Using Momentum Stocks to Call the Market

Hardly a day goes by without a reader asking me which indicators I follow when determining my impeccable market timing.

The short answer is that there are hundreds, and the 50-year accumulation updates real-time 24/7 in my head.

However, there is one in particular indicator that is worth mentioning today. That would be the performance of momentum stocks.

Momentum stocks are shares that deliver a larger move in price, or beta, than the market as a whole.

They tend to be the shares of high growth companies that deliver a reliable stream of positive earnings surprises.

In fact, they have earned a large following of traders, known as ‘momentum investors.”

Call them the canaries in the coal mine.

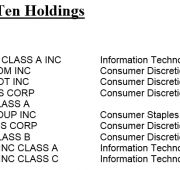

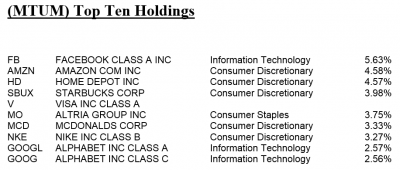

Look at the list of top ten holdings below, and you will find many that you know and love, and are often the subject of Mad Hedge Fund Trader Trade Alerts.

Momentum stocks are attractive because they substantially outperform a more sedentary index, like the S&P 500 (SPY).

Momentum stocks can be a great leading indicator for the stock market as a whole.

When momentum stocks take off like a scalded chimp, it is a good idea to adopt a “RISK ON” approach towards all of your asset selections.

When momentum stocks fail to reach new highs, it is a warning signal that the party is about to end and “RISK OFF” assets are about to gain favor.

This is why I always keep a close eye on momentum stocks when assembling my own trading book.

There is one really easy way to follow momentum stocks and that is to watch the iShares MSCI USA Momentum Factor ETF (MTUM) like a hawk.

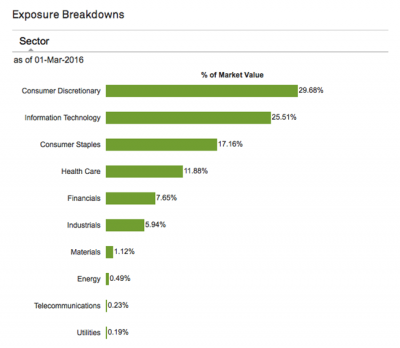

The (MTUM) seeks to track the performance of an index that measures the performance of 122 U.S. large and mid-capitalization stocks exhibiting relatively higher momentum characteristics than the main market before fees and expenses.

This portfolio is then rebalanced every six months to reflect new market trends and to deep six the losers.

If you want to see how well this works, just take a look at the chart below.

The (MTUM) is particularly attractive because its 0.15% expense ratio is the lowest among the several offerings in the marketplace.

The fund currently has $8.56 billion in assets, so the institutional community takes it seriously.

The trailing 30-day SEC yield is only 1.31%, reflecting the fact that many of its holdings are non-dividend paying technology and health care stocks.

To learn more about the details of the (MTUM) please click here.

And what are momentum stocks telling us right now?

That they have just had an incredible three-month run and are long overdue for a rest.

Just thought you’d like to know.