The US Balance of Payments Surplus in Education

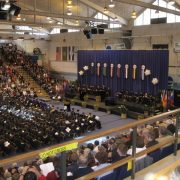

I spent the weekend attending a graduation in Washington state, a stone?s throw from where the 2010 Winter Olympics were held last year. While sitting through the tedious reading of 550 names, and listening to the wailing bagpipes, I did several calculations on the back of the commencement program. I came to some startling conclusions.

Higher education has grown into a gigantic industry, with a massively positive impact on America?s balance of payments, generating an impact on the world far beyond the dollar amounts involved. There are 671,616 foreign students in the US (90,000 from China alone) paying an average out-of-state tuition of $25,000 each, creating a staggering $16.8 billion of payments a year.

On a pro rata basis, that amounts to a serious part of our total receipts in services in Q4 2009 of $131.6 billion, not far behind financial services (click here for the Bureau of Economic Analysis site ) . A fortunate few, backed by endowed chairs and buildings built by wealthy and eager parents, land places at prestigious Universities like Harvard, Princeton, Yale, and UC Berkeley. The overwhelming majority, however, enroll in the provinces in a thousand rural state universities and junior colleges that most of us have never heard of.

The windfall has enabled once sleepy little schools to build themselves into world class institutions of higher learning with 30,000 or more students, boasting state of the art facilities, much to the joy of local residents and state education officials. Furthermore, this dominance of education industry is steadily Americanizing the global establishment.

I can?t tell you how many times over the decades I have run into the Persian Gulf sovereign fund manager who went to Florida State, the Asian CEO who attended Cal State Hayward, or the African finance minister who fondly recalled rooting for the Kansas State Wildcats. Those who constantly bemoan the impending fall of the Great American Empire can take heart by merely looking inland at these impressive degree factories. It also might give them an explanation of why the dollar is so strong in the face of absolute gigantic and perennial trade deficits.