Wallstreet's Myopia Is Your Opportunity

While preparing my presentation for this week's Online Traders Conference, I came across a pattern that made me stop cold. You see, I've been gathering examples of how institutional investors quietly accumulate positions while retail traders are looking the other way.

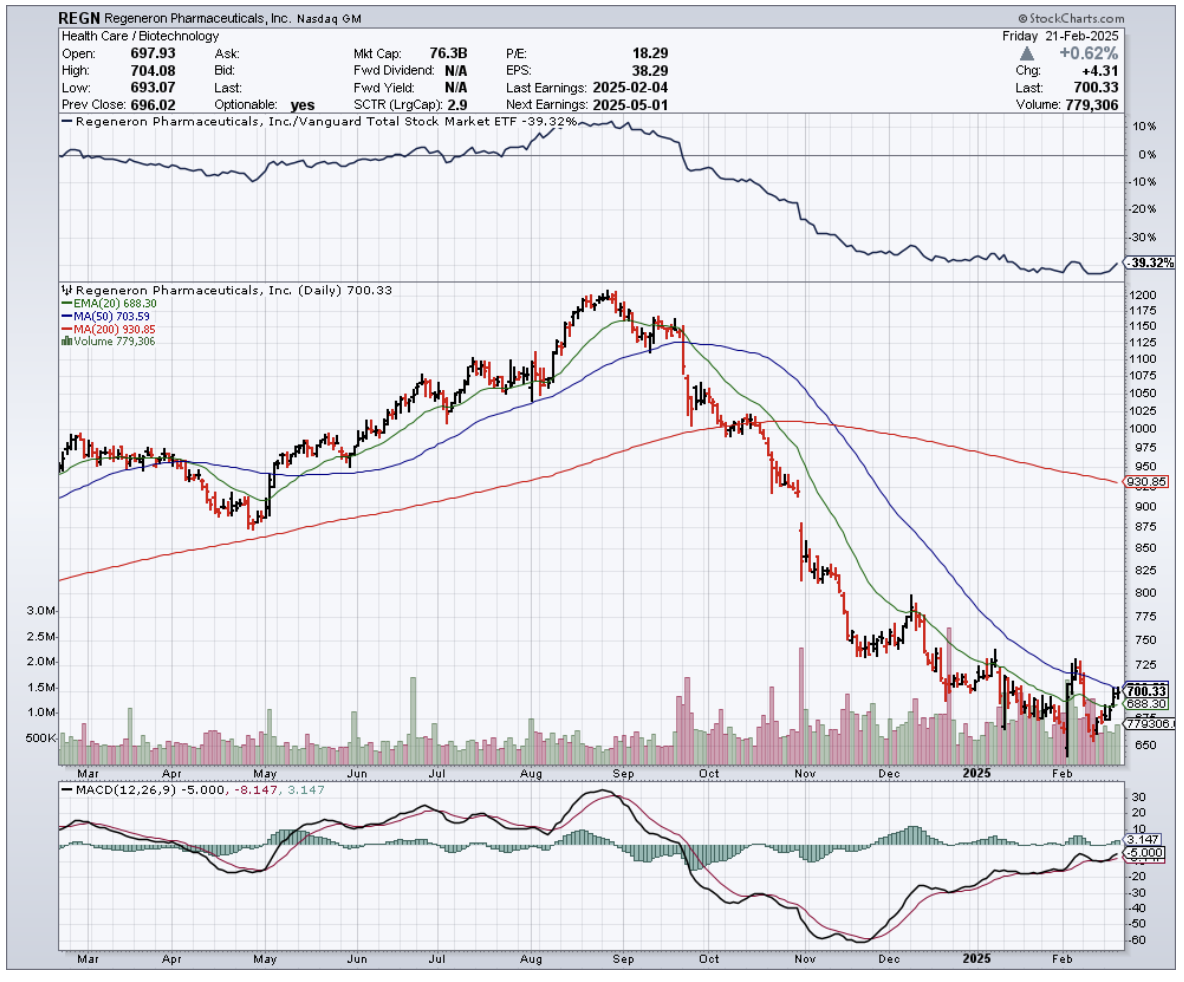

And there it was, right in front of me - Regeneron Pharmaceuticals (REGN), displaying exactly the kind of setup I'll be warning traders about starting February 24.

