The Road Out of Silicon Valley

In a study last year, 44% of Millennials planned to move out of the Bay Area in the “next few years.”

In the same study, 8% of Millennials indicated that they would move out of the Bay Area within the next 365 days.

Then Covid-19 hit.

The pandemic has accelerated this trend of Millennials ditching big-ticket cities and rental prices in San Francisco have experienced 30% drops with many owners offering free two months upon move in to salvage a souring situation.

The U.S. has also moved to ban foreign HB-1 visas citing the 40 million unemployed American citizens that are now looking for a job.

The knock-on effect is a wave of Indian and Chinese tech workers, who are usually the recipients of the HB-1 visas, that won’t be renting Silicon Valley apartments at inflated market prices.

The migratory trends sum it all up and the Bay Area has finally hit that inflection point where it is no longer the most desirable place to live anymore.

On a social level, the area has also become squalid like some third world countries due to a ravaging homeless problem that is growing faster than any software company.

The pandemic forced the local city government to create a tent encampment in front of San Francisco city hall.

The ones that weren’t gifted a spot in front of city hall were temporarily put up in five-star hotels in Russian Hill and paid by for the city because of the absence of any travelers.

Salesforce Founder and CEO Marc Benioff has lamented that San Francisco, where ironically he is from, is a diabolical “train wreck” and urged fellow tech CEOs to “walk down the street” and see it with their own eyes to observe the corrosion of society.

The leader of Salesforce doesn’t mince his words when he talks and beelines to the heart of the issues.

Sadly, the pandemic will put more pressure on the lower end of society and force more Americans into homelessness adding to the surge.

How many homeless can San Francisco absorb?

It’s scary to think about what will happen when the eviction moratorium ends and extended unemployment benefits stop.

It’s just another factor in a long list of why San Francisco is losing talent.

The environment has really turned from day to night in Silicon Valley where just a half a year ago, Silicon Valley was overflowing with tech jobs and now start-ups are shedding jobs faster than ever.

Uber, Lyft, and Google are just some that have rescinded job offers to new graduates, frozen salaries, slashed annual bonuses, and straight-up laid-off employees.

The trend of outsourcing tech jobs from California was already well underway before the pandemic.

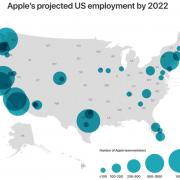

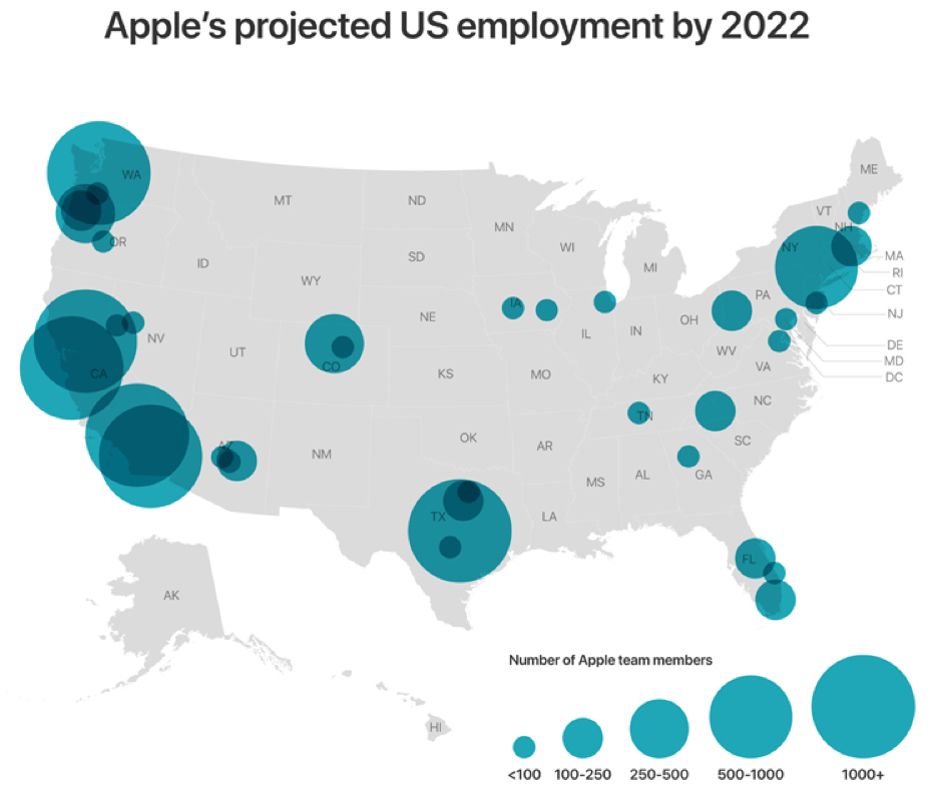

That was exactly what Apple’s $1 billion investment into a new tech campus in Austin, Texas and Amazon adding 500 employees in Nashville, Tennessee is all about.

Apple also added numbers in San Diego, Atlanta, Culver City, and Boulder just to name a few.

Apple currently employs 90,000 people in 50 states and is in the works to create 20,000 more jobs in the US by 2023.

Most of these new jobs won’t be in Silicon Valley but is it possible that the pace of new hires will get bogged down because of the health crisis.

Millennials are reaching that age of family formation and they are fleeing to places that are affordable and possible to take the first step onto the property ladder.

The health crisis has crushed many of their dreams to become a first-time homebuyer, meaning they could become lifelong renters.

Millennials came of age during 9-11, graduated into the Great Recession of 2008, and have now been dealt a cruel and devastating blow of navigating through Covid-19 during many of their best years of income earning.

No wonder why Silicon real estate has dropped, people and their paychecks are on the way out.

In a perfect storm of a health crisis, economic crisis, and the desire to live in more physical space as most jobs become remote, San Francisco has never been less attractive at any point in time.

It will no longer be the economic juggernaut that was so vital to tech companies.

Silicon Valley simply doesn’t share the wealth with all of its participants and the place is now feeling the side effects.

The last time San Francisco was this unattractive, you would have to go back to before the California Gold Rush of 1848 when San Francisco was just a backwater village of 10,000 people.

When hiring comes back, look for many of the second-tier cities like Nashville to recover fast taking off from what Silicon Valley built.

Just as harrowing as the health crisis, the start of wildfire season has just commenced in the state of California.

It used to be such a great place to live.