The Outage Bites

Microsoft (MSFT) dishing out blame to Delta Airlines (DAL) is yet another sign that we need a pullback in tech shares or at least some flat lining.

Arrogance comes in many forms, but evading accountability is definitely one of them.

It almost appears in the past few quarters that tech companies feel they can get away with almost anything, because they think they are the greatest thing since slice bread.

Throw in the generative A.I. narrative that has juiced up tech stocks even more and one can imagine that these companies must own a pretty high opinion about themselves and the work that they do.

But once sushi hits the fan then suddenly it is everyone else’s fault and they wash their hands of all their sins.

I am surprised that MSFT did not take a more humble stance from the global cyber outage and instead came out swinging hoping to defend their reputation as one of the leading tech companies.

Personally, I do believe that protecting ones reputation at all costs isn’t free especially when partial blame should be incurred.

Microsoft directly blamed Delta Air Lines for its multi-day struggle to recover from a global cyber outage that led it to cancel more than 6,000 flights.

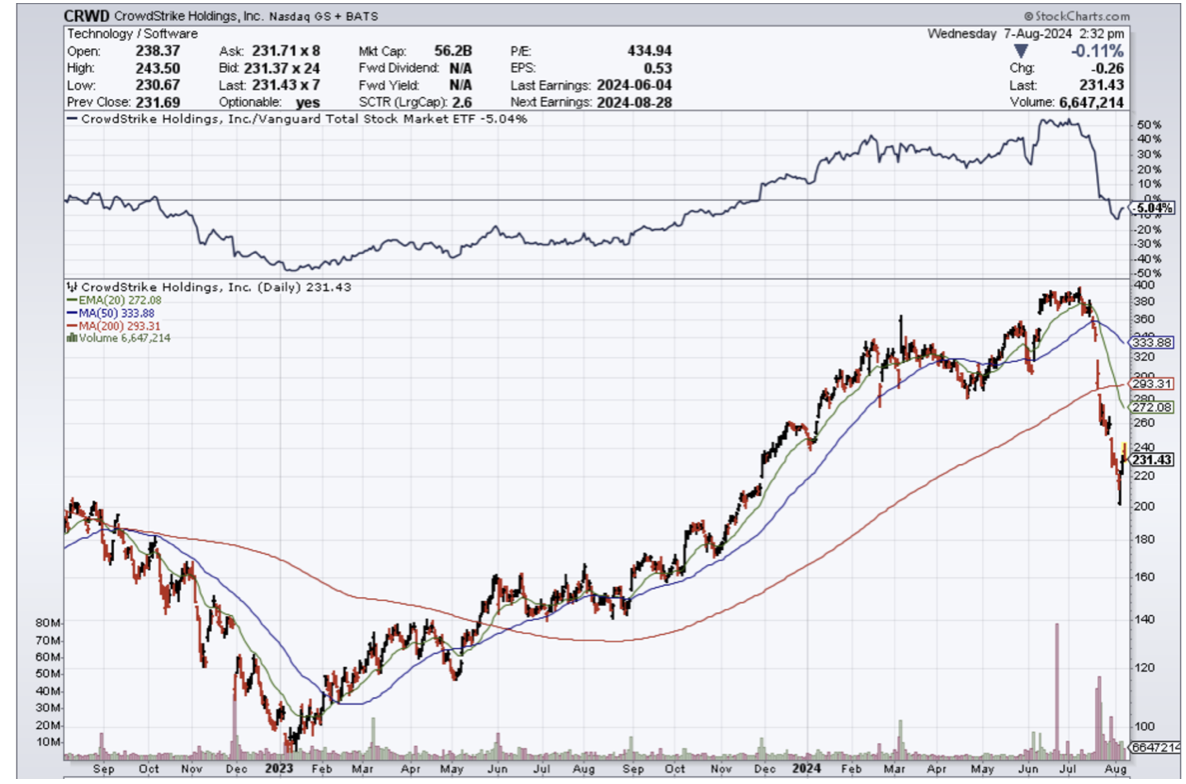

A software update last month by global cybersecurity firm CrowdStrike triggered system blackouts for Microsoft customers, including many airlines. But disruptions subsided the next day at other major U.S. carriers while persisting at Delta.

Microsoft said its preliminary review suggested that Delta, unlike its competitors, apparently had not modernized its IT infrastructure.

Delta, however, said it has invested billions of dollars in IT capital expenditures since 2016, in addition to the billions it spends every year in IT operating costs.

The flight disruptions stranded hundreds of thousands of travelers and are estimated to cost the Atlanta-based airline $500 million. Delta is also facing an investigation from the U.S. Transportation Department for the disruptions.

It has hired prominent litigator David Boies of Boies Schiller Flexner, known for high-stakes business cases, to seek damages from both CrowdStrike (CRWD) and Microsoft.

Cheffo said Microsoft's software had not caused the CrowdStrike incident, but the tech giant immediately offered to assist Delta at no charge. Its CEO Satya Nadella emailed Bastian, but never got a reply, he added.

The Nasdaq index hanging around at all-time highs is definitely part of it, but it is hard to believe in a global cyber outage that covered large swaths of the western globe that CrowdStrike and Microsoft weren’t part of the problem.

I get it – stakes are high these days.

Tech shares are even higher and a few percentage point slide could shave half a billion or more from the valuation.

At a time when every tech company is bringing out all tricks of the trade to squeeze share prices higher, owning up to at least partial blame will go a long way to maintaining healthy long term relationships with above average customers.

As it stands, we are still in full-on buy the dip mode in tech as high volatility subsides.