Trade Alert - (TSLA) May 8, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TSLA) - BUY

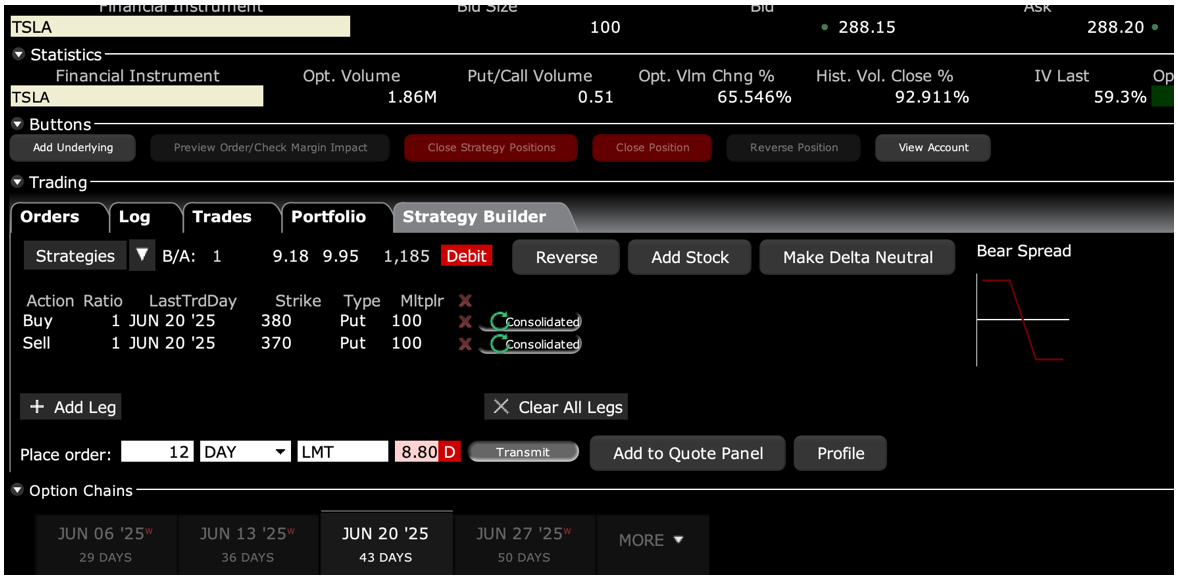

Buy the Tesla (TSLA) June 2025 $370-$380 in-the-money vertical bear put debit spread at $8.80 or best

Opening Trade

5-8-2025

expiration date: June 20, 2025

Portfolio weighting: 10% weighting

Number of Contracts = 12 contracts

The trade war is over. All the good news is in the price.

Well….not really.

Today, the president announced a trade deal with the UK that is not really a trade deal and doesn’t move the needle an iota. I’ll go into detail in the Monday letter. Many of the deals announced today were in fact agreed to years ago by the previous administration. It reveals a pattern.

One fake trade deal done, 79 to go.

Once people figure this out, the stock market has a good chance of peaking out in the next few days and testing new lows.

Looking at the many short-selling opportunities out there, it is tough to beat Tesla.

Plunging sales, profits down 71%, an unfolding recession, high interest rates, and the imminent demise of EV subsidies, what's not to hate here? The promised Robotaxis will be late and won’t become a major profit contributor for years, if ever.

The brand destruction has been permanent unless Trump’s base suddenly starts buying Teslas, which they won’t.

I have been in the business for 55 years, and I definitely know what over-promotion looks like.

