The Strength of AMD

Advanced Micro Devices Inc. (AMD) is a chip stock that needs some serious attention, even more so because of their new share repurchase program that has no end date.

They are led by one of the best tech CEOs in Silicon Valley Lisa Su, who has been in charge since 2014.

She transformed the company into a profitable one, secured incremental market share from Intel Corp. (INTC) and diminished concerns that AMD has a weak balance sheet.

Strength begets strength as AMD introduced a $4 billion stock buyback plan, its first repurchase authorization since 2001, signaling the chipmaker’s robust momentum in their own business.

The buyback will be distributed through cash from operations and will total about 4% of AMD’s market value.

AMD's stock in the high $70s right here looks like a screaming buy.

Share buyback is not only something Apple and Microsoft do, but other smaller players are getting in on the action displaying the great breadth and depth of the tech market.

We don’t see this anywhere else in any other industry because profitable companies simply return money back to shareholders and tech has the luxury of accelerated future earnings and revenue growth to buttress this.

Cut it up however you want, the tech sector is responsible for the bulk of earnings as it relates to the total market and that won’t change.

AMD delivered $832 million in free cash flow in Q1 2021.

The company has now pivoted from a net debt position to a balance sheet that will harness over $3 billion in net cash by the end of the current quarter.

This strength of the balance sheets is even pertinent if you strip out the Xilinx deal which will bring in their own array of financial pluses to add on to the might of AMD's current cash flow situation.

An accumulating share count is something to be wary of in any stock and given that AMD had the opportunity to reduce share count, it was a no-brainer.

Years ago, AMD had 766 million shares outstanding, and it would have climbed to over 1.6 billion considering the Xilinix shares by the end of this year.

This obviously makes EPS metrics appear rosier in future earnings reports and inching them up is a nod to AMD CFO Devinder Kumar who usually has a big say in these decisions.

Under Su’s helmsmanship, the company’s market value has toppled the $90 billion mark from only $2 billion just seven years ago.

That was the year she was named CEO and she hasn’t looked back.

Su’s key to returning AMD to profitability was to rely on the quality of product delivered — these new products snatched market share from Intel.

As what a savvy CEO usually does, she has played down success in order to tamper down high expectations in the stock price and business by saying, “without a doubt it does not get easier.”

I don’t think it was ever easy to begin with but that’s beside the point.

Su’s AMD has gone from an inferior chipmaker building cheaper knockoffs to Intel products to a premium provider of computer processors that win orders solely based on superior performance.

AMD has already repurchased $77 million of stock in its prior buyback plan two decades ago.

Su has rejuvenated AMD’s reputation and performance at a critical juncture and as chip shortages become the norm in this boom-and-bust industry.

The public health problem triggered a crazy demand for remote work and the devices that facilitate a work from home economy.

During this sensitive period, the world’s largest chipmaker, Intel, had struggled to develop its manufacturing technology, one of the foundations of its decades-long dominance of the computer industry.

The chip shortage is an example of the periodic mismatch between supply and demand in the semiconductor market whose companies avoid dipping into capital expenditure until capacity is stretched to the extreme limit.

This is an expensive business to get into, constructing high-performance chips is time-consuming and an engineering headache, thus barriers of entry are incredibly insurmountable.

Most new chip foundries and designers don’t happen unless sovereign nations make it a national security issue which is the case lately.

Ancillary industries started to hoard chips 6-8 months ago and I believe that these pressures will begin to subside soon as supply chains start to normalize.

These longer-term contracts to secure inputs we are seeing now will eventually be reduced easing the supply crunch as demand begins to slow and capacity begins to rise.

Even Su predicts supply of AMD chips, which are built by Taiwan Semiconductor Manufacturing (TSM), will catch up throughout 2021.

As the tech consolidation rips through chip stocks, I see this as an unequivocal buying opportunity for the strongest of names.

If AMD continues to build on their strong financial position — continue to offer more share repurchases and even a sweet dividend — it clearly means they are building premium products buyers want and that satisfaction not only filters down to the end-user of their chips but the owners of the stock.

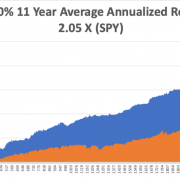

I first recommended this stock at $18 at the advent of the Mad Hedge tech letter in 2018, and I am still bullish AMD long term period.

It was a great company in 2018 — it’s gotten even better in 2021 — don’t miss out.