Trade Alert - (SCHW) LEAPS - Buy

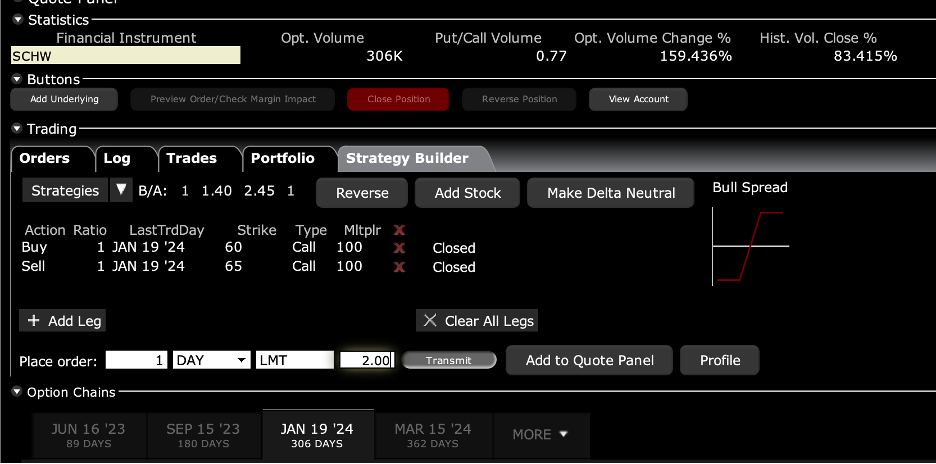

BUY the Charles Schwab (SCHW) January 2024 $60-$65 at-the-money vertical Bull Call debit spread LEAPS at $2.00 or best

Opening Trade

3-31-2023

expiration date: January 19, 2024

Number of Contracts = 1 contract

The brokerage sector has been beaten like the proverbial red-headed stepchild this year, with plunging stock market prices and volumes. However, it should be at the core of any long-term LEAPS portfolio.

The best time to pick up this position will be during a market meltdown day and the Volatility Index is over $30.

If you are looking for a lottery ticket, then here is a lottery ticket.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is 2:1. That is the probability that Charles Schwab shares will rise by 9.2% over the next nine months.

(SCHW) essentially doesn’t take risk. It is simply a fee taker in the form of stock commissions. It really has no trading income. It is strictly regulated by the SEC, whose requirements and reporting are far more rigorous than bank regulation.

Its shares seem to have suffered from a 35% hit simply because it is based in California, a one-hour drive from Silicon Valley Bank. You don’t get any more conservative and safer than Charles Schwab.

The regional banking crisis has pulled forward any recession and therefore the recovery. The Fed certainly raised interest rates by 25 basis point because it was already in the mail.

After that, there will be no interest rate rises for a decade. The cuts will start in June and continue rapidly after that. That’s when the economic data catch up with the reality that is happening right now, which is hugely deflationary.

(NVDA) and (TSLA) already know this, which rose sharply last week.

And here is the sweet spot. Fears of a recession have knocked $30, or 35% off the recent $85 high in (SCHW) shares this year.

I am therefore buying the Charles Schwab (SCHW) January 2024 $60-$65 at-the-money vertical Bull Call debit spread LEAPS at $2.00 or best.

Don’t pay more than $2.60 or you’ll be chasing on a risk/reward basis.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the Charles Schwab (SCHW) January 2024 $60-$65 at-the-money vertical Bull Call debit spread LEAPS are showing a bid/offer spread of $2.00-$3.00, which is typical. Enter an order for one contract at $2.30, another for $2.40, another for $2.50 and so on.

Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if this stock does NOT rise by 18% in nine months, the value of your investment goes to zero.

The way to play this is to buy LEAPS in ten different names. If one out of ten increases ten times, you break even. If two of ten work you double your money, and if only three of ten work you triple your money.

There is another way to cash in. Let’s say we get half of your double in the next three months, which from these low levels is entirely possible. Then you could earn half of the maximum potential profit in months. Then you can decide whether to keep the fivefold return or go for the full ten bagger. It’s a nice problem to have.

Notice that the day-to-day volatility of LEAPS prices is miniscule since the time value is so great. This means that the day-to-day moves in your P&L will be small. It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that an 18% rise in (SCHW) shares will generate a 150% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 30:1 across the $60-$65 space.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that Charles Schwab will not fall below $65 by the January 19, 2024 option expiration in 9 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2024 (SCHW) $60 calls at………….………$9.00

Sell short 1 January 2024 (SCHW) $65 calls at…….……$7.00

Net Cost:………………………….………..…………..........….....$2.00

Potential Profit: $5.00 - $2.00 = $3.00

(1 X 100 X $3.00) = $3.00 or 150% in 9 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.