The Top Is Not In For Tech Stocks

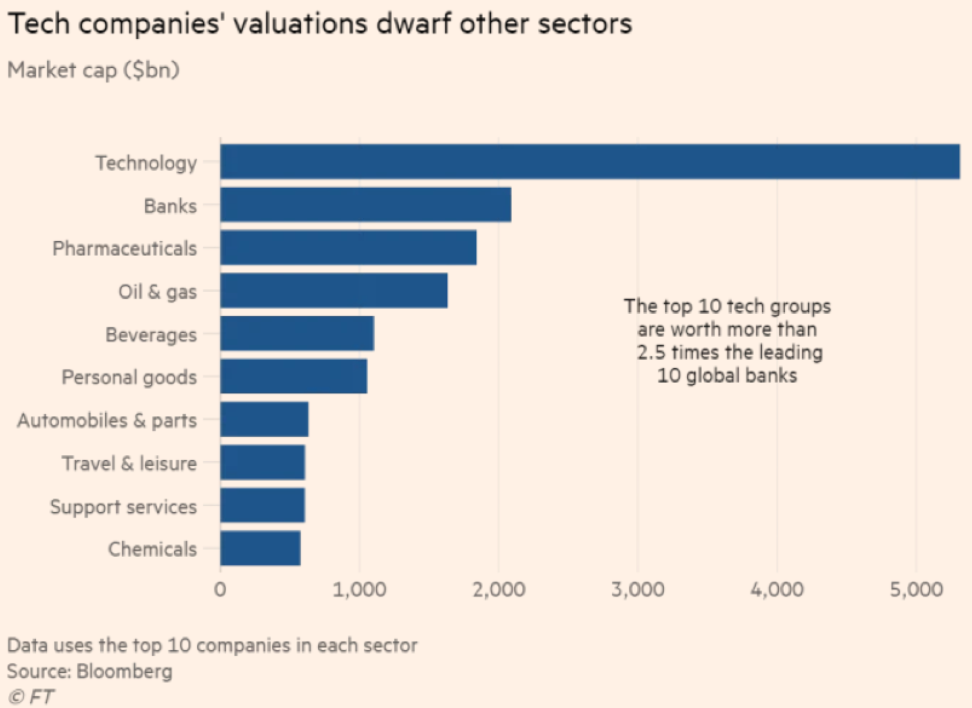

Tech shares are pricey, but that doesn’t mean they can’t get more expensive.

Strength often begets strength.

Let’s take for instance Apple (AAPL) – it delivered investors 86% in 2019 and that was their best performance in the past 10 years.

This was on the heels of a tumultuous 2018 where Apple sank 6%.

Many of the best of brightest of the tech industry beat the S&P last year, which itself gained 29%.

And as Apple leapfrogged into the software as a service business, they find themselves shunning China hardware revenue that got themselves into the 2018 mess.

Apple is betting that the confines of stateside consumer culture will offer greener pastures.

Overall, the market is pricing in a lukewarm 2020 for tech earnings boding well for the elite tech stocks that celebrated touchdown after touchdown in 2019.

Surpassing low expectations could be another rewind back to Q4 2019 which was a time that offered tech shares a platform to surge to all-time highs.

