What's On Your Plate For This Week?

Talk about someone sucking all the air out of the room!

That?s what Federal Reserve chairwoman Janet Yellen is doing, keeping us on the edge of our seats until 2:00 PM Wednesday, when the Open Market Committee?s decision on interest rates is announced.

Will she, or won?t she?

The bigger question is whether stocks will peak on the news, ending a torrid four-month, 30 handle upside move in the S&P 500 (SPY).

I bet she won?t, but then I have never been that good at predicting the needs of women.

Certainly the economic data is not there to justify a rise. And inflation is nowhere to be seen, the sole prerequisite for dearer money that Janet has told us she needs to see first.

In the meantime, a steady drumbeat of warning of an imminent stock market sell off from my old friends, George Soros and Carl Icahn, is rising to a deafening din.

Call them old fashioned, but equity price earnings multiple rising towards a nosebleed 20X against falling earnings, shrinking volume, and narrowing breadth does not scream ?BUY? to anyone with a memory.

Yes, global quantitative easing and negative interest rates may suck in enough foreign money to squeeze a few more points of upside from the S&P 500. But you can chase those pennies with your money, not mine.

In the meantime, individual investors are voting with their feet. According to data released by Lipper Analytical Services, some $850 million fled equity mutual funds last week, the sixth consecutive week out outflows.

The money fled into municipal bonds, $1.2 billion worth. No doubt investors find the stratospheric 1.32% yields irresistible. I guess the IShares National Muni Bond ETF (MUB) is the modern equivalent of a mattress.

It all sets up my scenario of the high frequency traders triggering a few more stop losses to squeeze a few more points of upside, then stocks rolling over and folding like a wet taco shell over the summer.

If that happens, US Treasury bonds will rocket to challenge century low 10-year yields of 1.36%. Fasten your seat belt, don your hard hat, and pass the ammunition!

I?m hearing that risk managers at all the major hedge funds are battening down the hatches and running scenario analyses until their mainframes melt.

Any other data releases will pale this week in the shadow of the Fed decision.

On Tuesday at 10:00 AM EST will be a yawn. The weekly Wednesday bond auctions should be well bid.

The Weekly Jobless Claims at 8:30 AM EST on Thursday will continue to peg numbers at four-decade lows.

It will be interesting to see if $50 plus oil will cause the Baker Hughes rig count to rise for a second week in a row at 1:00 PM EST on Friday.

A quadruple witching option expiration should provide the usual excitement at the Friday close as the plungers and market makers game the even money strikes.

If you have any questions on the above, you can call me via international radiotelephone on the Queen Mary 2 in the aft deck 10 Owner?s Penthouse Suite.

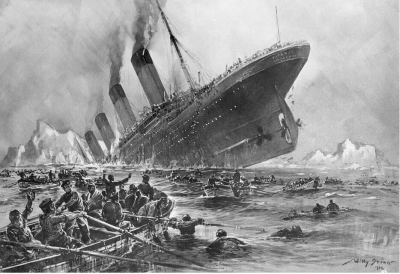

I should be somewhere in the mid Atlantic sipping my Dom Perignon sailing over the wreck of the Titanic.