed to buy a market that has just risen 22% in four months and has a multiple at a three year 18 high in the face of falling earnings during a global synchronized slowdown with a Volatility Index t $12. That’s why equity mutual fund redemptions are proceeding at record highs this year.

On the other hand, I’m not in a rush to sell short a market that has had all four 2019 interest rate hikes canceled and has seen $2.5 trillion in new liquidity pumped into the economy.

As a result, the rate of new Trade Alerts will slow down from Q1’s torrid pace. There’s just nothing to do. And yes, I can already hear the complaints coming. Of course, you expect Trade Alerts if you just paid $3,000 for a service that then tells you to do nothing.

But telling you to do nothing is far more valuable than telling you to do something that is wrong. There is no law that says you have to trade every day of the year. After all, you’re trying to pay for your own yacht, not your broker’s.

There are other services out there that DO give you Trade Alert a day and are even cheaper than mine. But they lose money hand over fist and don’t publish their results as I do. Caveat Emptor. You pay peanuts, you get monkeys.

There is one Goldilocks scenario that’s not impossible to unfold this year. Massive Chinese economic stimulus is working, which is why stocks in the Middle Kingdom have outperformed those in the US by 2:1. That strength spills over to Europe, which then ratchets up US multinational earnings and a sharp rebound in US stocks.

That’s why big tech has been leading the market all year, and why we have been running leveraged longs in that sector. It could happen, but I’m remaining cautious anyway. Being up 14% in three months MAKES me cautious, and I know that stock-only buyers made a lot more.

Earnings are coming in better than expected for Q1. It is looking like companies excessively cut forecasts during the dark days of December. But is it already in the price? Cut risk.

Bright US retail sales give the market a boost, up 1.6% in March, the most in 18 months. A rare positive data point on an otherwise dull economy.

Global PMIs are still weak, with dismal reports from Asia and Europe. The US is still the bright shining light on the hill. Bad news for US exporters through.

Home mortgage demand is soaring. It looks like an ultra-low 4.03% 30-year fixed rate mortgage is going to rescue the residential real estate market from the jaws of defeat this spring.

Broker earnings in free fall, as collapsing trading volumes take a bite. It seems investor faith in this rally is almost nil. Risk is high. Take profits you lucky bastard.

Oil hit a new 2019 high. OPEC discipline also hits a record. Gas at the pump will top $4.00 just as the summer driving hits and it's already there in high-taxed California. Maybe it’s time for a “staycation” this year? Take that long cross-country trip during the next global recession.

Apple (AAPL) and QUALCOMM ended their epic legal battle, over smartphone chip patent dispute. It finally became a high distraction of (AAPL). Buy (QCOM) on the dip.

The Mad Hedge Fund Trader treaded water this year, up 13.92% year to date, as we took profits on the last of our technology long positions.

We took profits on a six-month peak of 13 positions across the Global Trading Dispatch and the Mad Hedge Technology Letter services and will wait for markets to tell us what to do next.

April is so far down -1.50. My 2019 year to date return retreated to +13.92%, paring my trailing one-year down to +21.62%.

