What Stagflation Means For The Future Of Tech Stocks

Stagflation has reared its ugly head and yes it’s not here yet, but the risk it will hit us can’t be ignored at this point.

I’ll tell you what this means for tech stocks as well.

I won’t say that I told you so but this could have been seen from a thousand miles away.

The persistent increase in federal debt spent like a drunken sailor doesn’t mean anything until it means a lot this time around.

Remember that all that “job growth” came in the form of mostly government jobs and part-time workers adding more part-time jobs to pay for the cost of life.

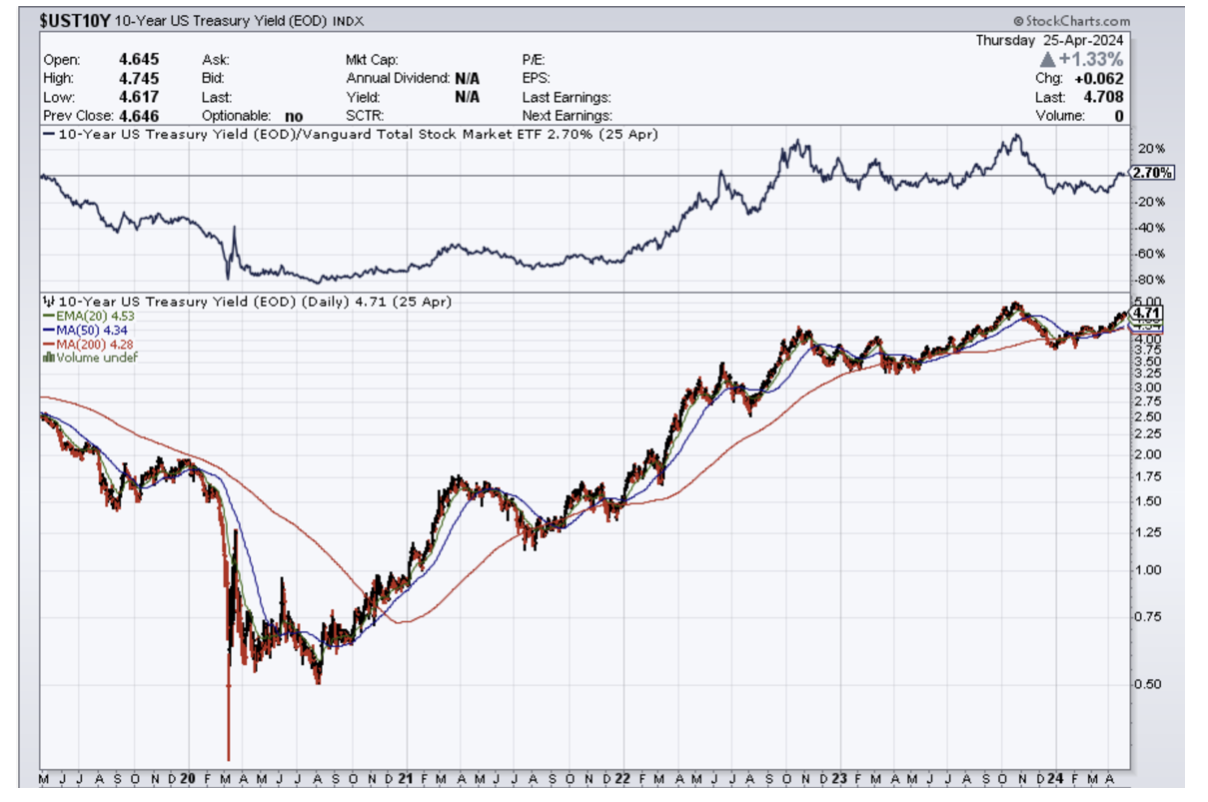

Now the numbers finally prove this as inflation stays sticky and growth has curtailed with the U.S. Real gross domestic product (GDP) rising just 1.6% from a year ago in the first quarter, which is a sizeable miss from 3.4% growth seen in the fourth quarter of last year.

Meanwhile, the Federal Reserve’s favorite inflation gauge—the core personal consumption expenditures (PCE) price index, which excludes more volatile food and energy prices—surged from 2% in the fourth quarter of 2023 to 3.7% in the first three months of this year.

I believe we are in the early throes that will usher us down a path of increasing inflation and lower growth which is the summation of stagflation.

Even with stagflation, certain tech companies will still grow, and do well.

Drowning in federal debt - now in the many trillions and skyrocketing each day.

