The New Hot A.I. Stock

Super Micro Computers (SMCI) could be a legitimate dark horse in this race to AI supremacy.

They are the meat of the whole operation.

This is an upstart company from California who really knows their stuff about computer infrastructure.

Although they are no Nvidia, they do pack a punch and its share price has exploded higher as the company has been buoyed by both excellent quarterly results and an even better forecast for the full year.

Institutional interest is also gaining steam as the stock continues to be bid up to higher highs.

It’s proving itself, along with Nvidia, to be one of the cleanest stock plays on the AI theme.

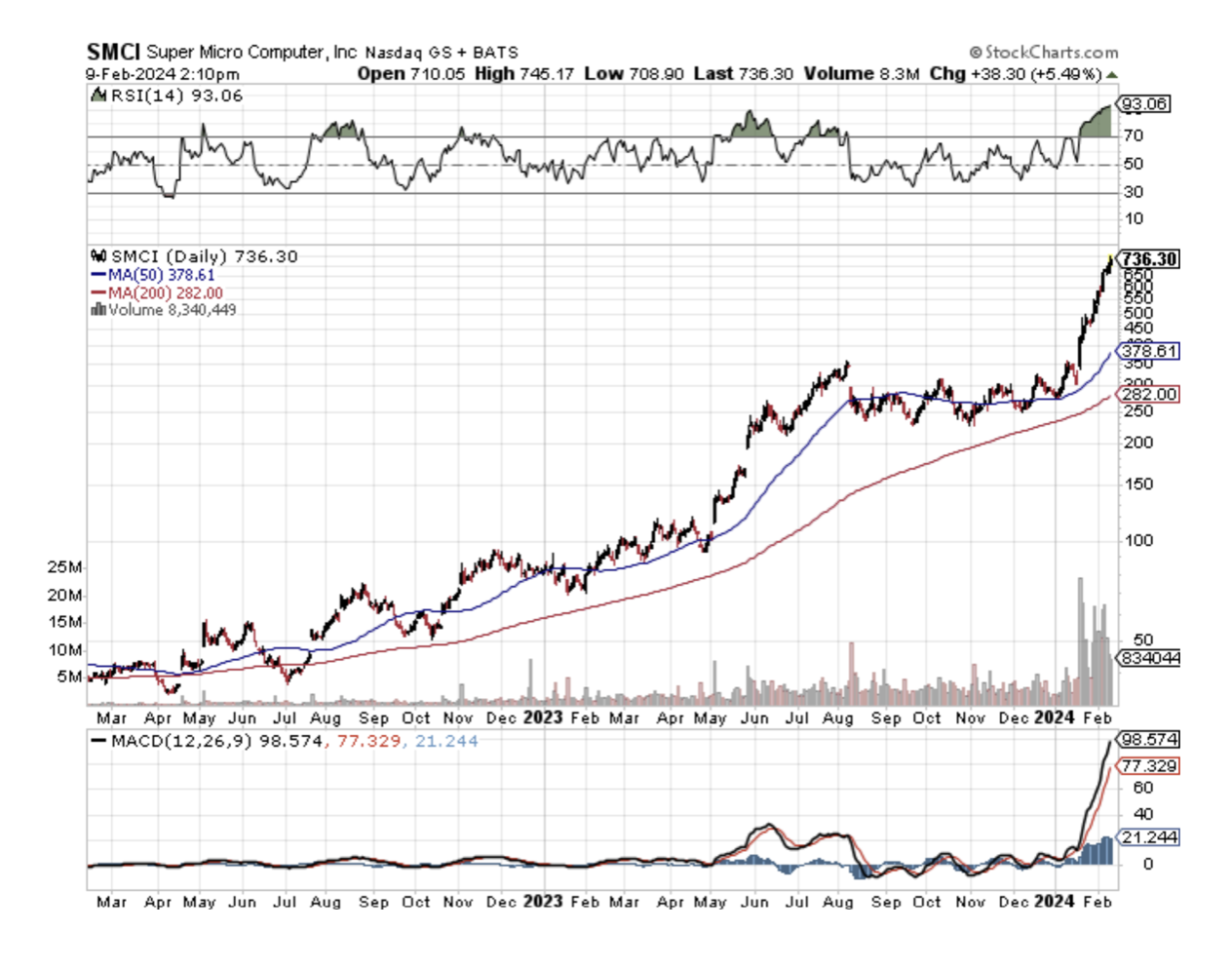

Shares of SMCI were languishing lower than $20 per share in 2019.

Fast forward to today and underlying shares are sitting pretty at $750 per share.

Nvidia and Supermicro are somewhat correlated.

Nvidia’s high-performance chips are essential for the AI revolution, they need cutting-edge data infrastructure and that’s how Supermicro’s slots in nicely.

SMCI takes an innovative, customized, and flexible approach to meet customers’ computing needs – which has made it the choice of heavyweight clients like Meta and Amazon. SMCI supplies in rapid time, and the uber-complicated tech behind these centers, which needs servers, networks, and cloud storage solutions to function.

The company also uses a liquid cooling technique to manage the temperature of its multi-rack servers in a more energy-efficient way.

By the end of September, research firm IDC estimated that Supermicro had become the fourth-biggest server provider in the world, ahead of Lenovo.

And, sure, Dell and Hewlett Packard Enterprise are the leaders, but their revenue growth has been falling while Supermicro’s is muscling up at a double-digit pace, making it a leader in the higher-priced and higher-margin AI server market.

In its latest earnings report, SMCI announced revenues of $3.66 billion, a 133% increase from the year-earlier period, and predicted sales of at least $14.3 billion in 2024.

Supermicro’s leadership will not stay inert.

They are partnering with Nvidia, AMD, and Intel – the three biggest AI chip suppliers – on next-generation AI designs. So its customers will likely include all the big AI spenders like Meta, Amazon, Apple, and Tesla.

SMCI is forecasted to bust out an EPS growth rate of 31% moving forward.

The key risk ahead is that Dell and maybe even Hewlett Packard Enterprise might compete again with Supermicro’s capability in data centers and put its operating margins under pressure.

That could undermine the company’s profit outlook, especially if overall demand growth for data centers wavers.

The stock is expensive even to the point where short-term technical indicators have shown the stock to be overbought for the past 3 weeks.

In fact, the stock was sitting at $300 per share on January 18th and the parabolic trajectory has meant that the stock has more than doubled in the past few weeks.

Readers need to let this stock drop and any medium-sized pullback just be bought with two hands.

These types of premium AI stocks are hard to find optimal entry points which could mean a long wait time.