You see, while everyone's been obsessing over the latest AI darlings, Regeneron has been quietly crushing it. Their Q4 revenue hit $3.79 billion, up 10.5% year-on-year.

But here's where it gets interesting - they beat consensus estimates by $43 million, and that's with their flagship eye drug Eylea taking a hit.

Speaking of Eylea, let's address the elephant in the room. Its sales dropped 11% to $1.19 billion, thanks to Roche's (RHHBY) Vabysmo muscling into their territory and Amgen's (AMGN) biosimilar crashing the party.

Four more biosimilars are waiting in the wings, held back only by patent disputes. Normally, this would send investors running for the hills.

But here's what the panic-sellers are missing.

Despite Eylea's challenges, Regeneron's non-GAAP EPS still climbed to $12.07, beating analyst expectations by 88 cents.

In fact, they've been playing jump rope with analyst estimates, leaping over them in 10 of the last 12 quarters. Yet their stock price has been doing its best impression of a sleeping cat - just lying there, barely moving.

As someone who's spent decades watching market cycles, I recognize this pattern.

We're in what technical analysts call an “accumulation phase.” While retail investors yawn and look elsewhere, institutional money is quietly building positions.

It's like watching a spring being compressed - boring until it isn't.

But here's what really got my attention: Regeneron just joined the dividend club. Starting March 20, they're paying $0.88 per quarter. Sure, the yield won't make income investors swoon, but that's not the point.

It reminds me of how AstraZeneca (AZN) played it - first, dominate growing markets, then gradually turn on the dividend spigot to attract the steady-money crowd.

They're also backing up the dividend with a $3 billion share buyback program.

With $9 billion in cash and short-term investments, they've got more dry powder than a Revolutionary War armory.

In Q4 alone, Regeneron spent $1.23 billion buying back shares - up 64.1% from last year.

And here's where it gets even more interesting. Their oncology franchise, led by Libtayo, is looking like a dark horse winner. Libtayo sales jumped 50.4% year-over-year to $367 million.

While that might not sound earth-shattering compared to cancer drug heavyweights like Merck's (MRK) Keytruda, Libtayo just pulled off something remarkable.

In their Phase 3 C-POST trial for high-risk skin cancer patients, Libtayo reduced death and disease recurrence risk by 68% compared to placebo.

Even better? Merck's competing trial for Keytruda in the same indication fell flat on its face. In this business, that's like watching your main competitor trip at the Olympic finals.

Looking ahead to 2029, I'm seeing revenue hitting $20.4 billion - think high single-digit growth each year. That would bring their price-to-sales ratio down from 5.12x to 3.53x.

Their non-GAAP EPS should hit $76.5, implying double-digit growth most years. With the stock currently trading at just 14.76x earnings - below most peers like AbbVie (19.06x) and Eli Lilly (64.96x).

On top of these, 2025 is packed with potential catalysts - clinical trial results and FDA decisions that could light a fire under the stock.

Analysts' average target is $929.37, suggesting about 38% upside. But in my experience, when you combine strong fundamentals, multiple growth drivers, and a market that's sleeping on the story, those targets often end up looking conservative.

Remember, the market loves nothing more than a comeback story.

With Regeneron, we might just be watching one unfold in slow motion. The question is: will you be holding shares when the spring finally releases?

For those who want to learn more about spotting these kinds of opportunities, I'll be diving deeper into institutional accumulation patterns at the Online Traders Conference running February 24 through March 1.

But don't wait for my presentation to take a serious look at Regeneron - the smart money isn't.