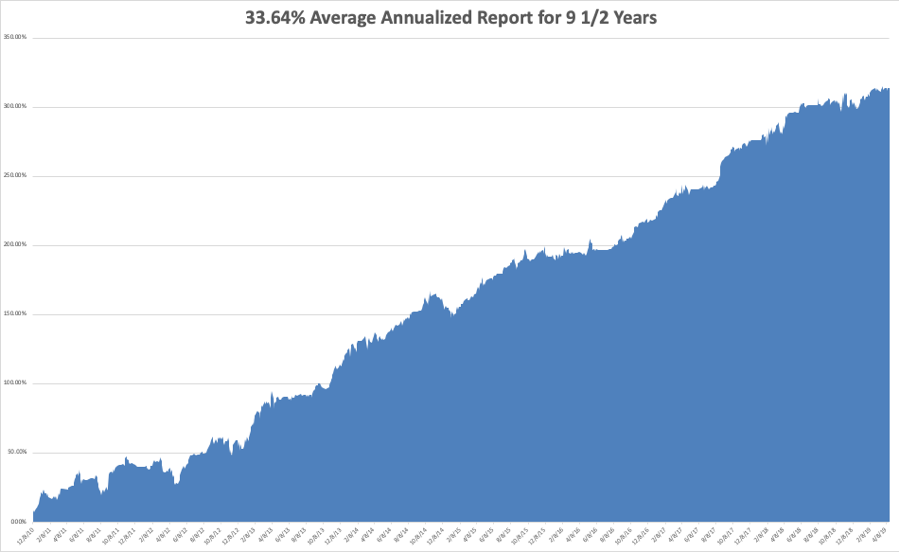

My nine and a half year return backed off to +314.06%. The average annualized return appreciated to +33.64%. I am now 100% in cash on both services.

The coming week will be the biggest for the entire Q1 earnings cycle.

On Monday, April 22 at 10:00 AM, we get March Existing Home Sales.

Kimberly Clark and Whirlpool report.

On Tuesday, April 23, 10:00 AM EST, we learn March New Home Sales.

Coca Cola (K) and Verizon (VZ) report.

On Wednesday, April 24, it’s a big day for earnings with Facebook (FB), Microsoft (MSFT), Boeing (BA), and Tesla (TSLA) reporting.

On Thursday, April 25 at 8:30 the Weekly Jobless Claims are produced. We also obtain March Durable Goods. Amazon (AMZN) and Intel (INTC) report.

On Friday, April 26 at 8:30 AM, we get the number we have been waiting for all month, the first Read on Q1 GDP. How mad will it be? Chevron (CVX) and Exxon (XOM) report.

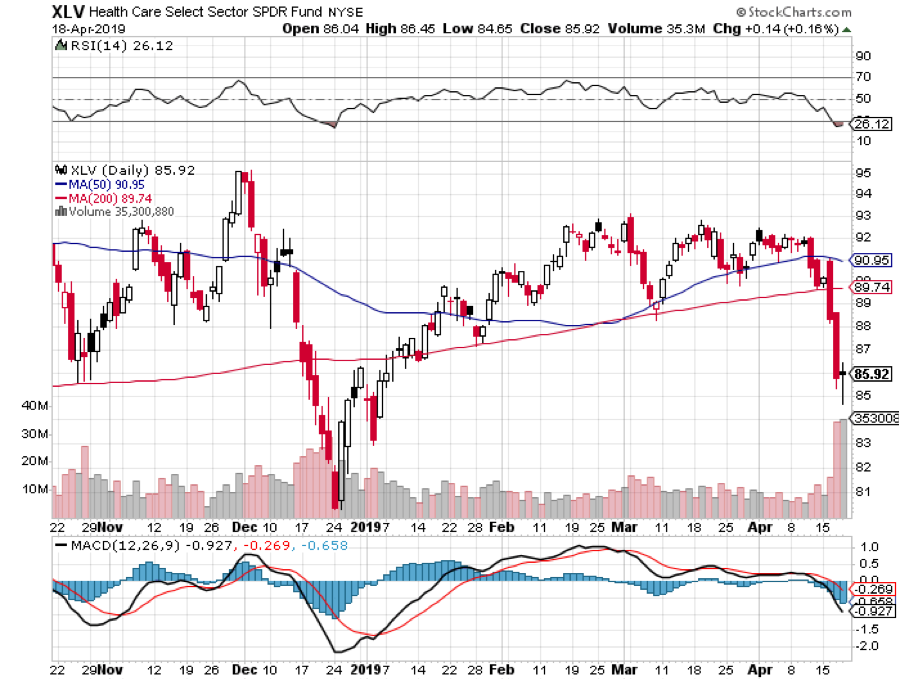

As for me, I’m back out of my deathbed, finally catching up with a backlog of admin and on the lookout for new Trade Alerts. Health Care (XLV) is starting to look interesting, now that it has been slaughtered by the coming election promises of Medicare for all.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader