This Tech Stock Has More Room To Run

There is more room for stocks to extend themselves to the upside, which is great news for many who think we might be reaching the last gasp up in tech.

We aren’t there yet and the longest late-cycle bull market continues.

It certainly isn’t over - we received some timely commentary from one of the most prominent venture capital firms in technology, Andreessen Horowitz.

The company isn’t afraid to tell the truth.

Sometimes that means sticking in where it really hurts like a jab to the gut in an industry where most people get their feelings hurt quite easily.

I understand the bravado partly results from the mountains of success that have preceded them, but nonetheless, it is refreshing to hear from successful people who have their pulse on the tech sector.

Google might be among corporate America's favorite success stories, but some people aren't convinced Big Tech is operating as efficiently as it could be.

There is still a lot of frittering away in Mountain View, California or that is what Andreessen Horowitz has to say.

The venture capitalist firm said that most Google workers don’t really do anything.

What do I mean by that?

To do nothing “except complete a 10-minute task every now and again” is what they said.

Some workers used their weekdays to learn how to scuba dive or go for a Thai massage because there wasn’t much for them to do in the office.

Companies retaining a bloated headcount with people who don't actually help drive the company forward shows how profitable these companies are.

When push comes to shove and a recession slams us blindly, Google will know what to do with these workers.

The company later said a “bunch of people” in large corporations are working “BS jobs.”

“Anyone who works in a 10,000+ person or larger white-collar job company knows that a bunch of the people can probably be let go tomorrow and the company wouldn’t really feel the difference, maybe it’d even improve with fewer people inserting themselves into things.”

Much of the vendetta against tech workers isn’t all justified, but I do believe it is more about the top 10% carrying the load for the other 90%.

The top end of the talent pool is so brilliant, they are leading $2 trillion companies and that doesn’t happen with a bunch of morons, does it?

However, another trend I have noticed is that America could be running out of talent after exhausting India and China while work visas have never been harder to procure.

After getting rid of the bad workers, will there be those superstars that move the window and that is a big doubt moving forward.

Talking with people in the know, there is great uncertainty with the direction of big tech as nobody understands what will really succeed the smartphone.

The smartphone was that one vehicle of profit that all companies knew they had to make money from and now what is next?

Is it a virtual reality with all those goofy headsets giving people headaches?

Companies are pouring billions into figuring out what the next iPhone is and it’s more like throwing paint on the wall and seeing what sticks.

Luckily, the tech bull market should continue but many companies are facing existential threats due to lack of innovation and lack of top-end employee talent.

If innovation somehow takes a wild turn away from the AI path, many companies could blow up.

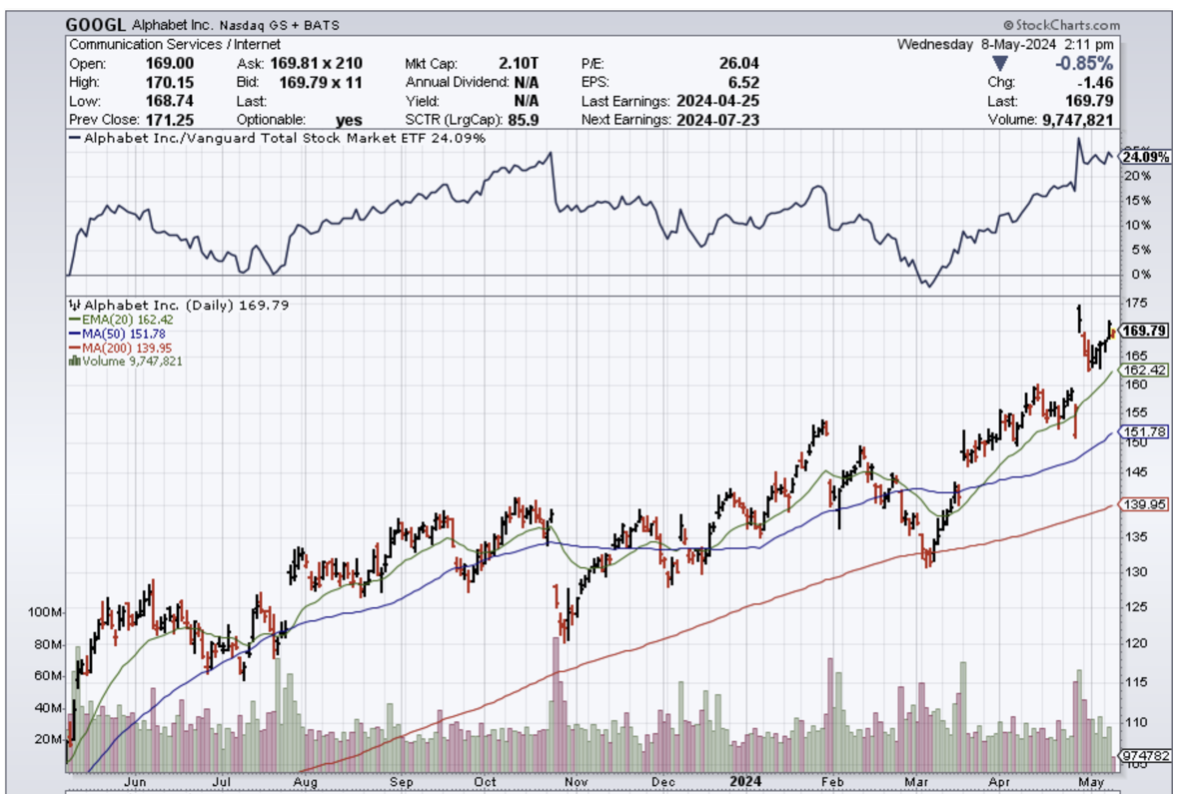

Until then, buy the dip in GOOGL until a black swan hits the industry or sub-sector. They have many ways to keep the stock from going down like their newly minted dividend which is a first in the company.