Trade Alert - (FTNT) February 13, 2020 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Tech Alert - Fortinet, Inc. (FTNT) – SELL – TAKE PROFITS

SELL Fortinet, Inc. (FTNT) February 2020 $110-$115 in-the-money vertical BULL call spread at $4.55

Closing Trade

2-13-2020

expiration date: February 21, 2020

Portfolio weighting: 10%

Number of Contracts = 25 contracts

Fortinet spiked 0.8% at the open providing us a magical exit point to take profits on a day when coronavirus cases grow 10-fold.

Growth is usually a good word in economics and finance but not when it comes to pandemics.

And yes, this virus could get worse and hit tech companies harder than first thought.

Unfortunately, price action in Fortinet has been poor, the stock sold off at $120, then again at $118, and I will use this third haul up to exit with a nice profit.

I believe readers will be able to roll strikes down in this name by $5 if they are patient.

We are only extracting 55% of the maximum profit. If readers try to roll the dice and try to reap full profits at expiration in 9 days, they have a 64.40% chance of this occurring.

Don’t get me wrong – I love this stock, but its time to pull the rip cord in the short-term.

The chart has gone parabolic since last fall. It’s very difficult to get into this name and I squeezed in a trade.

Company was down after an earnings’ report that wasn’t that bad.

The Q4 21% year over year revenue growth was fine but the mixed Q1 outlook was underwhelming.

The company needed to hit a home run because of such high expectations.

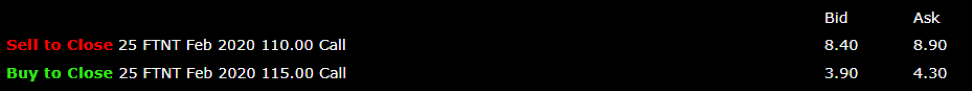

Here are the specific trades you need to execute this position:

Sell 25 February 2020 (FTNT) $110 call at………...........….………$8.65

Buy to cover short 25 February 2020 (FTNT) $115 call at...…….$4.10

Net Proceeds:……………………..…….………........................…….....$4.55

Profit: $4.55 - $4 = $.55

(25 X 100 X $.55) = $1,375 or 13.75%

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain about how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.