Trade Alert - (SPLK) August 22, 2019 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SPLK) – BUY

BUY the Splunk Inc. (SPLK) September 2019 $95-$100 in-the-money vertical BULL CALL spread at $4.45 up to $4.60

Opening Trade

8-22-2019

expiration date: September 20, 2019

Portfolio weighting: 10%

Number of Contracts = 22 contracts

Splunk Inc. provides software solutions that enable organizations to gain real-time operational intelligence in the United States and internationally. Its products enable users to investigate, monitor, analyze, and act on data regardless of format or source.

The company offers Splunk Enterprise, a machine data platform with collection, indexing, search, reporting, analysis, alerting, monitoring, and data management capabilities.

The data analytics stock Splunk (SPLK) was downgraded from Outperform to Neutral with a $127 target by an analyst this morning.

Yesterday, Splunk reported Q2 beats with upside revenue outlook and announced the $1.1B acquisition of SignalFx.

The stock is down 11% this morning offering investors a good entry point.

SignalFx, emerged from stealth in 2015, provides real-time cloud monitoring solutions, predictive analytics and more.

This acquisition will allow it to become a leader “in observability and APM for organizations at every stage of their cloud journey, from cloud-native apps to homegrown on-premises applications.”

Splunk will become a power player in the cloud space as it expands its support for cloud-native applications and the modern infrastructures and architectures those rely on.

Prices are all over the map because of the violent move to the downside, thus, prudent to execute only limit orders.

Don’t pay more than $4.60 or you will be chasing.

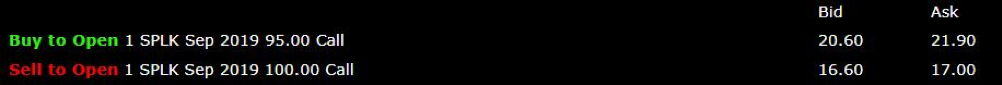

Here are the specific trades you need to execute this position:

Buy 22 September 2019 (SPLK) $95 calls at…………....………$21.25

Sell short 22 September 2019 (SPLK) $100 calls at………….$16.80

Net Cost:……………………..…….………..….........................….....$4.45

Potential Profit: $5.00 - $4.45 = $0.55

(22 X 100 X $0.55) = $1,210 or 12.10% in 30 days.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.