Trade Alert - (TLT) February 13, 2019 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – TAKE PROFITS

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) March 2019 $126-$129 in-the-money vertical BEAR PUT spread at $2.95 or best

Closing Trade

2-13-2018

expiration date: March 15, 2019

Portfolio weighting: 10%

Number of Contracts = 40 contracts – SELL REMAINING POSITION

If you don’t buy the dips, you can’t sell the rips, and it really makes no difference in which order you do these.

I am going to use the two-point plunge in the bond market from last week’s high to take profits in my remaining March short position in US Treasury bonds. This was my way of going long the stock market, but with a lot less risk and a lot higher probability of success.

Of course, this week’s US Treasury auction of $95 billion worth of paper to an ever-diminishing group of international buyers has a lot to do with it.

I am therefore selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) March 2019 $126-$129 in-the-money vertical BEAR PUT spread at $2.95 or best. We are now a full six points in the money.

With 91.66% of the maximum potential profit in hand and nearly five weeks left until the March 15 option expiration the risk/reward of continuing with the position is no longer favorable.

Specifically, I am selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) March 2019 $126-$129 in-the-money vertical BEAR PUT spread at $2.90 or best, which is dead in the middle of the market.

This was a bet that the (TLT) would not rise above $126.00 by the March 15 expiration day. That would require ten-year US Treasury bonds to fall below 2.40%, a three-year low, versus the then current 2.63%.

That was highly unlikely, given all the stimulus that is out there in the economy. Once bonds lost their upside momentum this position became an almost overnight winner.

That leaves me with my February 15 (TLT) $124-$126 vertical bear but spread, which expires the day after tomorrow. Occasionally, having 50 years of trading experience comes in handy.

If you bought the (TBT) instead of the options keep it. You should be able to squeeze a full 10% out of this trade.

You can count on me going back into this position on the next three-point rally.

The fundamental reasons for this trade are growing by the day.

1) Resolution of the China trade war will provide a short burst of economic growth, even if it doesn’t happen by March 1.

2) The Fed is dropping on the bond market $50 billion a month, or $1.70 billion a day worth of paper in its QE unwind.

3) Massive Tax cuts for corporations are still providing further stimulus for the US economy.

4) With the foreign exchange markets now laser-focused on America’s exploding deficits and fading interest rate picture, a weak US dollar has triggered a capital flight out of the US.

5) We also now have evidence that China has started to dump it’s massive $1 trillion in US Treasury bond holdings.

All are HUGELY bond negative.

To lose money on this position the (TLT) would have to rise above $126, and yields would have to drop below 2.40%, which they absolutely won’t ahead of a new deluge of bond selling from the Fed.

If you don’t do options, this would be a great level to scale into a long in the ProShares Ultra Short 20+ Treasury Bond Fund (TBT), a bet that bonds will fall.

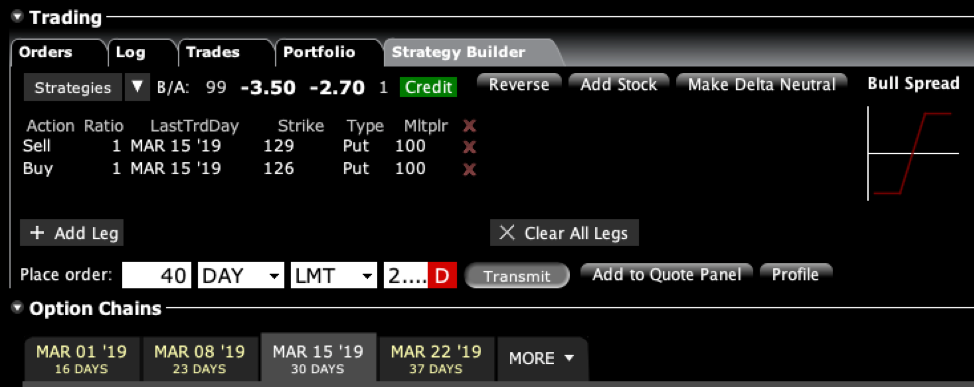

Here are the specific trades you need to execute this position:

Sell 40 March 2018 (TLT) $129 puts at………….…….……$8.45

Buy to cover short 40 March 2018 (TLT) $126 puts at……….$5.55

Net Proceeds:………………………….……..………….….....$2.95

Profit: $2.95 - $2.40 = $0.55

(40 X 100 X $0.55) = $2,200 or 22.91% in 4 trading days.

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.