When The Rubber Meets The Road

It’s funny that the Fed ever thought they could initiate an interest rate cut cycle with gold bullion at $3,000 per ounce and bitcoin at $100,000 per coin.

Whatever they are smoking – please pass some of it over here.

These indicators show that there is too much paper out there following too few good and services.

This is why eggs are about to become 4 bucks per dozen.

The Federal Reserve employs 100,000 PhDs to botch the only job they have (decide what to do with interest rates) by refusing to deploy common sense.

Apparently, PhDs don’t deliver much these days either, which is why nobody goes to college anymore.

The consequence is that the bond market has dictated to the Fed what to do, and we have seen that over the past few years.

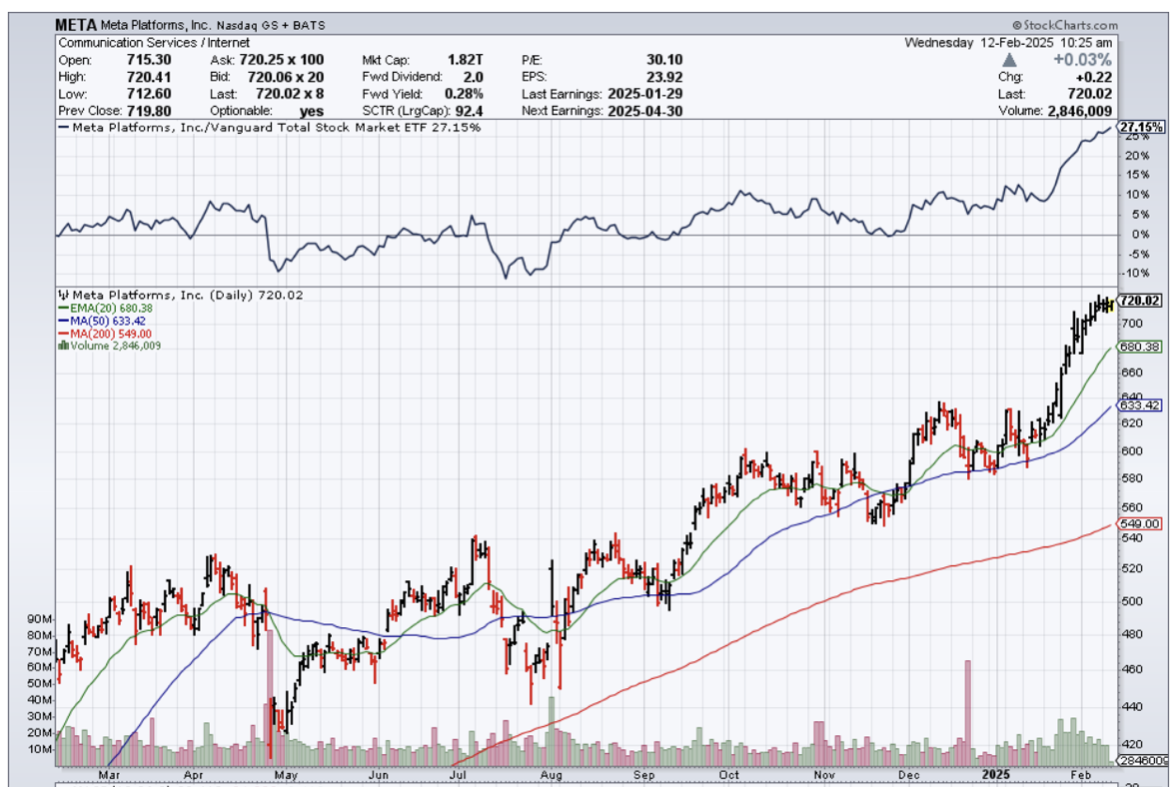

The US 10-year interest rate lurching closer to 5% means that tech stocks will have a tough grind and small tech companies get disproportionally penalized in this whipsaw environment.

On cue, Magnificent 7 are going strong because it put to use a strong balance sheet that many other tech firms don’t have.

It is funny to think about that once upon a time, these Mag 7 tech companies were the scrappy upstarts.

They have turned into total corporate monoliths like a titanic unable to steer.

New inflation data out Wednesday showed headline consumer prices rose more than forecast in January as core prices reversed last month's easing with the Federal Reserve's path forward in focus.

Seasonal factors contribute to higher inflation, like higher fuel costs and continued stickiness in food inflation, which kept the headline figures elevated. Notably, the index for eggs increased 15.2%, the largest increase since June 2015. It accounted for about two-thirds of the total monthly food at home increase.

Core inflation has remained stubbornly elevated due to sticky costs for shelter and services like insurance and medical care. Shelter did, however, show some signs of easing last month, rising 4.4% on an annual basis, the smallest 12-month increase in three years.

On Monday, President Trump announced global 25% tariffs on steel and aluminum imports, which will take effect on March 12. 25% tariffs on Mexico and Canada are set to come next month, while 10% duties on China have already been implemented.

The unpredictable volatility of interest rates will mean a choppy trading environment for tech stocks.

The Deepseek AI fiasco for OpenAI will also mean that tech companies will need to show investors soon if AI will profit or not.

This sets the stage for a polarizing short-term trading environment.

I will issue tech trade alert on big dips and ride them for defined time frames.

This is the best way to go about tech equities.

Readers need to understand that the time of just sitting and holding tech stocks to infinity is over.

This is when the rubber meets the road, and big drawdowns are susceptible when prices are this high and the system is creaky with institutions of centuries destined to bite dust.

At the very best, institutions like the Fed are ineffective.

Tech stocks will need to prove their worth in 2025 or else expect discounts across the board.