It now also has a landing spot besides Ukraine and that’s in the form of more American inflation.

Prices will go up and adding more government jobs won’t bring down inflation.

Then the big question becomes, does the Fed save the dollar or save the US economy?

When the rubber hits the road, I do believe the Fed will choose to save the economy over the purchasing power of the Americans.

This means that the price of a loaf of bread will give you sticker shock because a dollar in 2024 will be worth a lot less in 2025 and beyond.

But the important thing is to save the economy and the biggest growth element to the US economy is, you guessed it right, tech stocks.

Tech stocks will outperform during a time of stagflation because even if most of the rest of the economy is doing poorly, tech will still navigate around these tougher times.

The Fed has essentially crippled purchasing power with its “transitory inflation” blunder, and I don’t think they have the guts to take down the stock market in an election year.

Therefore, I do expect interest rate cuts to take place later this year, and that will put a floor under tech stocks and marry up that with the AI narrative one must love the end-of-year prospects for Nvidia, Microsoft, Google, and Amazon.

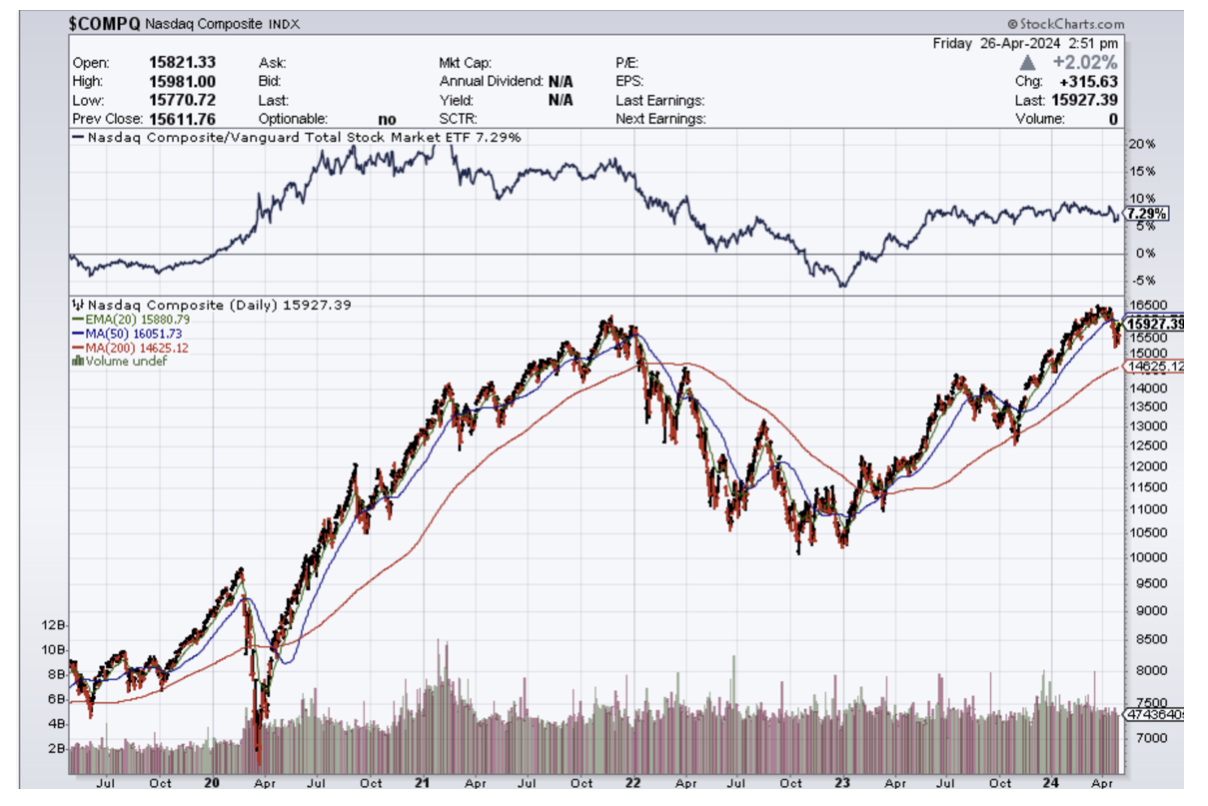

Get ready for the medium term because it’s most likely to involve the “bet on the Fed pivot” rally which will take us to the next up leg in the Nasdaq.

Readers should take solace in the fact that tech stocks will go up in stagflationary environment, but of course, tech stocks have that extra mojo when rates and inflation are low.