The New AI Play That You Might Want To Know About

This new artificial intelligence stock could be a keep.

As an insider, let me fill you in on the details.

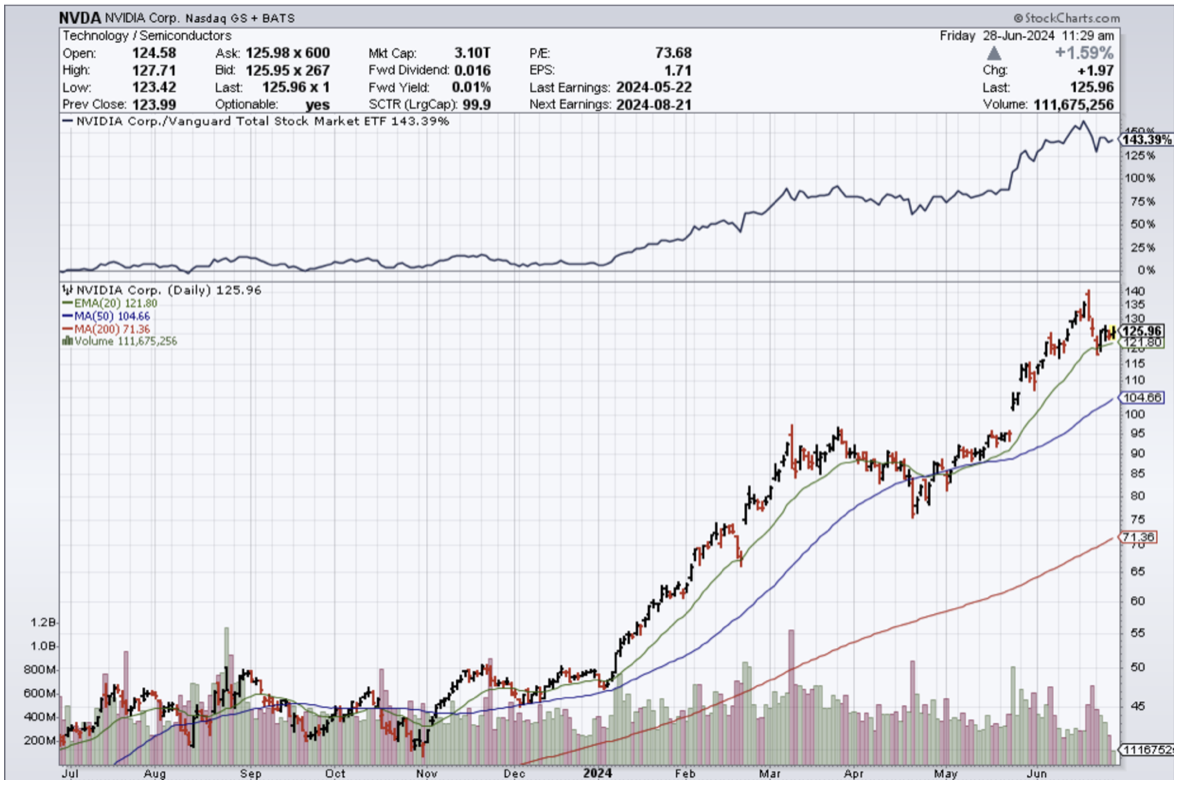

Readers need to look at a company that is literally collaborating with Nvidia to position themselves closest to Nvidia’s business model.

Aligning themselves with the hottest stock in the best sub-sector in the industry that grows the fastest isn’t a bad idea.

That’s why readers should take a peek at Vertiv (VRT) shares which has gone absolutely ballistic over the past year.

VRT is a provider of coolant distribution infrastructure for data centers.

IT cooling challenges continue escalating as new server-accelerated compute technologies, machine learning, artificial intelligence, and high-performance computing drive higher heat densities in the data center environment. Liquid cooling is rapidly emerging as the technology for efficiently handling power-dense hot spots.

These massive data centers require significantly more electricity to operate.

That offers upside to industrials, utilities, and commodities, according to the firm.

GPUs need 2-2.5x more power than CPUs, and expected power usage for US data centers under construction is equivalent to more than 50% of the power currently used by US data centers.

Here is how Vertiv aids the technological revolution:

High-Density Power and Cooling Solutions: The ever-growing processing power of AI requires robust power and cooling infrastructure.

Vertiv's data center solutions are designed to handle the intense heat generated by AI workloads, ensuring optimal performance and preventing overheating.

Technical Partnerships: Vertiv actively collaborates with leading AI chipmakers like Nvidia. These partnerships ensure their solutions are specifically tailored to meet the unique power and cooling demands of cutting-edge AI hardware.

End-to-End Expertise: Vertiv doesn't just provide individual components. They offer comprehensive solutions that manage power delivery and heat rejection from the power grid all the way to the individual chip. This holistic approach streamlines AI infrastructure deployment and optimizes performance.

Their scalable solutions can adapt to the ever-increasing power and cooling needs of AI applications.

Organic orders increased by 60% compared to the same period last year and net sales reached $6.82 billion.

Operating profit for the quarter was $203 million, while adjusted operating profit stood at $249 million, reflecting a significant year-over-year growth of 42%.

The company also began returning cash to shareholders, repurchasing approximately 9.1 million shares at an average price of $66 per share.

Its strong performance is due to robust demand, particularly in AI-driven deployments and liquid cooling technologies, positioning VRT for continued growth and operational improvement in the evolving digital infrastructure landscape.

The necessity of power usage also makes these GPUs considerably hotter, putting pressure on firms such as VRT to improve cooling systems in data centers.

VRT shares have essentially gone up in a straight line in the past 1.5 years from $12 per share to $86.

That type of return has been entirely justified.

Moving forward, I believe the stock will behave in a similar fashion as the demand for its products grows strongly.

Under no scenario do I find a way that its cooling technology will go by the wayside.

In fact, they could have such a great product that it might fuel speculation of getting acquired which would fuel an even higher share price.

I am bullish VRT.