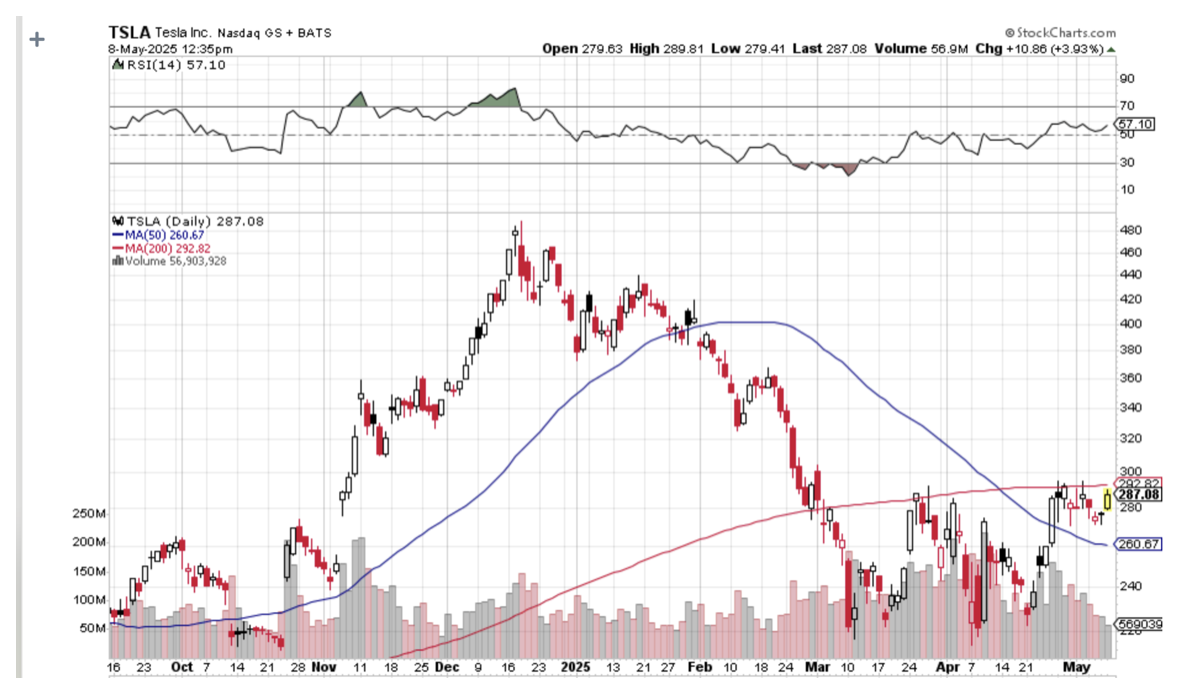

We have just seen a monster $70, or 32% rally in the Tesla shares, creating yet another window for a short play. The one thing that could have created a spike in shares has happened already: Elon Musk’s announcement that he is substantially paring back his time with DOGE. That had to happen once Musk flipped from an asset to a liability in the bi-elections.

We also have the Mad Hedge Market Timing Index at a highish 62, a 2 1/2 month high.

Tesla is toast.

With a European boycott of its products because of Elon Musk’s political choices, there is no way that the company will reach its 2 million sales target for 2025. 1.7 million or less, less than last year, is more likely. Picket lines are not taking place at the California showrooms and factory. Showrooms in Europe are being set on file.

Given the company’s still sky-high 59% implied volatility, the highest of any major company, I believe we can enter a low-risk/high-return short position here.

This trade also benefits from huge upside resistance from the 200-day moving average at $292.82.

Therefore, I am buying the Tesla (TSLA) June 2025 $370-$380 in-the-money vertical bear put debit spread at $8.80 or best

DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES.

Don’t pay more than $9.30 or you will be chasing.

Simply enter your limit order, wait five minutes, and if you don’t get done, cancel your order and increase your bid by 10 cents with a second order.

If you don’t want to sit in front of a computer screen all day or live in a foreign time zone when the US stock market is closed, such as Australia, or don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $9.30, $9.20, $9.10, $9.00, $8.90, and $8.80. You should get done on some or all of these.

With this trade, I am willing to bet that Tesla shares will not rise above $370 by the June 20 option expiration in 29 trading days.

Here are the specific trades you need to execute this position:

Buy 12 June 2025 (TSLA) $380 puts at………....…$95.00

Sell short 12 June 2025 (TSLA) $370 puts at…….$86.20

Net cost:……………………….……….…………….............$8.80

Potential Profit: $10.00 - $8.80 = $1.20

(12 X 100 X $1.20) = $1,440 or 13.64% in 29 trading days

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually, or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.