Trade Alert - (AAPL) June 10, 2025 - TAKE PROFITS - SELL

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (AAPL) – TAKE PROFITS

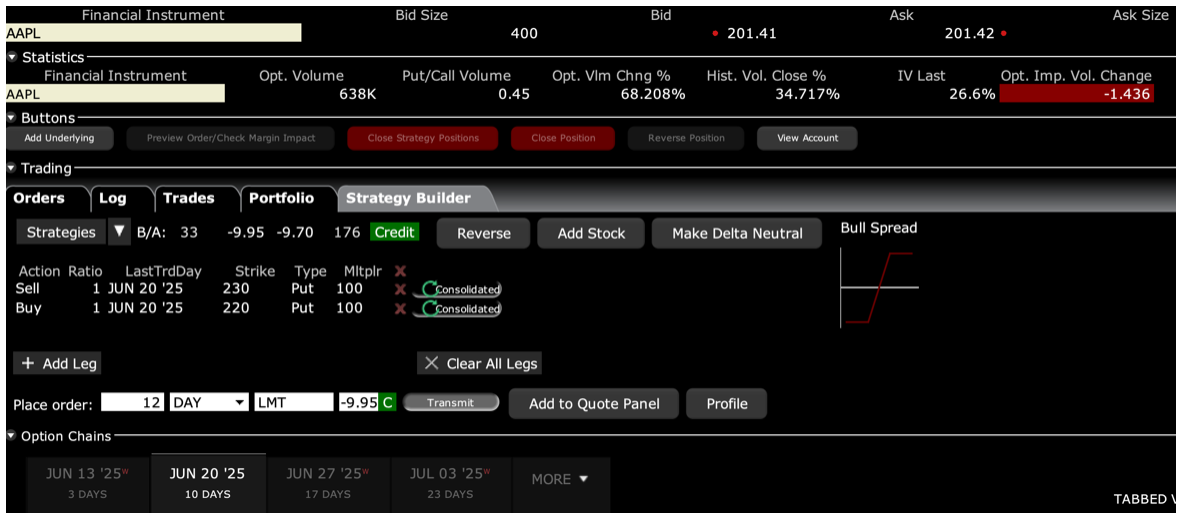

SELL the Apple (AAPL) June 2025 $220-$230 in-the-money vertical Bear Put debit spread at $9.95 or best

Closing Trade

6-10-2025

expiration date: June 20, 2025

Number of Contracts = 12 contracts

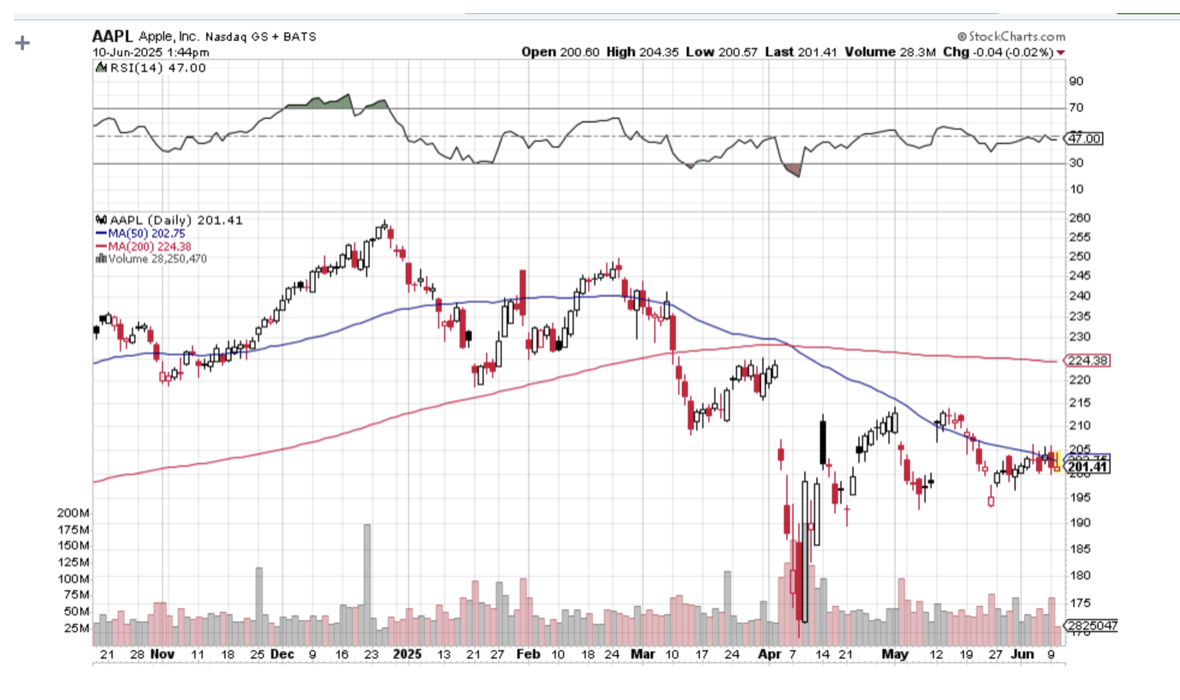

This turned out to be a great short position. As I expected, the Worldwide Developers Conference held in San Francisco this week turned out to be a snore. Nothing of consequence was announced. It was an innovation-free event.

In the mealtime, the trade war drags on, clouding Apple’s long-term outlook.

Even though the shares rose $6 against us in 26 trading days, we caught an enormous decline on the options implied volatility, from 65% to 34%, one of the sharpest drops I have ever seen.. Time decay was working for us every day.

With 95.8% of the maximum potential profit in hand, the risk/reward for continuing 7 more trading days until the June 20 option expiration is no longer favorable. A headline from the trade war can hit any time, and we have a monster US Treasury bond auction on June 12.

As a result, you get to take home $1,380 or 13.07% in 26 trading days. Well done, and on the next trade.

With the bulk of its products made in China, Apple is one of the worst affected by the trade war. It hasn’t introduced any new product lines in years. It artificial intelligence products have lagged far behind promises.

Worst of all, Apple is the most overowned stock in the world as it is viewed as a “safe” stock.

I am therefore selling the Apple (AAPL) June 2025 $220-$230 in-the-money vertical Bear Put debit spread at $9.95 or best

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and lower your offer by 2 cents with a second order.

If you don’t want to sit in front of a computer screen all day or live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $9.95, $9.93, and $9.91. You should get done on some or all of these.

To learn more about the company, please visit their website at www.apple.com

This was a bet that Apple would not rise above $220 by the June 20 option expiration in 32 trading days.

Apple Inc. (formerly Apple Computer, Inc.), based in Cupertino CA, is the largest publicly listed company in the United States (ahead of Nvidia) with a market capitalization of $3 trillion. It dominates in smartphones with a 66% US market share and accounts for 90% of global profits.

It designs, develops, and sells a variety of consumer electronics, computers, and their software, and online services. Its products include the iPhone, iPad, Apple Watch, Mac computers, the artificial reality Vision Pro headset, and Apple TV. It is also entering the movie production and distribution business. In my early days, I knew the co-founders Steve Jobs and Steve Wozniak.

Here are the specific trades you need to exit this position:

Sell 12 June 2025 (AAPL) $230 puts at………….……….....…$28.00

Buy to cover short 12 June 2025 (AAPL) $220 puts at……$18.05

Net Proceeds:………………………….……………..…....................$9.95

Profit: $9.95 - $8.80 = $1.15

(12 X 100 X $1.15) = $1,380 or 13.07% in 26 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.