Why Business is Booming at the Money Printers

With US deficits exploding, the National Debt racing towards $35 trillion, and the velocity of money (or the turnover) ticking up, one particularly industry is suddenly doing particularly well.

Business is fantastic at the money printers. The only problem is that there is no way you can participate in this boom as an individual investor, unless you want to marry into a certain family.

All of the high-grade paper used by the US Treasury to print money is bought from a single firm, Crane & Co., which has been in the same family for seven generations.

Last year, the Feds printed 38 million banknotes worth $639 million. Although they briefly saw the Great Recession cause the velocity of money to decline, recent hyper reflationary efforts have spurred a big increase in demand for paper for $100 dollar bills.

The US Treasury first issued paper money in 1861 to help finance the Civil War, and Crane has been supplying them since 1879.

The average life of a dollar bill is 21 months. M1, or notes and coins in circulation, is already exploding. Is this a warning of an imminent jump in inflation? It could be.

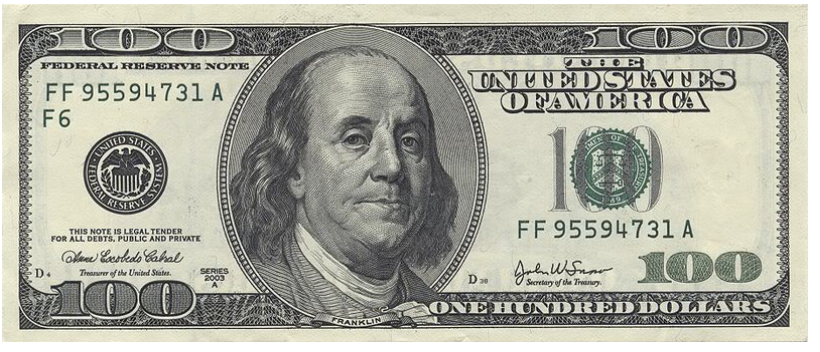

In the meantime, check out the new 3D $100 bill. It includes the latest anti-counterfeiting techniques, like a new blue security strip, tiny liberty bells that morph into the number 100, and “United States of America” micro printed on Franklin’s jacket collar.

The new bills started entering circulation in 2013 to frustrate industrial scale North Korean counterfeiting efforts.

No matter what efforts the US Treasury undertakes to keep this 19th century form of exchange alive, its days may be numbered. It is just a matter of time before blockchain technology replaces the greenback with all digital, and unprintable currencies. I hope the Crane family has a nice retirement nest egg.

It’s ironic that the balanced scales on the dollar, a symbolic reference to the founding fathers’ commitment to maintaining a balanced budget, are still on the new Benjamin.

Old Ben must be turning over in his grave.

Out With the Old

In With the New