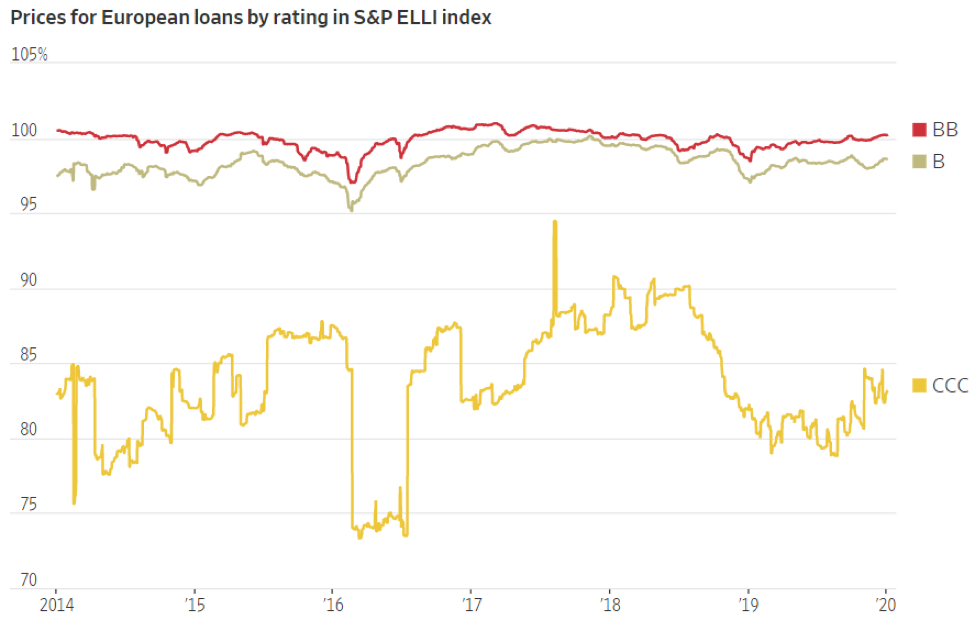

The worrying development for 2020 is that poorer-rated tech corporations won’t have the same access to cheap debt as they did in 2018 or even 2019.

The chapter of loose credit is about to close stymying loss-making tech companies who thought they could use subsidies to achieve success.

The prices of CCC-rated European bonds have declined immensely in the past year showing investors' lack of appetite for the riskier part of the corporate debt market.

Venture capitalists aren’t going to foot the bill for the next big thing in Silicon Valley at this point in the economic cycle unless the unit economics are too good to be true.

The story of 2020 will be the intensification between the haves and have nots in tech.

This is the case of the market putting a premium on time-honored tech brands and bulletproof balance sheets that they have cultivated.

On a broader level, the Fed who has presided over a $600 billion expansion in their balance sheet in the last four months offers yet another tailwind to tech shares in the short-term.

The Fed’s decision in the last few months to re-start large-scale asset purchases will help keep a foot under tech shares in early 2020 and responds like a de facto QE.

If you thought 2019 was a bad year for Uber and Lyft, then wait until this year plays itself out.

The gig economy stocks are in the direct firing line with nowhere to run and other non-sensical profit models will find it costly to search for debt alternatives in which to service their visions.

If the tech sector does become a war of attrition between the FANGs staving off one another by acquiring inorganic growth, then marginal tech players will get squeezed because they don’t have the capital bazookas to compete with the likes of Facebook (FB) and Google (GOOGL).

This is the year that we could see a slew of fringe tech companies go bust as debt markets sour on false narratives of future profits and equity markets turn against them.

The feast versus famine theme is also aligned with 5G, with many of the same cast of characters such as Apple, Alphabet posed to usurp revenue when this new technology finally becomes pervasive in consumer culture.

The Apple refresh cycle will dust off its playbook for another blockbuster rollout later this year when Apple debuts its much-awaited 5G phone.

Much of the share appreciate in Apple of late can be attributed to the anticipation of the new iPhone and the fresh infusion of revenue that branches off from it.

The applications that result from the new 5G Apple phone is seen as a luscious force multiplier to many 3rd party companies as well.

Chip stocks will be counted on as the ones lifting the tech foundations and just looking at shares in China, demonstrations of frothiness are running wild throughout their markets.

The Chinese government, to counteract the trade war, has been on a mission to flood its tech sector with unlimited capital as a catchup mechanism to overcome its inferior domestic chip industry.

Will Semiconductor, a supplier of integrated circuit products for telecommunications and electronics for cars, delivered a 390% performance in 2019 ranking it as the best performer in the Chinese stock market.

Luxshare Precision Industry and GoerTek, suppliers of consumer electronics products supplying Apple, and GigaDevice Semiconductor, producing flash chips, weren’t too shabby either each eclipsing at least 193% last year.

Even though 5G construction isn’t fully operational, I can attest that revenue creation for the companies involved are in full swing.

Investors must narrow their pickings to the biggest and financially resilient; this is not the time to expose oneself to the ugly trepidations of the mood-sensitive tech market.

For investors who can balance the delicate relationship of risk and surgical maneuvering, this year will end positive.