Trapped in Purgatory

I can't believe my eyes.

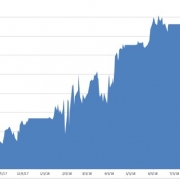

Here we are at the midpoint of 2018 and the main markets are virtually unchanged. The Dow Average is down 1.5%, the S&P 500 is up +1%, NASDAQ has gained 8.79%, and the Russell 2000 has tacked on 7.18%.

Despite all the promises that happy days are here again, here we are dead in the water. Since the passage of one of the most simulative tax bills in December, we have gone absolutely nowhere.

We are essentially stuck in stock market purgatory.

Of course, you can blame the trade wars, the onset of which marked the top of the bull market on January 24 at 26,252.

The president got one thing right. Trade wars are easy to win, but for dictatorships not for democracies.

If you complain about trade policies in China you are told to shut up or face getting sent to a re-education camp. Worst case you might disappear in the night as has happened to a number of Chinese billionaires lately.

In America any restraint of trade anywhere invites 10,000 highly paid lobbyists desperate to reverse the action. Offer any resistance and the reprobates are thrown out of office, as may happen here in four months.

The Chinese have one weapon against which we have no defense. They can go hungry. They'll just tell their people to toughen up for the greater good of the nation. When I first arrived in the Middle Kingdom 45 years ago they were still recovering from the aftereffects of a famine that killed 50 million (there are NO substitutes for food). Try doing that in the U.S.

The Chinese have another secret weapon at their disposal. They paid $3.63 a week for a subscription to the New York Times (including Sundays). Because of this they know that the president is going into the midterm elections with the lowest approval ratings in history.

And they are doing this running on a policy of sending children to concentration camps, which they don't even do in China anymore. This will cost the party votes in every state except in Oklahoma.

So the Chinese are content to hang tough, meet every tit with a tat, match every escalation, and wait out the current administration. The only question for them is whether the president will be gone in 2 1/2 years or in six months, so it pays to stall.

This is a country where history is measured in millennia. When I asked premier Zhou Enlai in the 1970s what the outcome of the 1792 French Revolution was, he responded "It's too early to say."

None of this is good for stock prices.

So I will continue with my now five-month-old prediction that markets will remain trapped in narrow ranges until before the midterms, and then rally strongly. It will do this not because of who wins, but because of the mere fact that it is over.

If you are a trader, unless you can buy stocks on those horrific capitulation panic days and sell on the most euphoric peaks, it's better just to stay away. I can do that, but I bet most of you can't. But then I've been practicing for 50 years. This is why I dumped the last of my positions yesterday morning at the highs of the day, shooting out three Trade Alerts in rapid succession.

By the way, these are excellent reasons to avoid the bond market as well. While the fundamentals tell us that interest rates should continue to rise for years, the charts tell us a different story.

With 10-year U.S. Treasury bond yields (TLT) hitting a five-month low today, it is hinting that a recession isn't a 2019 event, it in fact has already started. Bulls better fall down on their knees and pray to their chosen idol that this is nothing more than an extended short covering rally.

It all sounds like a great time to take a long cruise to me.

China in 1973